- China

- /

- Semiconductors

- /

- SHSE:688061

A Piece Of The Puzzle Missing From Shanghai Orient-Chip Technology Co.,LTD.'s (SHSE:688061) 28% Share Price Climb

Shanghai Orient-Chip Technology Co.,LTD. (SHSE:688061) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 49% over that time.

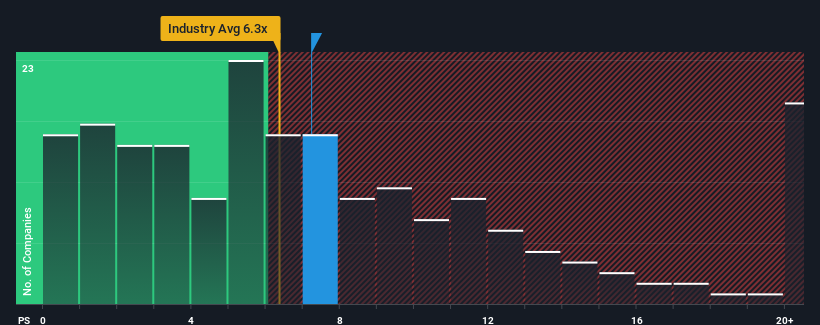

Although its price has surged higher, you could still be forgiven for feeling indifferent about Shanghai Orient-Chip TechnologyLTD's P/S ratio of 7.2x, since the median price-to-sales (or "P/S") ratio for the Semiconductor industry in China is also close to 6.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Shanghai Orient-Chip TechnologyLTD

What Does Shanghai Orient-Chip TechnologyLTD's Recent Performance Look Like?

Shanghai Orient-Chip TechnologyLTD could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Shanghai Orient-Chip TechnologyLTD's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Shanghai Orient-Chip TechnologyLTD?

In order to justify its P/S ratio, Shanghai Orient-Chip TechnologyLTD would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 23%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 57% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 58% as estimated by the one analyst watching the company. With the industry only predicted to deliver 37%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Shanghai Orient-Chip TechnologyLTD's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Shanghai Orient-Chip TechnologyLTD's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, Shanghai Orient-Chip TechnologyLTD's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you settle on your opinion, we've discovered 2 warning signs for Shanghai Orient-Chip TechnologyLTD (1 is a bit concerning!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688061

Shanghai Orient-Chip TechnologyLTD

Engages in the research and development, design, and production of digital-analog hybrid integrated circuits and analog integrated circuits.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives