- China

- /

- Electrical

- /

- SHSE:688772

Global Value Stocks: 3 Companies Priced Below Estimated Intrinsic Value

Reviewed by Simply Wall St

In the current global market landscape, recent geopolitical tensions and trade discussions have led to fluctuations in major indices, with U.S. stocks experiencing a decline amid escalating conflicts in the Middle East and renewed trade uncertainties. Despite these challenges, opportunities arise for discerning investors who recognize that undervalued stocks—those priced below their estimated intrinsic value—can offer potential for growth when market sentiment stabilizes.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TTS (Transport Trade Services) (BVB:TTS) | RON4.275 | RON8.43 | 49.3% |

| Taiyo Yuden (TSE:6976) | ¥2349.50 | ¥4687.42 | 49.9% |

| Sparebank 68° Nord (OB:SB68) | NOK183.40 | NOK365.75 | 49.9% |

| Shenzhen KSTAR Science and Technology (SZSE:002518) | CN¥21.78 | CN¥43.42 | 49.8% |

| Range Intelligent Computing Technology Group (SZSE:300442) | CN¥42.92 | CN¥85.57 | 49.8% |

| PixArt Imaging (TPEX:3227) | NT$219.50 | NT$436.51 | 49.7% |

| Peijia Medical (SEHK:9996) | HK$6.43 | HK$12.71 | 49.4% |

| Good Will Instrument (TWSE:2423) | NT$43.85 | NT$87.14 | 49.7% |

| Food & Life Companies (TSE:3563) | ¥6539.00 | ¥12894.02 | 49.3% |

| ABO Energy GmbH KGaA (XTRA:AB9) | €35.70 | €71.01 | 49.7% |

We'll examine a selection from our screener results.

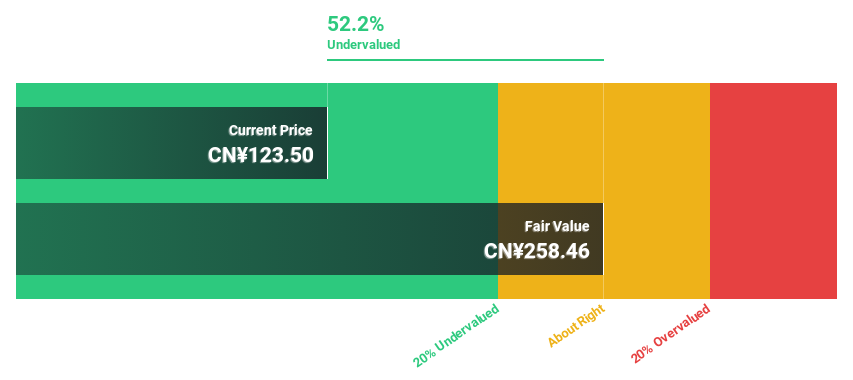

Sany Renewable EnergyLtd (SHSE:688349)

Overview: Sany Renewable Energy Co., Ltd. focuses on the research, development, manufacture, and sale of wind turbines and generators in China, with a market cap of CN¥29.59 billion.

Operations: Sany Renewable Energy Co., Ltd. generates revenue primarily through its activities in the research, development, manufacturing, and sales of wind turbines and generators within China.

Estimated Discount To Fair Value: 41.9%

Sany Renewable Energy Ltd. is trading at a significant discount to its estimated fair value, offering potential for investors focused on undervalued stocks based on cash flows. Despite lower profit margins compared to last year and a dividend not well-covered by free cash flows, the company's earnings are projected to grow significantly faster than the market average. The recent Power Purchase Agreement with Serbia's Alibunar Project underscores Sany R.E.'s strategic expansion into new markets, enhancing its global clean energy footprint.

- Our expertly prepared growth report on Sany Renewable EnergyLtd implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Sany Renewable EnergyLtd with our comprehensive financial health report here.

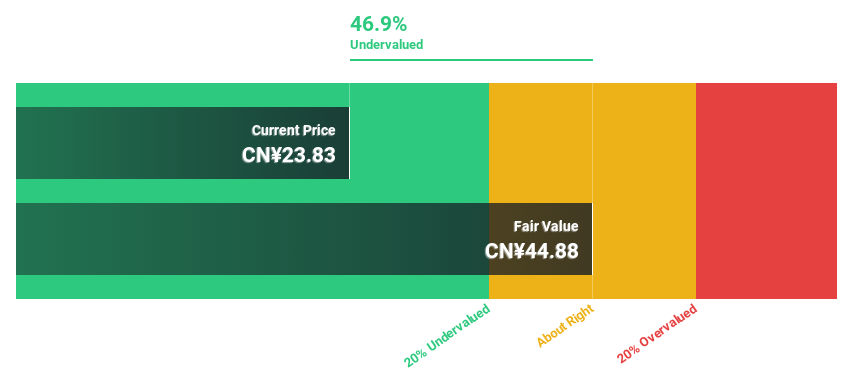

Zhuhai CosMX Battery (SHSE:688772)

Overview: Zhuhai CosMX Battery Co., Ltd. manufactures and supplies polymer lithium-ion batteries globally, with a market capitalization of CN¥15.88 billion.

Operations: Zhuhai CosMX Battery Co., Ltd. generates its revenue primarily from the production and distribution of polymer lithium-ion batteries on a global scale.

Estimated Discount To Fair Value: 45.8%

Zhuhai CosMX Battery is trading significantly below its estimated fair value, presenting a potential opportunity for investors interested in undervalued stocks based on cash flows. Despite recent net losses and high debt levels, the company's earnings are forecast to grow substantially faster than the market average over the next three years. The ongoing share repurchase program highlights management's confidence in long-term value creation, although current dividends are not well-supported by free cash flows.

- Insights from our recent growth report point to a promising forecast for Zhuhai CosMX Battery's business outlook.

- Take a closer look at Zhuhai CosMX Battery's balance sheet health here in our report.

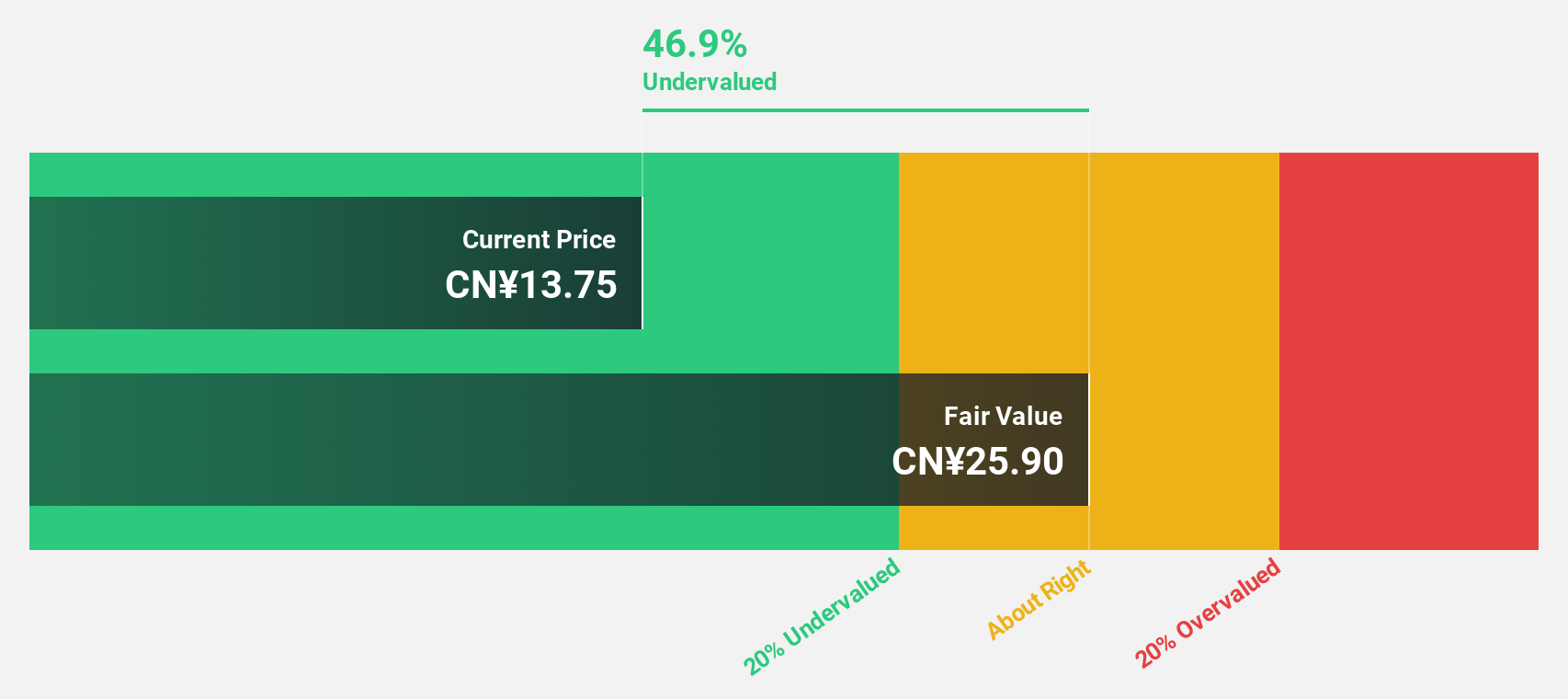

Shenzhen Techwinsemi Technology (SZSE:001309)

Overview: Shenzhen Techwinsemi Technology Co., Ltd. develops, manufactures, and sells storage control chips and modules both in China and internationally, with a market cap of CN¥19.56 billion.

Operations: Shenzhen Techwinsemi Technology Co., Ltd. generates revenue through the development, manufacturing, and sale of storage control chips and modules across domestic and international markets.

Estimated Discount To Fair Value: 49.2%

Shenzhen Techwinsemi Technology is trading well below its estimated fair value, offering potential for investors focused on cash flow undervaluation. Despite a recent net loss and lower profit margins, the company's earnings are forecast to grow significantly faster than the market average. However, interest payments are not well covered by earnings. Recent dividend increases reflect management's positive outlook despite these challenges.

- The growth report we've compiled suggests that Shenzhen Techwinsemi Technology's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Shenzhen Techwinsemi Technology stock in this financial health report.

Turning Ideas Into Actions

- Embark on your investment journey to our 498 Undervalued Global Stocks Based On Cash Flows selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhuhai CosMX Battery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688772

Zhuhai CosMX Battery

Manufactures and supplies polymer lithium-ion batteries worldwide.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives