- China

- /

- Semiconductors

- /

- SHSE:688458

Maxic Technology, Inc. (SHSE:688458) Might Not Be As Mispriced As It Looks After Plunging 35%

The Maxic Technology, Inc. (SHSE:688458) share price has fared very poorly over the last month, falling by a substantial 35%. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

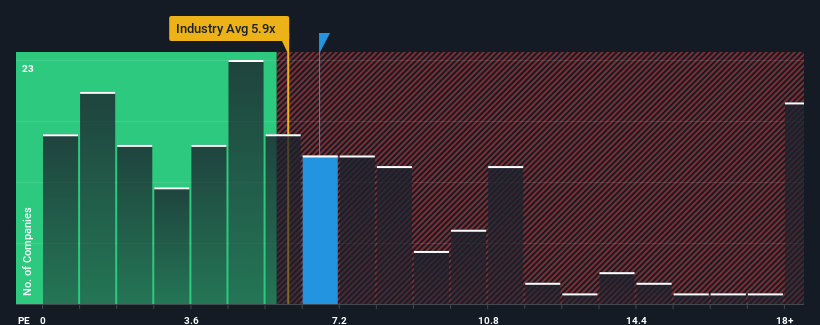

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Maxic Technology's P/S ratio of 6.7x, since the median price-to-sales (or "P/S") ratio for the Semiconductor industry in China is also close to 5.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Maxic Technology

How Maxic Technology Has Been Performing

With revenue growth that's inferior to most other companies of late, Maxic Technology has been relatively sluggish. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Maxic Technology's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

Maxic Technology's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.1% last year. This was backed up an excellent period prior to see revenue up by 217% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 78% over the next year. With the industry only predicted to deliver 34%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Maxic Technology is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Maxic Technology's P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for Maxic Technology looks to be in line with the rest of the Semiconductor industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, Maxic Technology's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Having said that, be aware Maxic Technology is showing 1 warning sign in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688458

Maxic Technology

Engages in the design and sale of analog and digital-analog hybrid integrated circuits (ICs) in China and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives