- China

- /

- Healthtech

- /

- SZSE:300451

3 Growth Companies With High Insider Ownership And 33% Revenue Growth

Reviewed by Simply Wall St

As global markets navigate the complexities of escalating Middle East tensions and unexpected job gains in the U.S., investors are keenly observing how these factors influence stock performance across various sectors. Amidst this backdrop, identifying growth companies with high insider ownership can be particularly appealing, as such ownership often signals confidence in a company's long-term potential and aligns management interests with those of shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

Let's take a closer look at a couple of our picks from the screened companies.

Jiangsu Cnano Technology (SHSE:688116)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Cnano Technology Co., Ltd. is engaged in the research, development, production, and sale of carbon nanotube materials and related products in China, with a market cap of approximately CN¥11.25 billion.

Operations: Jiangsu Cnano Technology generates its revenue primarily through the research, development, production, and sale of carbon nanotube materials and associated products within China.

Insider Ownership: 18%

Revenue Growth Forecast: 33.6% p.a.

Jiangsu Cnano Technology demonstrates strong growth potential with earnings and revenue expected to grow significantly at 33.6% annually, well above the Chinese market average. Despite recent volatility in its share price, the company reported increased half-year net income of CNY 115.51 million from CNY 89.88 million previously. However, the dividend yield of 0.92% is not adequately supported by free cash flows, and future return on equity is forecasted to be low at 15.9%.

- Click here to discover the nuances of Jiangsu Cnano Technology with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Jiangsu Cnano Technology shares in the market.

Primarius Technologies (SHSE:688206)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Primarius Technologies Co., Ltd. is a Chinese company that researches, designs, and develops EDA tools, with a market cap of CN¥9.25 billion.

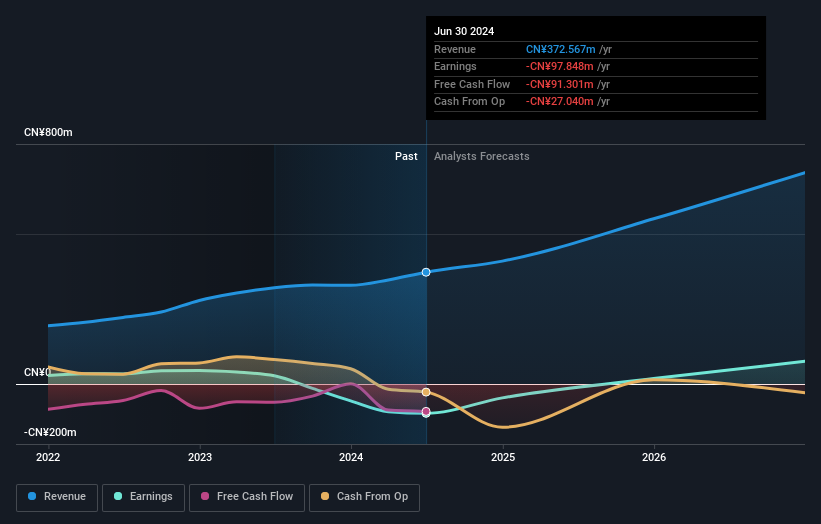

Operations: The company generates revenue from EDA Solutions, amounting to CN¥372.57 million.

Insider Ownership: 16.2%

Revenue Growth Forecast: 26.4% p.a.

Primarius Technologies is poised for significant growth, with revenue expected to increase by 26.4% annually, surpassing the broader Chinese market. Despite a volatile share price and a net loss of CNY 40.88 million for the first half of 2024, the company is anticipated to achieve profitability within three years. The recent completion of a share buyback program totaling CNY 17.02 million underscores management's confidence in its long-term prospects despite low forecasted return on equity at 0.2%.

- Take a closer look at Primarius Technologies' potential here in our earnings growth report.

- Our valuation report unveils the possibility Primarius Technologies' shares may be trading at a premium.

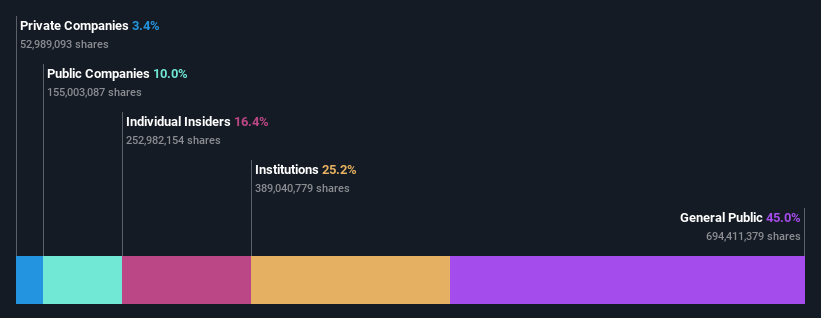

B-SOFTLtd (SZSE:300451)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: B-SOFT Co., Ltd. operates in the medical and health industry in China with a market cap of CN¥9.02 billion.

Operations: Revenue segments for SZSE:300451 include software development at CN¥1.25 billion and system integration services at CN¥850 million.

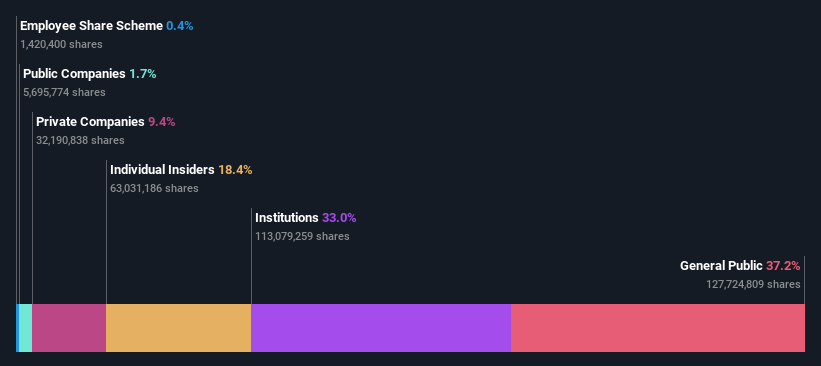

Insider Ownership: 16.4%

Revenue Growth Forecast: 17.4% p.a.

B-SOFT Ltd. demonstrates potential for growth, with expected annual earnings growth of 54.7%, outpacing the Chinese market's 23.3%. The company recently became profitable, reporting a net income of CNY 27.38 million for the first half of 2024. Despite high share price volatility and low forecasted return on equity at 6.7%, revenue is projected to grow by 17.4% annually, indicating robust future prospects amidst stable insider ownership dynamics.

- Delve into the full analysis future growth report here for a deeper understanding of B-SOFTLtd.

- According our valuation report, there's an indication that B-SOFTLtd's share price might be on the expensive side.

Seize The Opportunity

- Get an in-depth perspective on all 1486 Fast Growing Companies With High Insider Ownership by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if B-SOFTLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300451

Flawless balance sheet with reasonable growth potential.