- China

- /

- Semiconductors

- /

- SHSE:688503

October 2024's Leading Growth Stocks With Insider Ownership

Reviewed by Simply Wall St

As global markets navigate a mix of economic signals, with the S&P 500 advancing and the Nasdaq Composite rallying on strong tech earnings, investors are keenly watching growth companies that boast high insider ownership. In such an environment, stocks with substantial insider stakes can be appealing as they often signal confidence from those who know the company best, potentially aligning management's interests with those of shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

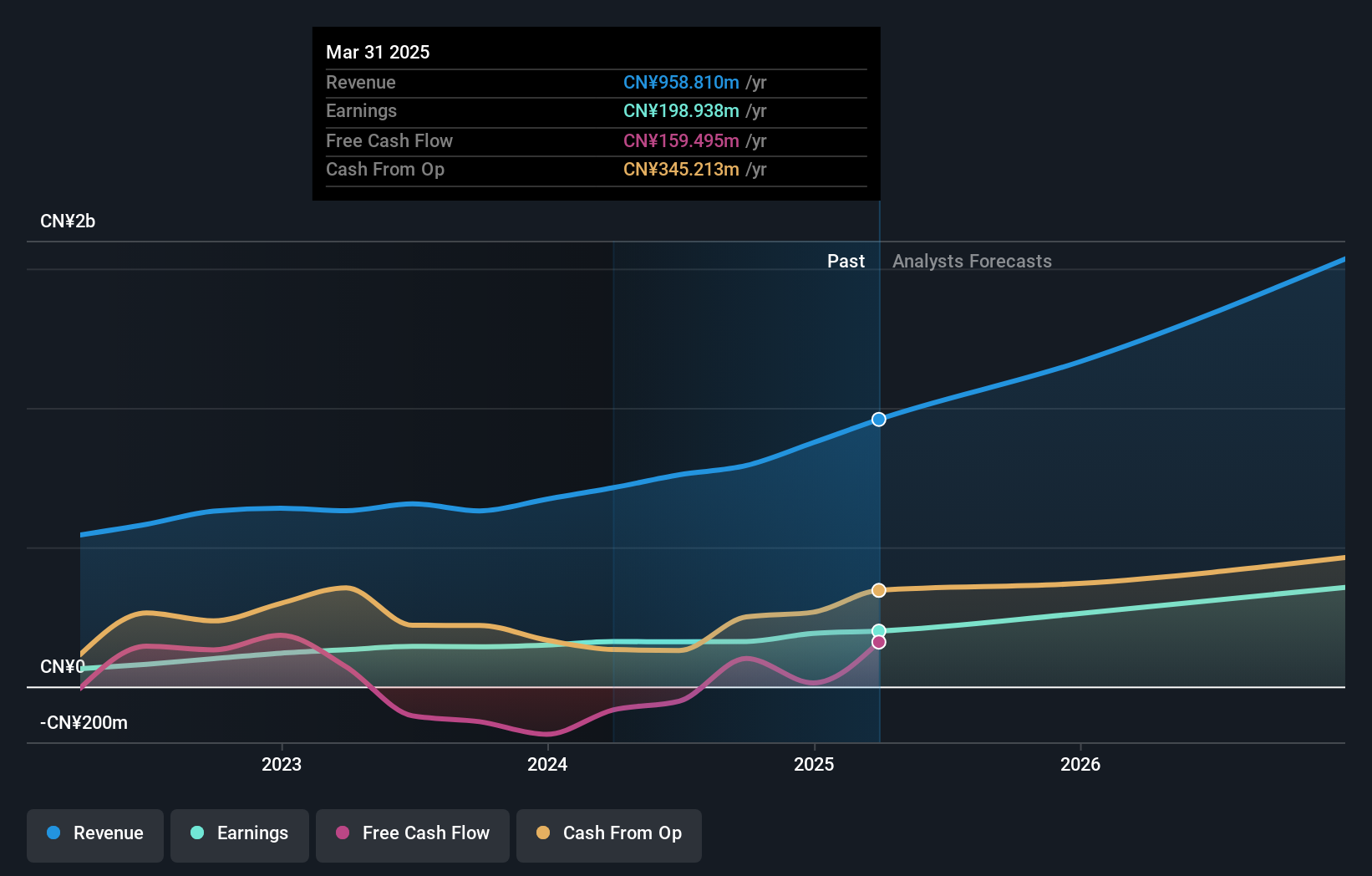

Shenzhen Newway Photomask Making (SHSE:688401)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Newway Photomask Making Co., Ltd, operating in the lithography sector, focuses on designing, developing, and producing mask products in China with a market cap of CN¥5.35 billion.

Operations: The company's revenue is primarily derived from its Electronic Components & Parts segment, totaling CN¥760.13 million.

Insider Ownership: 32.1%

Earnings Growth Forecast: 29.1% p.a.

Shenzhen Newway Photomask Making is experiencing significant growth, with earnings forecasted to increase by 29.1% annually, outpacing the broader Chinese market. The company's revenue is also expected to grow at a robust 27.4% per year. Despite its high volatility and low return on equity projections, its price-to-earnings ratio of 33.3x remains attractive compared to industry averages. Recent inclusion in the S&P Global BMI Index and consistent earnings improvements underscore its growth trajectory amidst substantial insider ownership dynamics.

- Get an in-depth perspective on Shenzhen Newway Photomask Making's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Shenzhen Newway Photomask Making shares in the market.

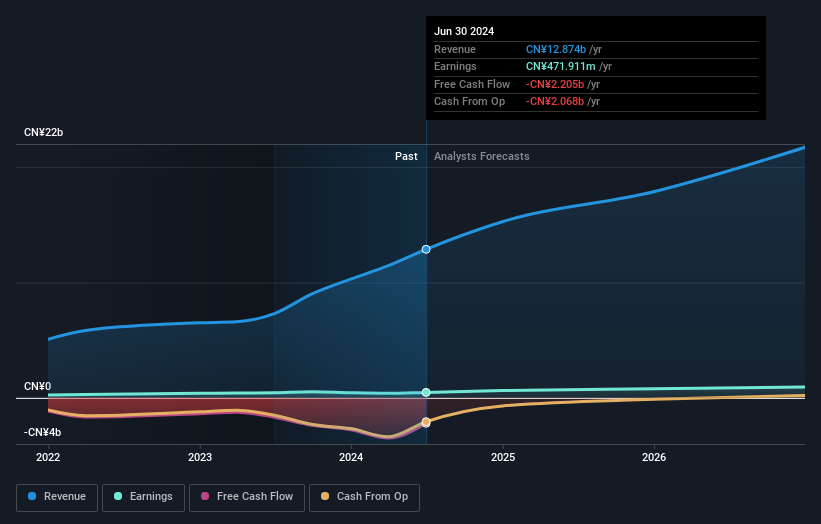

Changzhou Fusion New Material (SHSE:688503)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Changzhou Fusion New Material Co., Ltd. specializes in the R&D, production, and sale of conductive silver paste and other materials for the photovoltaic industry across China, South East Asia, and globally, with a market cap of CN¥8.03 billion.

Operations: The company's revenue is primarily derived from its Electronic Components & Parts segment, amounting to CN¥12.87 billion.

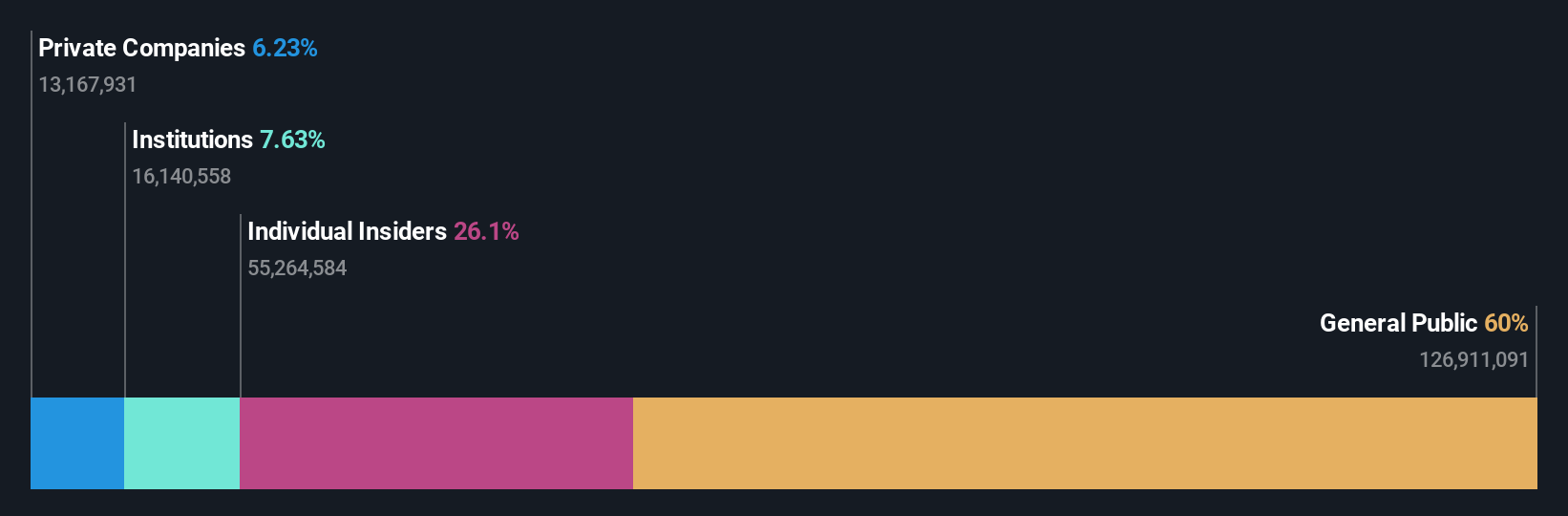

Insider Ownership: 25.3%

Earnings Growth Forecast: 25.6% p.a.

Changzhou Fusion New Material demonstrates strong growth prospects, with earnings projected to rise by 25.6% annually, surpassing the broader Chinese market. Despite a lower return on equity forecast and declining profit margins from 6.1% to 3.7%, its price-to-earnings ratio of 17x is favorable compared to the market average of 33.1x. Recent inclusion in the S&P Global BMI Index and a completed share buyback enhance its appeal amidst substantial insider ownership dynamics.

- Take a closer look at Changzhou Fusion New Material's potential here in our earnings growth report.

- Our valuation report here indicates Changzhou Fusion New Material may be undervalued.

Macmic Science&TechnologyLtd (SHSE:688711)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Macmic Science&Technology Co., Ltd. designs, develops, produces, and sells power semiconductor chips, single tubes, and modules in Taiwan and internationally with a market cap of CN¥4.23 billion.

Operations: The company generates revenue of CN¥1.38 billion from its semiconductor segment.

Insider Ownership: 26.2%

Earnings Growth Forecast: 26.8% p.a.

Macmic Science&Technology Ltd. exhibits promising growth potential, with revenue forecasted to increase by 26.2% annually, outpacing the Chinese market's average. However, recent financials show a decline in net income and profit margins due to significant one-off items. Despite trading at a substantial discount to its estimated fair value, the company faces challenges with volatile share prices and low return on equity projections amidst completed share buybacks enhancing shareholder value.

- Click here to discover the nuances of Macmic Science&TechnologyLtd with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Macmic Science&TechnologyLtd's current price could be inflated.

Summing It All Up

- Unlock our comprehensive list of 1480 Fast Growing Companies With High Insider Ownership by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688503

Changzhou Fusion New Material

Engages in the research and development, production, and sale of conductive silver paste, electronic component paste, conductive adhesive, and semiconductor materials for photovoltaic industry in China, South East Asia, and internationally.

Excellent balance sheet with reasonable growth potential.