- China

- /

- Semiconductors

- /

- SHSE:688150

Investors Appear Satisfied With Shaanxi Lighte Optoelectronics Material Co.,Ltd's (SHSE:688150) Prospects As Shares Rocket 25%

Those holding Shaanxi Lighte Optoelectronics Material Co.,Ltd (SHSE:688150) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 9.3% over the last year.

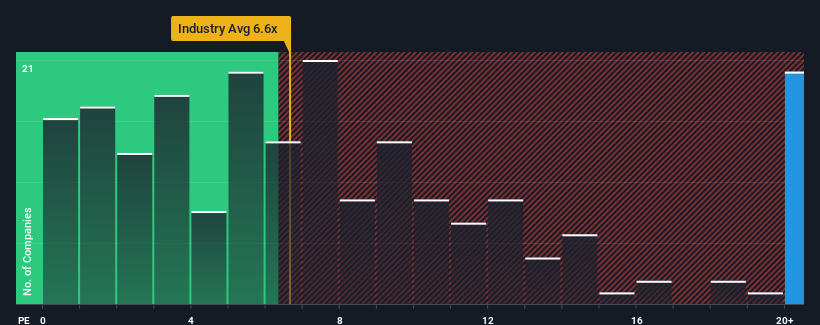

After such a large jump in price, Shaanxi Lighte Optoelectronics MaterialLtd may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 28.4x, since almost half of all companies in the Semiconductor industry in China have P/S ratios under 6.6x and even P/S lower than 3x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Shaanxi Lighte Optoelectronics MaterialLtd

How Shaanxi Lighte Optoelectronics MaterialLtd Has Been Performing

Recent times haven't been great for Shaanxi Lighte Optoelectronics MaterialLtd as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Shaanxi Lighte Optoelectronics MaterialLtd will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Shaanxi Lighte Optoelectronics MaterialLtd's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 7.3%. The latest three year period has also seen a 9.5% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 80% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 35%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Shaanxi Lighte Optoelectronics MaterialLtd's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Shares in Shaanxi Lighte Optoelectronics MaterialLtd have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Shaanxi Lighte Optoelectronics MaterialLtd shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Shaanxi Lighte Optoelectronics MaterialLtd that you need to be mindful of.

If you're unsure about the strength of Shaanxi Lighte Optoelectronics MaterialLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688150

Shaanxi Lighte Optoelectronics MaterialLtd

Engages in the research, development, production, and sales of organic light-emitting diodes (OLED) materials.

Exceptional growth potential with solid track record.

Market Insights

Community Narratives