- China

- /

- Semiconductors

- /

- SHSE:688596

Top Growth Companies With Insider Ownership In October 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by rising oil prices and geopolitical tensions in the Middle East, U.S. stocks have shown resilience, buoyed by unexpected job gains. This environment underscores the importance of insider ownership in growth companies, as it can signal confidence from those who know the business best and potentially align with investor interests during uncertain times.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34.2% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Medley (TSE:4480) | 34% | 30.4% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Here's a peek at a few of the choices from the screener.

Shanghai GenTech (SHSE:688596)

Simply Wall St Growth Rating: ★★★★★☆

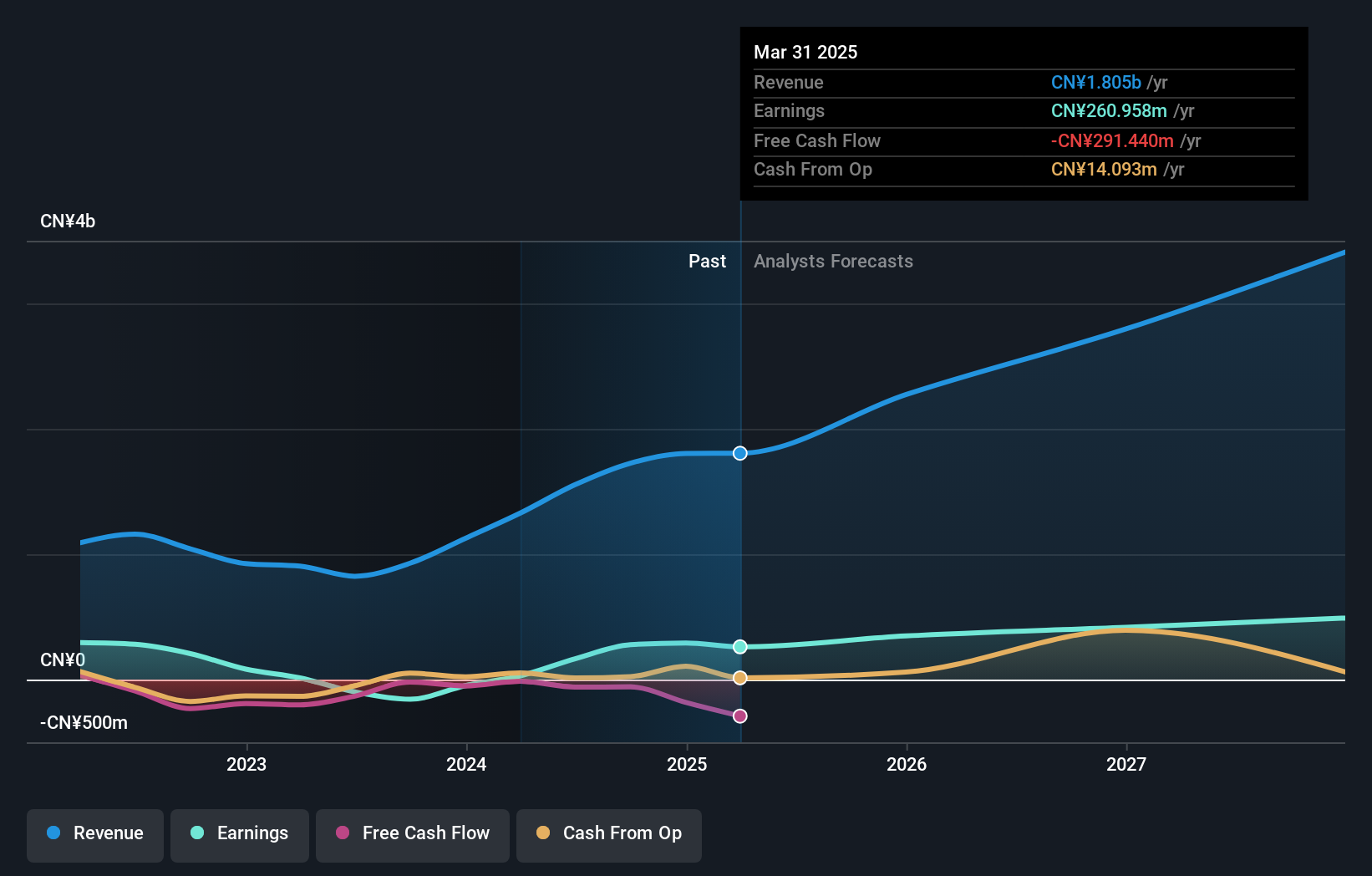

Overview: Shanghai GenTech Co., Ltd. offers process critical system solutions to hi-tech and advanced manufacturing industries in China, with a market cap of CN¥9.75 billion.

Operations: Shanghai GenTech Co., Ltd. generates its revenue by providing essential system solutions to clients within China's hi-tech and advanced manufacturing sectors.

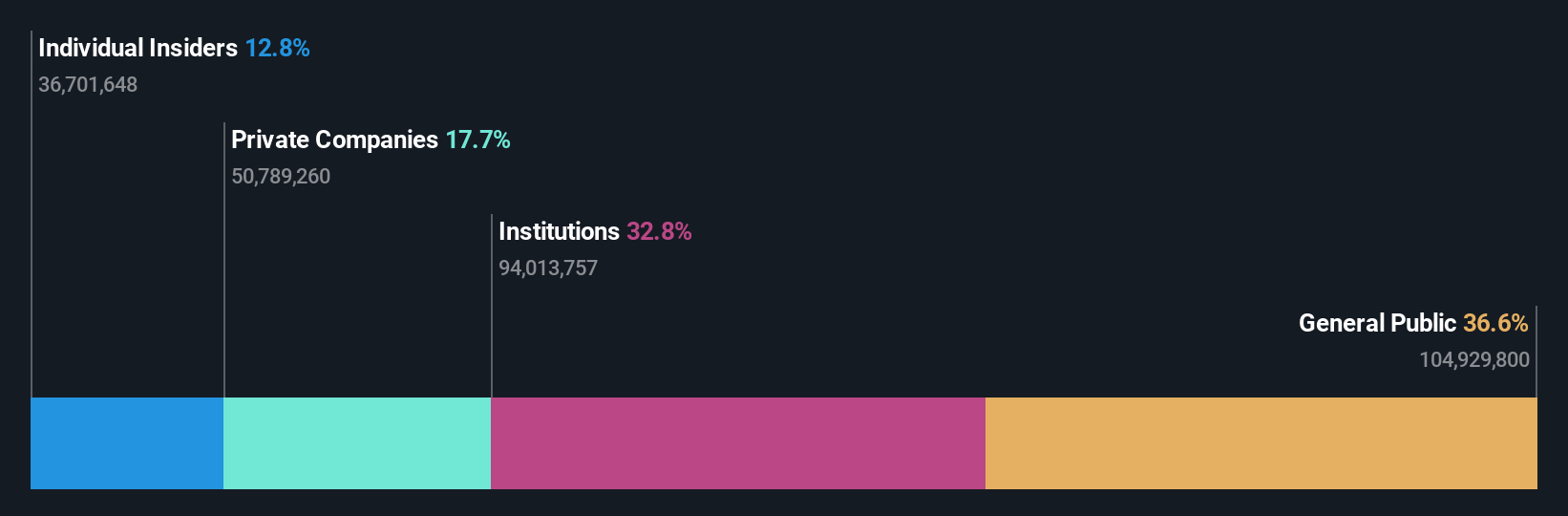

Insider Ownership: 13.5%

Shanghai GenTech demonstrates strong growth potential with forecasted earnings and revenue growth rates significantly outpacing the Chinese market. Despite recent volatility in share price, it trades at a favorable valuation compared to peers. The company reported CNY 1.85 billion in revenue for the first half of 2024, marking substantial year-over-year growth, though net income declined. A recent buyback program aims to align employee and shareholder interests, potentially supporting long-term development despite low dividend coverage by free cash flow.

- Dive into the specifics of Shanghai GenTech here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Shanghai GenTech's current price could be quite moderate.

Circuit Fabology Microelectronics EquipmentLtd (SHSE:688630)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Circuit Fabology Microelectronics Equipment Co., Ltd. (SHSE:688630) operates in the microelectronics equipment sector with a market capitalization of approximately CN¥8.65 billion.

Operations: Circuit Fabology Microelectronics Equipment Co., Ltd. generates its revenue from various segments within the microelectronics equipment industry.

Insider Ownership: 29.8%

Circuit Fabology Microelectronics Equipment Ltd. shows robust growth potential with forecasted revenue and earnings growth significantly outpacing the Chinese market. The company reported CNY 449.43 million in sales for the first half of 2024, a substantial increase from the previous year, alongside improved net income. Despite high volatility in its share price, it trades at a relatively lower P/E ratio than industry peers, and recent buyback activities could enhance shareholder value despite limited dividend coverage by free cash flows.

- Delve into the full analysis future growth report here for a deeper understanding of Circuit Fabology Microelectronics EquipmentLtd.

- Our expertly prepared valuation report Circuit Fabology Microelectronics EquipmentLtd implies its share price may be too high.

Puya Semiconductor (Shanghai) (SHSE:688766)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Puya Semiconductor (Shanghai) Co., Ltd. designs and sells non-volatile memory chips and derivative chips based on memory chips both in China and internationally, with a market cap of CN¥8.63 billion.

Operations: The company's revenue primarily comes from its Integrated Circuit segment, amounting to CN¥1.55 billion.

Insider Ownership: 33.3%

Puya Semiconductor (Shanghai) demonstrates strong growth potential, with earnings expected to grow significantly over the next three years. The company reported CNY 895.83 million in sales for H1 2024, a substantial increase from last year, and achieved profitability with a net income of CNY 135.98 million. Despite recent share price volatility, its P/E ratio of 52x is below the industry average. Revenue growth forecasts exceed both industry and market averages, indicating robust future performance prospects.

- Click here to discover the nuances of Puya Semiconductor (Shanghai) with our detailed analytical future growth report.

- The analysis detailed in our Puya Semiconductor (Shanghai) valuation report hints at an inflated share price compared to its estimated value.

Turning Ideas Into Actions

- Access the full spectrum of 1492 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688596

Shanghai GenTech

Provides process critical system solutions to customers in hi-tech and advanced manufacturing industries in China.

High growth potential with adequate balance sheet.