- China

- /

- Semiconductors

- /

- SZSE:002079

Suzhou Good-Ark Electronics Co., Ltd. (SZSE:002079) Shares Fly 25% But Investors Aren't Buying For Growth

Suzhou Good-Ark Electronics Co., Ltd. (SZSE:002079) shares have continued their recent momentum with a 25% gain in the last month alone. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

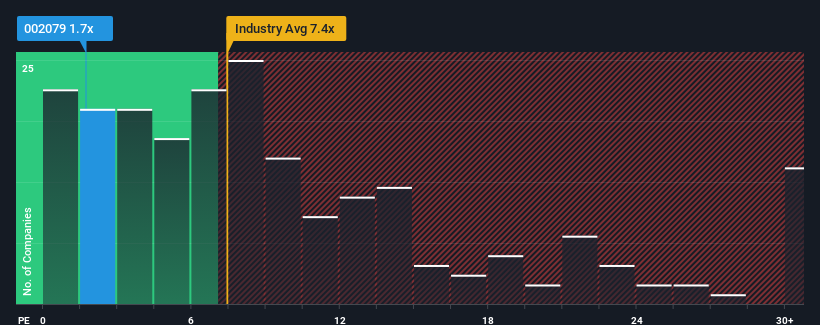

Even after such a large jump in price, Suzhou Good-Ark Electronics' price-to-sales (or "P/S") ratio of 1.7x might still make it look like a strong buy right now compared to the wider Semiconductor industry in China, where around half of the companies have P/S ratios above 7.4x and even P/S above 13x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Suzhou Good-Ark Electronics

What Does Suzhou Good-Ark Electronics' Recent Performance Look Like?

Recent times have been quite advantageous for Suzhou Good-Ark Electronics as its revenue has been rising very briskly. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Suzhou Good-Ark Electronics' earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Suzhou Good-Ark Electronics' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 55% last year. The latest three year period has also seen an excellent 123% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 42% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Suzhou Good-Ark Electronics' P/S sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From Suzhou Good-Ark Electronics' P/S?

Even after such a strong price move, Suzhou Good-Ark Electronics' P/S still trails the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Suzhou Good-Ark Electronics revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Suzhou Good-Ark Electronics that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002079

Suzhou Good-Ark Electronics

Engages in the design, manufacturing, packaging, and sale of semiconductor discrete device diode in China and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success