Stock Analysis

- China

- /

- Semiconductors

- /

- SHSE:688498

Three Growth Companies On Chinese Exchange With High Insider Ownership And Up To 42% Revenue Growth

Reviewed by Simply Wall St

Amidst a backdrop of global economic shifts and market adjustments, Chinese equities have experienced notable fluctuations, reflecting broader concerns about inflation and consumer confidence within the region. In such an environment, identifying growth companies with high insider ownership on Chinese exchanges can offer investors a unique blend of potential resilience and growth, particularly those demonstrating robust revenue increases up to 42%.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Suzhou Shijing Environmental TechnologyLtd (SZSE:301030) | 22% | 54.9% |

| Ningbo Deye Technology Group (SHSE:605117) | 24.8% | 28.4% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 36.2% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 24.8% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| Eoptolink Technology (SZSE:300502) | 26.7% | 39.1% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

| UTour Group (SZSE:002707) | 24% | 33.1% |

| Offcn Education Technology (SZSE:002607) | 26.1% | 65.3% |

Let's take a closer look at a couple of our picks from the screened companies.

Shenzhen Kiwi Instruments (SHSE:688045)

Simply Wall St Growth Rating: ★★★★★☆

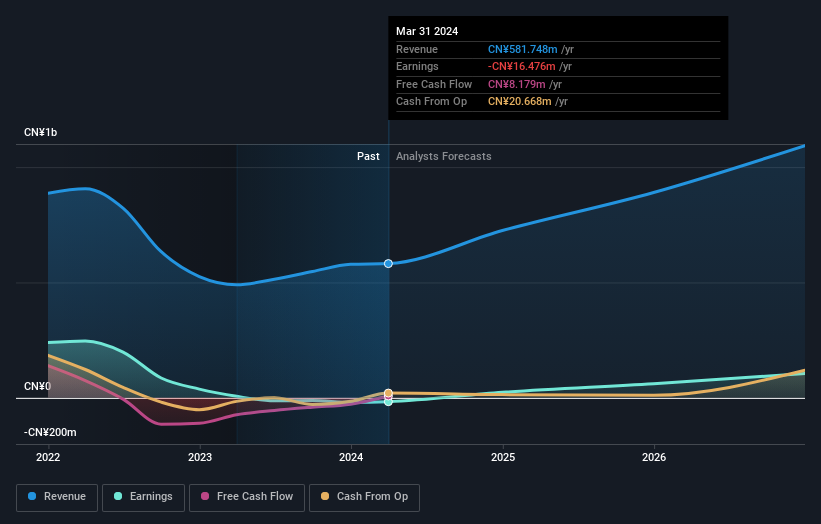

Overview: Shenzhen Kiwi Instruments Co., Ltd. specializes in developing and selling analog and mixed-signal power management integrated circuits, with a market capitalization of approximately CN¥2.26 billion.

Operations: The company generates CN¥581.75 million in revenue from its semiconductor segment.

Insider Ownership: 38.2%

Revenue Growth Forecast: 22.3% p.a.

Shenzhen Kiwi Instruments is poised for notable growth with its revenue projected to increase at 22.3% annually, outpacing the broader Chinese market. The company recently transitioned from a loss to a modest profit of CNY 0.28 million in Q1 2024, showcasing improved financial health. Despite this progress, the forecasted return on equity remains low at 5%, suggesting potential challenges in generating shareholder value efficiently. Recent activities include significant share buybacks and regular extraordinary shareholders' meetings, indicating active management engagement and confidence.

- Navigate through the intricacies of Shenzhen Kiwi Instruments with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Shenzhen Kiwi Instruments implies its share price may be too high.

Yuanjie Semiconductor Technology (SHSE:688498)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Yuanjie Semiconductor Technology Co., Ltd. is a company specializing in semiconductor technology with a market capitalization of CN¥12.29 billion.

Operations: The firm primarily generates its revenue from semiconductor technology operations.

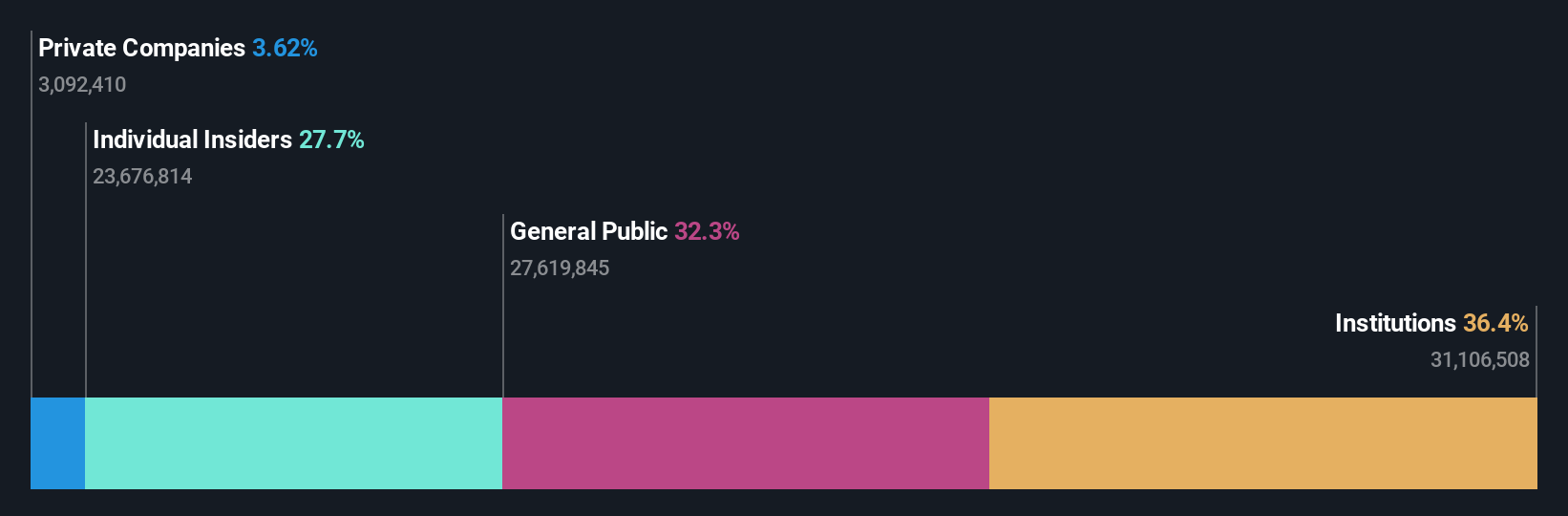

Insider Ownership: 27.7%

Revenue Growth Forecast: 42% p.a.

Yuanjie Semiconductor Technology has demonstrated robust growth prospects, with revenue and earnings forecasted to expand significantly above the Chinese market average. However, recent financials reveal a dip in net profit margins from the previous year, alongside a substantial one-off item affecting results. Insider transactions have been quiet over the last three months. The company's active share buyback program underscores management's confidence in its trajectory despite some financial inconsistencies.

- Get an in-depth perspective on Yuanjie Semiconductor Technology's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Yuanjie Semiconductor Technology shares in the market.

Wuhan Jingce Electronic GroupLtd (SZSE:300567)

Simply Wall St Growth Rating: ★★★★★☆

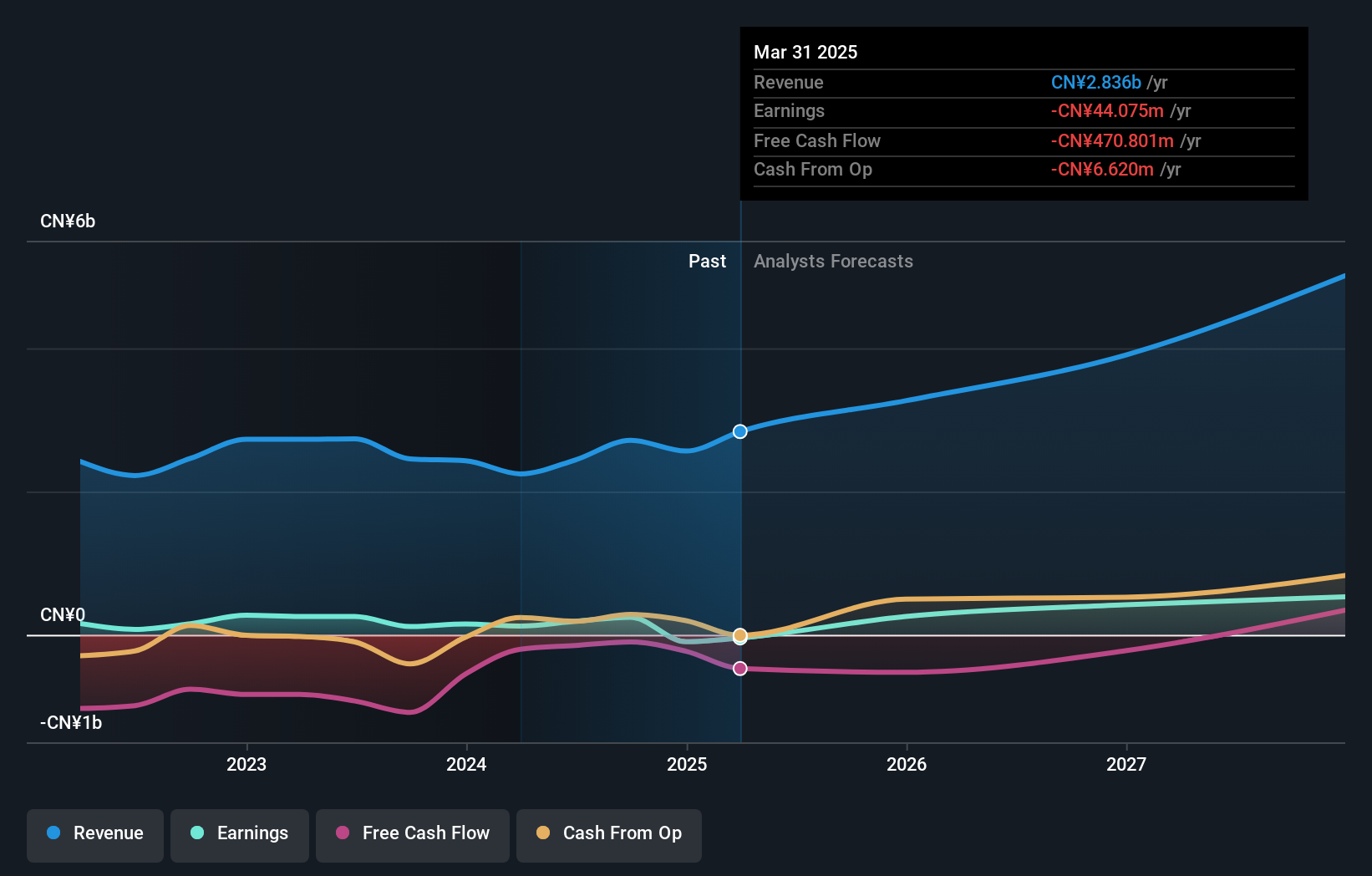

Overview: Wuhan Jingce Electronic Group Co., Ltd. specializes in researching, developing, producing, and selling display, semiconductor, and new energy detection systems with a market capitalization of approximately CN¥17.39 billion.

Operations: The company generates revenue primarily through its electron product segment, which brought in CN¥2.25 billion.

Insider Ownership: 37.3%

Revenue Growth Forecast: 27.1% p.a.

Wuhan Jingce Electronic GroupLtd has seen a decline in recent financial performance, with a notable drop in revenue and a shift from net profit to loss. Despite this, the company's long-term growth prospects remain strong, with expected revenue and earnings growth significantly outpacing the Chinese market. Recent corporate actions include adjustments to share repurchase plans and amendments to company bylaws, reflecting active management engagement. However, insider trading activity has been minimal over the past three months.

- Take a closer look at Wuhan Jingce Electronic GroupLtd's potential here in our earnings growth report.

- Our valuation report here indicates Wuhan Jingce Electronic GroupLtd may be overvalued.

Summing It All Up

- Investigate our full lineup of 368 Fast Growing Chinese Companies With High Insider Ownership right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Yuanjie Semiconductor Technology is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688498

Yuanjie Semiconductor Technology

Yuanjie Semiconductor Technology Co., Ltd.

Flawless balance sheet with high growth potential.