- China

- /

- Semiconductors

- /

- SHSE:688416

Zbit Semiconductor, Inc. (SHSE:688416) Soars 29% But It's A Story Of Risk Vs Reward

Zbit Semiconductor, Inc. (SHSE:688416) shares have continued their recent momentum with a 29% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 43% in the last twelve months.

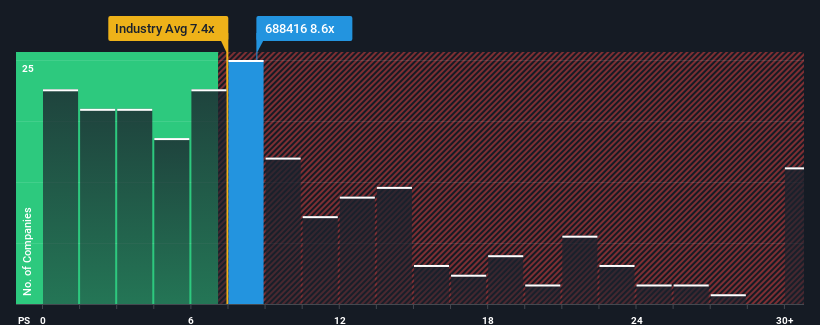

Although its price has surged higher, it's still not a stretch to say that Zbit Semiconductor's price-to-sales (or "P/S") ratio of 8.6x right now seems quite "middle-of-the-road" compared to the Semiconductor industry in China, where the median P/S ratio is around 7.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Zbit Semiconductor

What Does Zbit Semiconductor's P/S Mean For Shareholders?

Recent revenue growth for Zbit Semiconductor has been in line with the industry. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. Those who are bullish on Zbit Semiconductor will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zbit Semiconductor.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Zbit Semiconductor's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 17%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 39% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 62% over the next year. With the industry only predicted to deliver 42%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Zbit Semiconductor's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Its shares have lifted substantially and now Zbit Semiconductor's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at Zbit Semiconductor's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Plus, you should also learn about this 1 warning sign we've spotted with Zbit Semiconductor.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Zbit Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688416

Zbit Semiconductor

An integrated circuit design company, engages in the research and development, design, and sale of memory chips and MCU chips in China.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives