- China

- /

- Semiconductors

- /

- SHSE:688458

What Maxic Technology, Inc.'s (SHSE:688458) 25% Share Price Gain Is Not Telling You

Maxic Technology, Inc. (SHSE:688458) shareholders are no doubt pleased to see that the share price has bounced 25% in the last month, although it is still struggling to make up recently lost ground. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

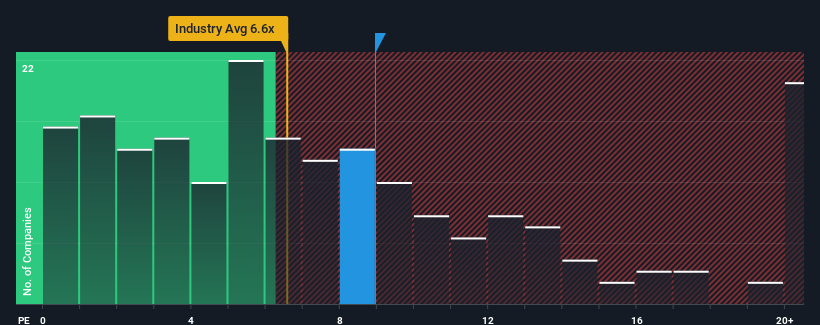

After such a large jump in price, Maxic Technology may be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 8.9x, since almost half of all companies in the Semiconductor in China have P/S ratios under 6.6x and even P/S lower than 3x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Maxic Technology

How Has Maxic Technology Performed Recently?

With revenue growth that's inferior to most other companies of late, Maxic Technology has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Maxic Technology will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Maxic Technology's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a decent 7.1% gain to the company's revenues. Pleasingly, revenue has also lifted 217% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 77% during the coming year according to the dual analysts following the company. That's shaping up to be materially lower than the 20,706% growth forecast for the broader industry.

With this information, we find it concerning that Maxic Technology is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Maxic Technology's P/S?

Maxic Technology's P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It comes as a surprise to see Maxic Technology trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 1 warning sign for Maxic Technology that you should be aware of.

If these risks are making you reconsider your opinion on Maxic Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688458

Maxic Technology

Engages in the design and sale of analog and digital-analog hybrid integrated circuits (ICs) in China and internationally.

Flawless balance sheet and overvalued.

Market Insights

Community Narratives