- China

- /

- Medical Equipment

- /

- SHSE:688212

Three Growth Stocks With Strong Insider Ownership To Watch

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by rate cuts in Europe and fluctuating indices in the U.S., investors are keenly observing sectors that continue to show resilience, such as utilities and real estate. In this environment, growth companies with high insider ownership can offer unique insights into potential opportunities, as strong insider stakes often signal confidence in a company's long-term prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

Underneath we present a selection of stocks filtered out by our screen.

Shanghai Aohua Photoelectricity Endoscope (SHSE:688212)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai AoHua Photoelectricity Endoscope Co., Ltd. is a medical device company that focuses on the research, development, manufacture, and sale of electronic endoscopic equipment and consumables both in China and internationally, with a market cap of CN¥6.86 billion.

Operations: The company generates revenue primarily from its diagnostic kits and equipment segment, totaling CN¥742.52 million.

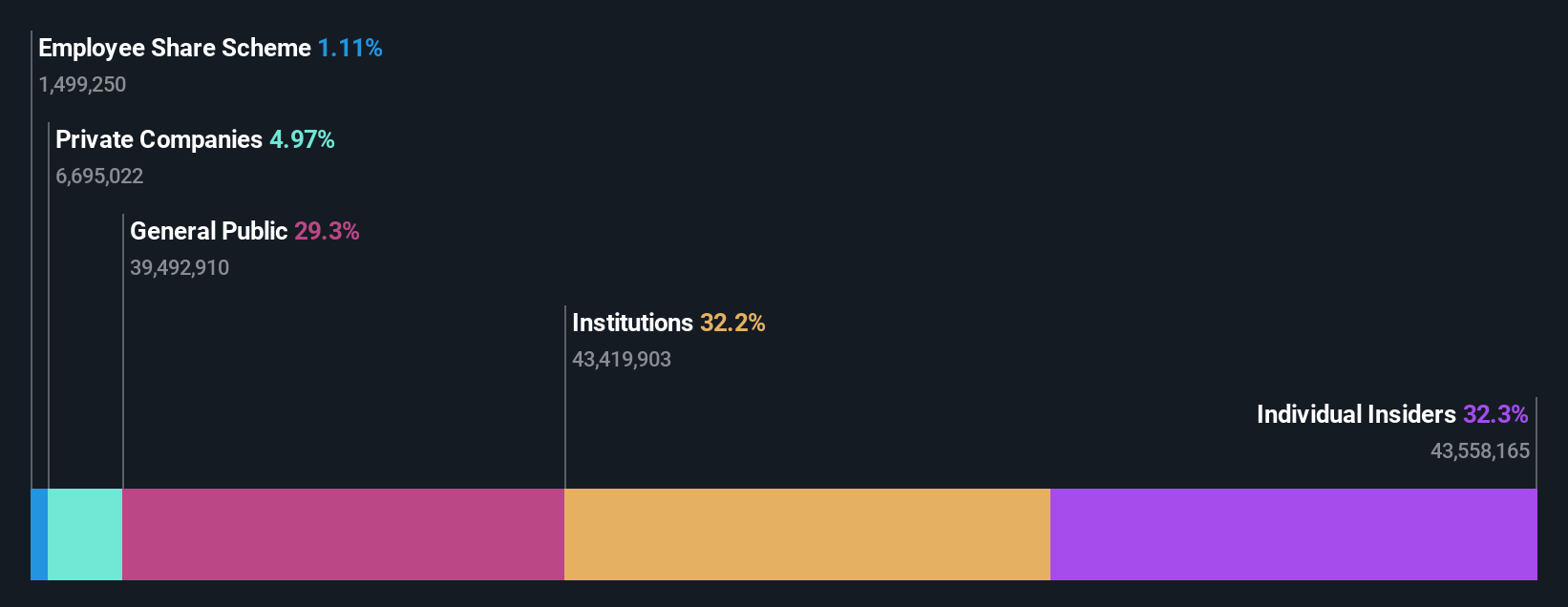

Insider Ownership: 32.3%

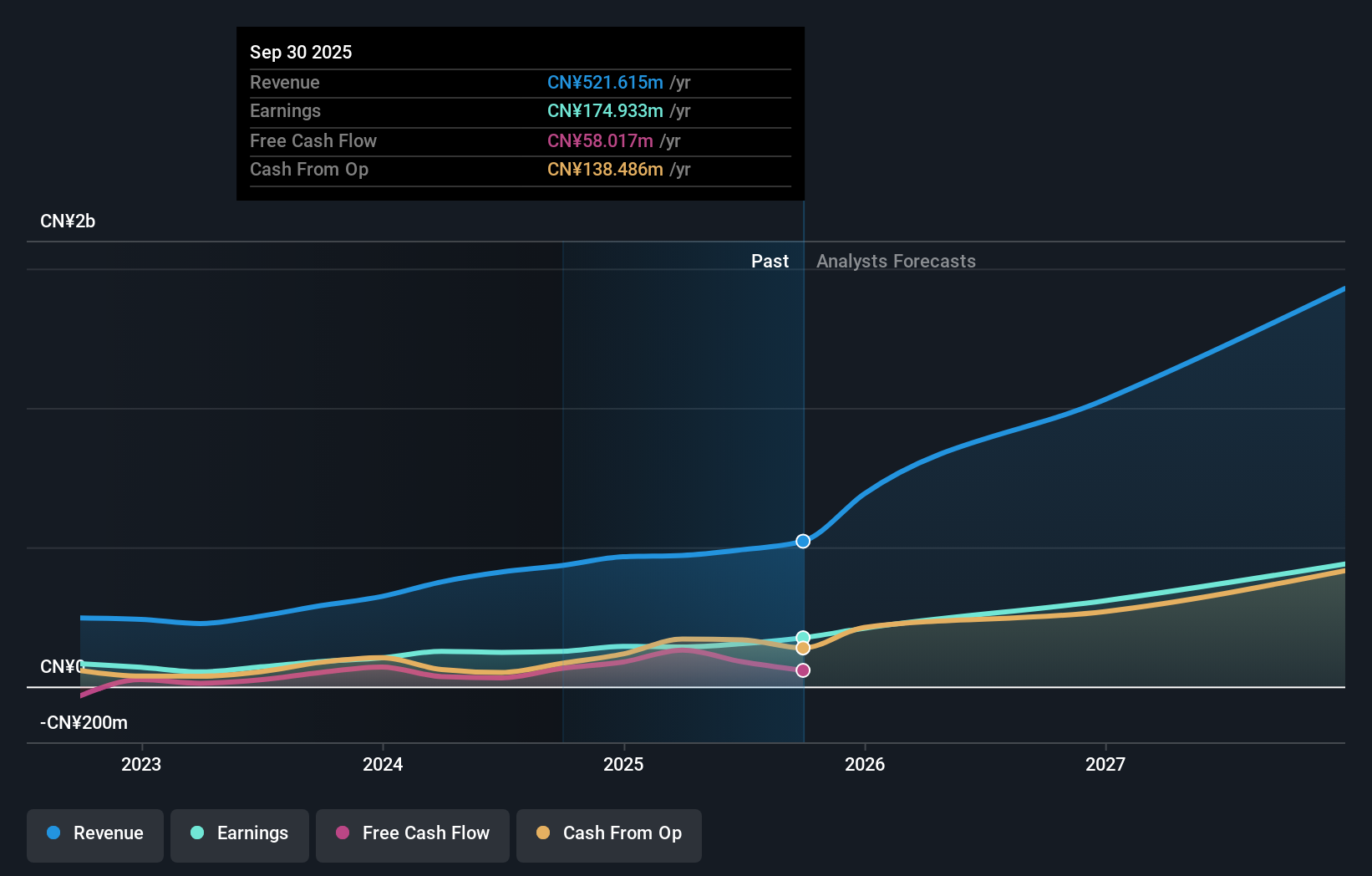

Earnings Growth Forecast: 73% p.a.

Shanghai Aohua Photoelectricity Endoscope showcases potential as a growth company with high insider ownership, though recent earnings reveal challenges. Despite a significant drop in net income to CNY 5.66 million, revenue increased to CNY 353.52 million for the half year ended June 2024. The company's earnings are forecasted to grow significantly at 73% annually over the next three years, surpassing market expectations, although profit margins have declined and share price volatility remains high.

- Take a closer look at Shanghai Aohua Photoelectricity Endoscope's potential here in our earnings growth report.

- Our valuation report unveils the possibility Shanghai Aohua Photoelectricity Endoscope's shares may be trading at a premium.

Lontium Semiconductor (SHSE:688486)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lontium Semiconductor Corporation designs, manufactures, and sells semiconductor products in China with a market capitalization of CN¥6.55 billion.

Operations: Lontium Semiconductor Corporation generates revenue through the design, manufacturing, and sale of semiconductor products in China.

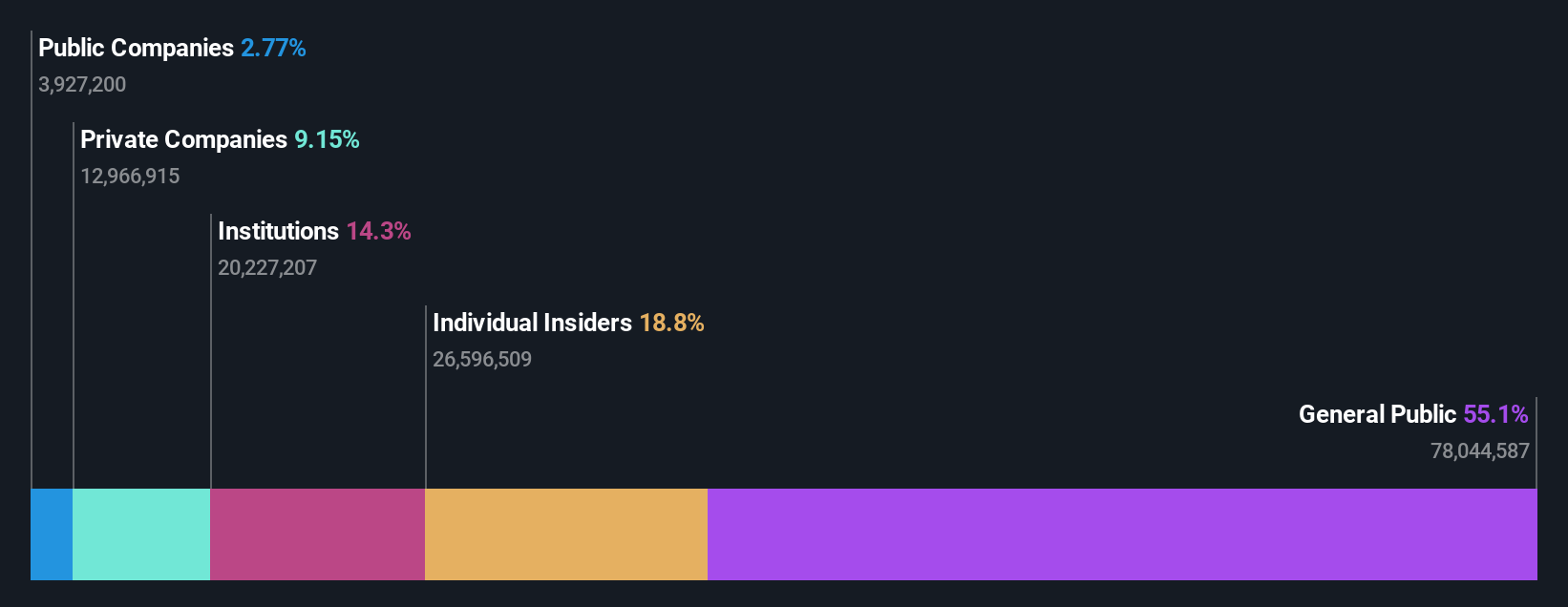

Insider Ownership: 38.5%

Earnings Growth Forecast: 37.3% p.a.

Lontium Semiconductor demonstrates growth potential with significant earnings and revenue increases, reporting sales of CNY 333.59 million for the nine months ended September 2024, up from CNY 222.1 million a year prior. Despite a volatile share price and low forecasted return on equity, its earnings are projected to grow at 37.3% annually, outpacing market expectations. The company completed a share buyback program worth CNY 59.2 million, indicating confidence in its future prospects.

- Click here to discover the nuances of Lontium Semiconductor with our detailed analytical future growth report.

- Our valuation report here indicates Lontium Semiconductor may be overvalued.

Wuxi DK Electronic MaterialsLtd (SZSE:300842)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuxi DK Electronic Materials Co., Ltd. is a technology company focused on the R&D, production, and sale of performance electronic materials for solar photovoltaic, display, lighting, and semiconductor industries in China with a market cap of CN¥6.18 billion.

Operations: The company's revenue is primarily derived from its Electronic Special Materials segment, which generated CN¥12.56 billion.

Insider Ownership: 19%

Earnings Growth Forecast: 26.3% p.a.

Wuxi DK Electronic Materials has shown robust growth, with revenue doubling to CNY 7.59 billion for the first half of 2024. Despite its volatile share price and large one-off items affecting earnings quality, its P/E ratio of 14.9x suggests better value compared to the broader Chinese market. The company forecasts significant annual earnings growth of over 26%, surpassing market expectations, though debt coverage by operating cash flow remains a concern. Recent shareholder meetings focused on equity incentive plans could align management interests with shareholders further.

- Navigate through the intricacies of Wuxi DK Electronic MaterialsLtd with our comprehensive analyst estimates report here.

- The analysis detailed in our Wuxi DK Electronic MaterialsLtd valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Unlock our comprehensive list of 1480 Fast Growing Companies With High Insider Ownership by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688212

Shanghai Aohua Photoelectricity Endoscope

Shanghai AoHua Photoelectricity Endoscope Co., Ltd., a medical device company, engages in the research and development, manufacture, and sale of electronic endoscopic equipment and other consumables in China and internationally.

High growth potential with adequate balance sheet.