- China

- /

- Semiconductors

- /

- SHSE:688584

Subdued Growth No Barrier To Wafer Works (Shanghai) Co., Ltd. (SHSE:688584) With Shares Advancing 26%

Despite an already strong run, Wafer Works (Shanghai) Co., Ltd. (SHSE:688584) shares have been powering on, with a gain of 26% in the last thirty days. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

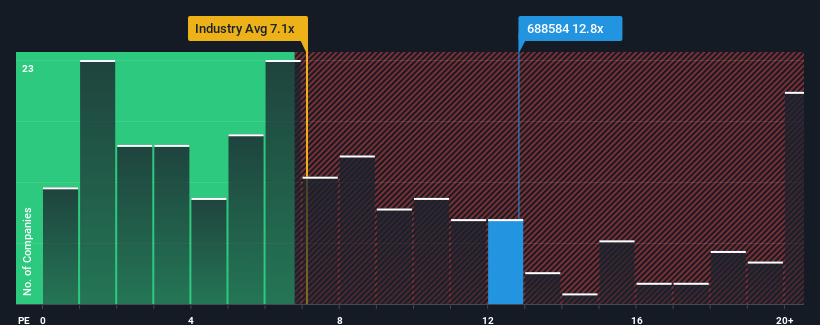

After such a large jump in price, Wafer Works (Shanghai)'s price-to-sales (or "P/S") ratio of 12.8x might make it look like a strong sell right now compared to other companies in the Semiconductor industry in China, where around half of the companies have P/S ratios below 7.1x and even P/S below 3x are quite common. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Wafer Works (Shanghai)

What Does Wafer Works (Shanghai)'s P/S Mean For Shareholders?

For example, consider that Wafer Works (Shanghai)'s financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Wafer Works (Shanghai) will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Wafer Works (Shanghai) would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 24% decrease to the company's top line. As a result, revenue from three years ago have also fallen 16% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 43% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we find it concerning that Wafer Works (Shanghai) is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What We Can Learn From Wafer Works (Shanghai)'s P/S?

Wafer Works (Shanghai)'s P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Wafer Works (Shanghai) currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Wafer Works (Shanghai) (of which 2 are a bit unpleasant!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Wafer Works (Shanghai) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688584

Wafer Works (Shanghai)

Operates as an integrated manufacturer of semiconductor silicon epitaxial wafers in China, North America, Europe, and other Asian countries.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success