- China

- /

- Semiconductors

- /

- SZSE:300474

Top Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

In the wake of the Federal Reserve's recent rate cut, global markets have surged to new highs, reflecting investor optimism. This positive sentiment provides a fertile ground for growth companies, especially those with high insider ownership, which often signals strong confidence from those closest to the business. A good stock in this context is one that not only shows potential for significant growth but also has substantial insider ownership. This combination can be particularly appealing in today's market environment where investor confidence is buoyed by favorable economic conditions and strategic monetary policy decisions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 29.9% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| Medley (TSE:4480) | 34% | 30.4% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.3% | 95% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

Underneath we present a selection of stocks filtered out by our screen.

BIWIN Storage Technology (SHSE:688525)

Simply Wall St Growth Rating: ★★★★★★

Overview: BIWIN Storage Technology Co., Ltd. researches, develops, designs, packs, tests, produces, and sells semiconductor memories with a market cap of CN¥17.42 billion.

Operations: The company generates revenue primarily from its semiconductor segment, amounting to CN¥5.88 billion.

Insider Ownership: 18.8%

BIWIN Storage Technology shows strong growth potential with forecasted annual revenue growth of 22.3% and expected profitability within three years, outpacing the CN market. Recent earnings reveal substantial improvements, with half-year sales rising to CNY 3.44 billion from CNY 1.15 billion year-over-year and net income turning positive at CNY 283.36 million. The stock's addition to the S&P Global BMI Index underscores its growing market presence despite recent share price volatility.

- Take a closer look at BIWIN Storage Technology's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that BIWIN Storage Technology is trading beyond its estimated value.

Beijing Enlight Media (SZSE:300251)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Enlight Media Co., Ltd. engages in the investment, production, and distribution of film and television projects in China with a market cap of CN¥19.29 billion.

Operations: Beijing Enlight Media generates revenue from the investment, production, and distribution of film and television projects in China.

Insider Ownership: 12.1%

Beijing Enlight Media's recent earnings report highlights significant growth, with half-year sales increasing to CNY 1.32 billion from CNY 604.3 million year-over-year and net income rising to CNY 472.77 million from CNY 202.78 million. Despite a lower-than-industry-average Price-to-Earnings ratio of 29.4x, the company forecasts annual earnings growth of 25%, surpassing the CN market's average growth rate. However, revenue is expected to grow at a slower pace of 14.8% annually, and Return on Equity remains modest at an estimated 10.8%.

- Click here to discover the nuances of Beijing Enlight Media with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Beijing Enlight Media shares in the market.

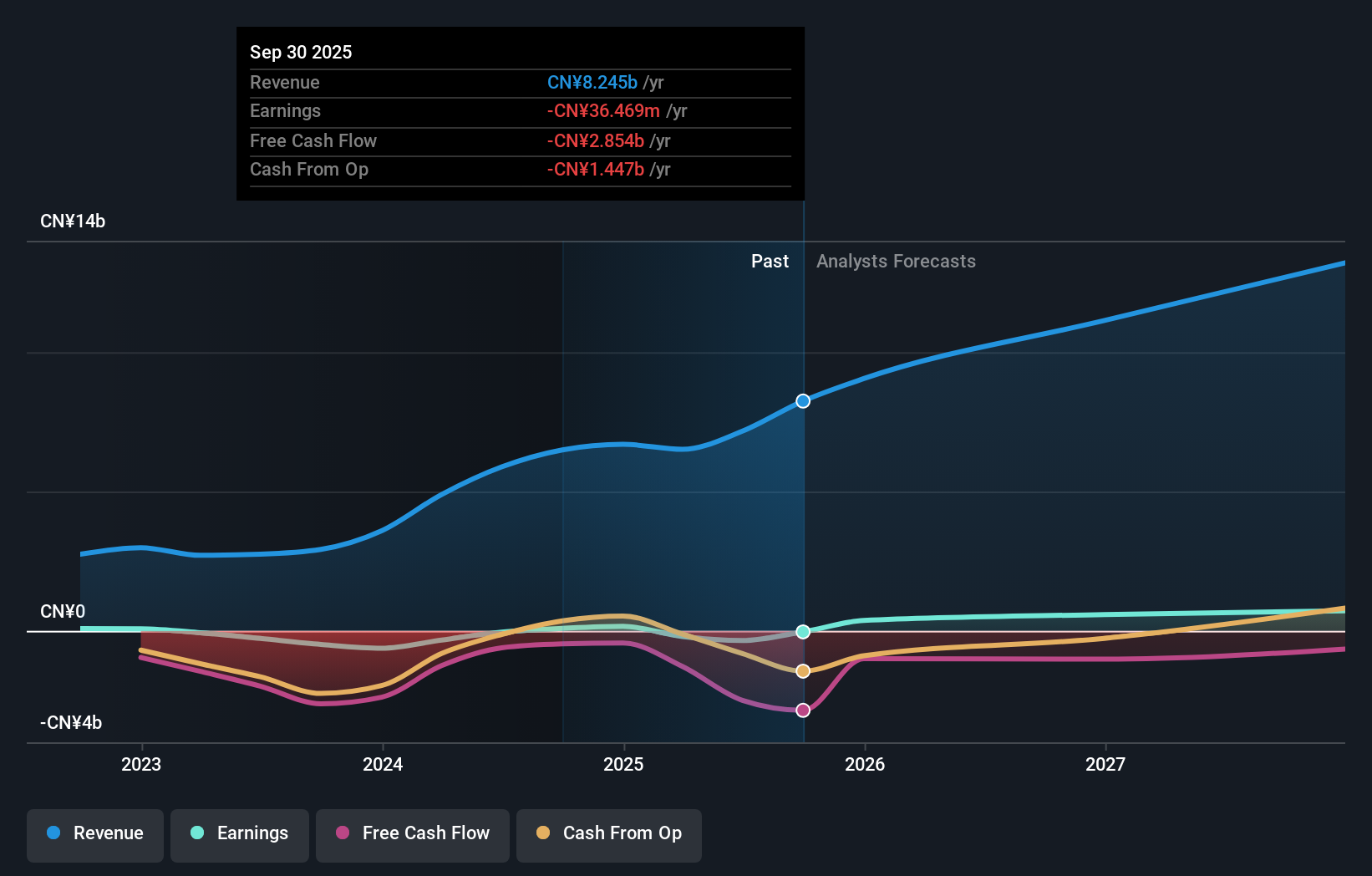

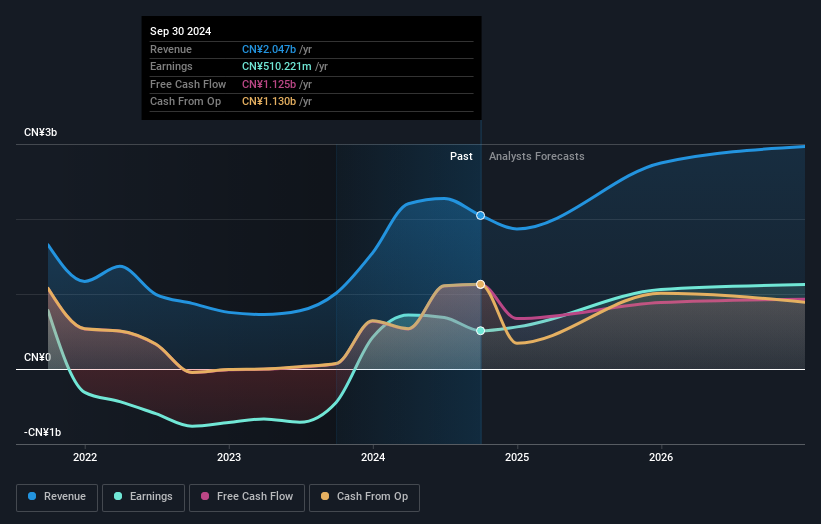

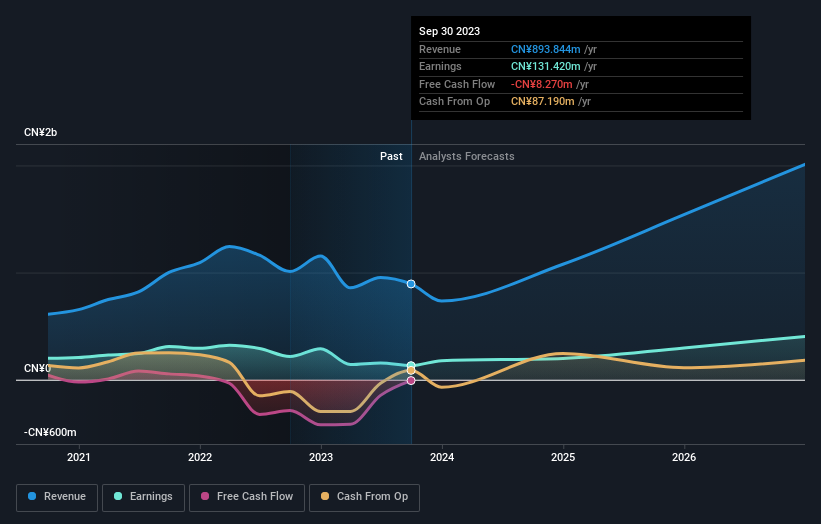

Changsha Jingjia Microelectronics (SZSE:300474)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Changsha Jingjia Microelectronics Co., Ltd. (SZSE:300474) is a company engaged in the design and production of microelectronic components, with a market cap of CN¥24.38 billion.

Operations: Changsha Jingjia Microelectronics Co., Ltd. (SZSE:300474) is a company engaged in the design and production of microelectronic components, with a market cap of CN¥24.38 billion. The company's revenue primarily comes from its Computer, Communications, and Other Electronic Equipment Manufacturing segment, which generated CN¥893.84 million.

Insider Ownership: 39%

Changsha Jingjia Microelectronics is forecast to experience robust revenue growth of 27.7% per year, outpacing the CN market's 13.1%. Earnings are also expected to grow significantly at 31.6% annually, surpassing the market average of 23%. Despite a lower Return on Equity forecast (9%) and declining profit margins (14.7% from 21.4%), recent results show improved performance with net income rising to CNY 34.15 million from a previous loss of CNY 7.66 million year-over-year.

- Get an in-depth perspective on Changsha Jingjia Microelectronics' performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Changsha Jingjia Microelectronics is priced higher than what may be justified by its financials.

Next Steps

- Click this link to deep-dive into the 1522 companies within our Fast Growing Companies With High Insider Ownership screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300474

Changsha Jingjia Microelectronics

Changsha Jingjia Microelectronics Co., Ltd.

High growth potential with excellent balance sheet.