- China

- /

- Semiconductors

- /

- SHSE:688596

Shanghai GenTech Co., Ltd. (SHSE:688596) Stock Rockets 28% But Many Are Still Ignoring The Company

Shanghai GenTech Co., Ltd. (SHSE:688596) shares have had a really impressive month, gaining 28% after a shaky period beforehand. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 7.6% in the last twelve months.

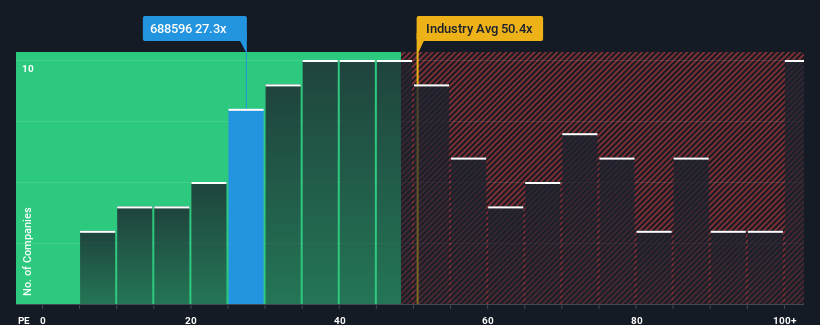

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Shanghai GenTech's P/E ratio of 27.3x, since the median price-to-earnings (or "P/E") ratio in China is also close to 30x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Shanghai GenTech has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

View our latest analysis for Shanghai GenTech

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Shanghai GenTech's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 2.8% decrease to the company's bottom line. Even so, admirably EPS has lifted 106% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 38% each year as estimated by the three analysts watching the company. With the market only predicted to deliver 19% each year, the company is positioned for a stronger earnings result.

In light of this, it's curious that Shanghai GenTech's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Shanghai GenTech appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Shanghai GenTech currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Shanghai GenTech (of which 1 shouldn't be ignored!) you should know about.

You might be able to find a better investment than Shanghai GenTech. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688596

Shanghai GenTech

Provides process critical system solutions to customers in hi-tech and advanced manufacturing industries in China.

Exceptional growth potential with moderate risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success