- China

- /

- Semiconductors

- /

- SHSE:688535

Jiangsu HHCK Advanced MaterialsLtd's (SHSE:688535) Returns Have Hit A Wall

What are the early trends we should look for to identify a stock that could multiply in value over the long term? Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. Although, when we looked at Jiangsu HHCK Advanced MaterialsLtd (SHSE:688535), it didn't seem to tick all of these boxes.

Return On Capital Employed (ROCE): What Is It?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Jiangsu HHCK Advanced MaterialsLtd:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.021 = CN¥22m ÷ (CN¥1.2b - CN¥181m) (Based on the trailing twelve months to June 2024).

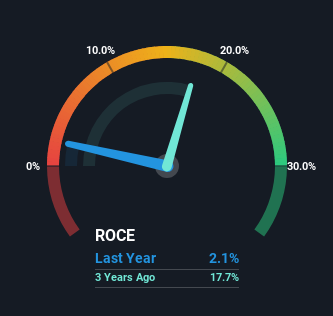

Therefore, Jiangsu HHCK Advanced MaterialsLtd has an ROCE of 2.1%. In absolute terms, that's a low return and it also under-performs the Semiconductor industry average of 4.3%.

Check out our latest analysis for Jiangsu HHCK Advanced MaterialsLtd

Above you can see how the current ROCE for Jiangsu HHCK Advanced MaterialsLtd compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Jiangsu HHCK Advanced MaterialsLtd .

So How Is Jiangsu HHCK Advanced MaterialsLtd's ROCE Trending?

In terms of Jiangsu HHCK Advanced MaterialsLtd's historical ROCE trend, it doesn't exactly demand attention. The company has employed 1,114% more capital in the last five years, and the returns on that capital have remained stable at 2.1%. This poor ROCE doesn't inspire confidence right now, and with the increase in capital employed, it's evident that the business isn't deploying the funds into high return investments.

One more thing to note, even though ROCE has remained relatively flat over the last five years, the reduction in current liabilities to 15% of total assets, is good to see from a business owner's perspective. This can eliminate some of the risks inherent in the operations because the business has less outstanding obligations to their suppliers and or short-term creditors than they did previously.

The Key Takeaway

As we've seen above, Jiangsu HHCK Advanced MaterialsLtd's returns on capital haven't increased but it is reinvesting in the business. And investors appear hesitant that the trends will pick up because the stock has fallen 24% in the last year. All in all, the inherent trends aren't typical of multi-baggers, so if that's what you're after, we think you might have more luck elsewhere.

While Jiangsu HHCK Advanced MaterialsLtd doesn't shine too bright in this respect, it's still worth seeing if the company is trading at attractive prices. You can find that out with our FREE intrinsic value estimation for 688535 on our platform.

While Jiangsu HHCK Advanced MaterialsLtd isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688535

Jiangsu HHCK Advanced Materials

Jiangsu HHCK Advanced Materials Co., Ltd.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives