3 Growth Companies With High Insider Ownership And Up To 29% Revenue Growth

Reviewed by Simply Wall St

In a week marked by geopolitical tensions and consumer spending concerns, global markets experienced volatility with major U.S. indices posting declines despite early gains. As investors navigate these uncertain times, focusing on growth companies with high insider ownership can be appealing due to their potential for substantial revenue growth and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.1% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Findi (ASX:FND) | 35.8% | 133.7% |

Let's review some notable picks from our screened stocks.

Asian Star Anchor Chain Jiangsu (SHSE:601890)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Asian Star Anchor Chain Co., Ltd. Jiangsu, with a market cap of CN¥7.23 billion, manufactures and sells anchor chains, marine mooring chains, and related accessories globally through its subsidiaries.

Operations: Asian Star Anchor Chain Jiangsu's revenue is derived from the production and distribution of anchor chains, marine mooring chains, and associated accessories on a global scale.

Insider Ownership: 37.6%

Revenue Growth Forecast: 20.9% p.a.

Asian Star Anchor Chain Jiangsu demonstrates growth potential with expected earnings and revenue increases of 21.4% and 20.9% annually, respectively, outpacing the broader CN market's revenue growth rate. Its P/E ratio of 28.8x suggests it is undervalued compared to the CN market average of 38x. However, its dividend yield of 1.38% isn't well covered by free cash flows, and its forecasted Return on Equity remains relatively low at 9.8%.

- Click to explore a detailed breakdown of our findings in Asian Star Anchor Chain Jiangsu's earnings growth report.

- The analysis detailed in our Asian Star Anchor Chain Jiangsu valuation report hints at an deflated share price compared to its estimated value.

JHT DesignLtd (SHSE:603061)

Simply Wall St Growth Rating: ★★★★★☆

Overview: JHT Design Co., Ltd. specializes in the research, development, production, and sale of semiconductor chip testing equipment in China with a market cap of CN¥4.54 billion.

Operations: JHT Design Co., Ltd. generates its revenue primarily from the research, development, production, and sale of semiconductor chip testing equipment in China.

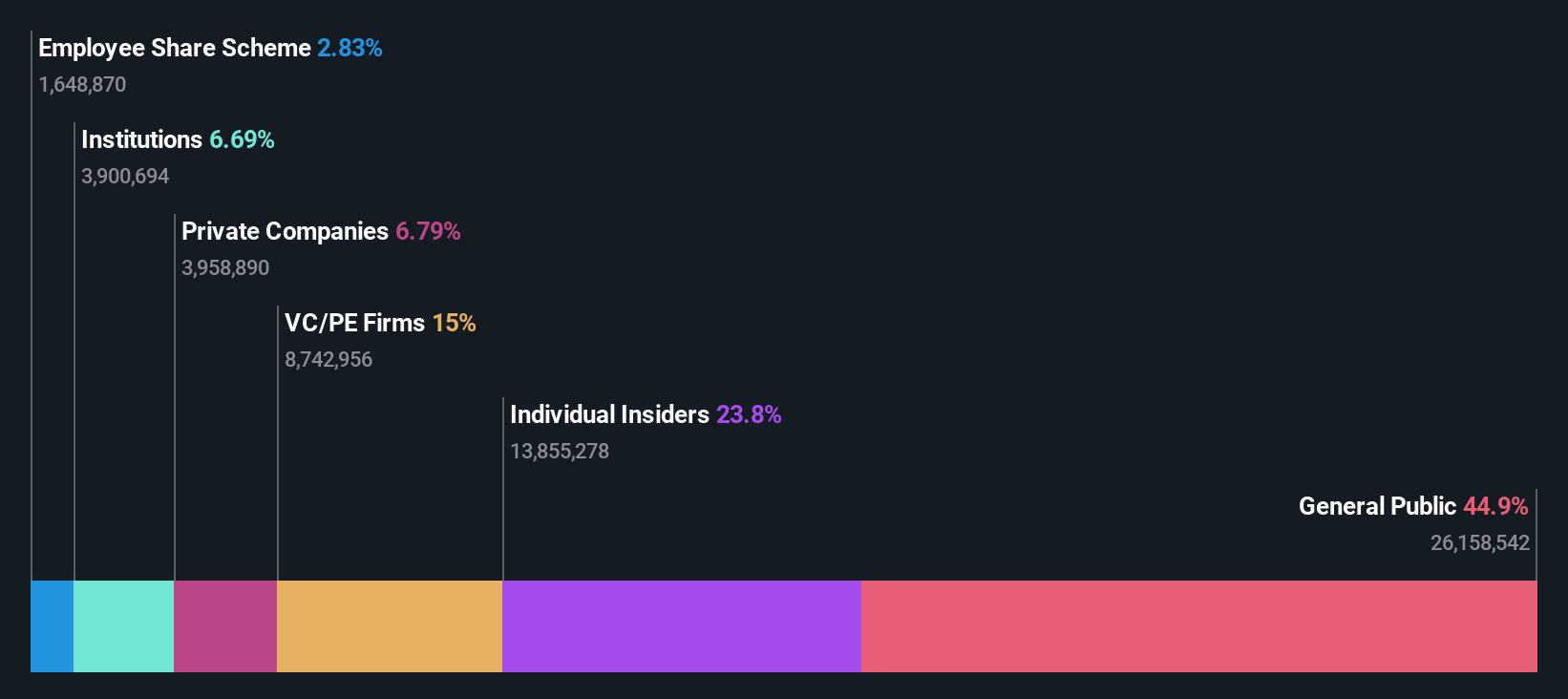

Insider Ownership: 23.8%

Revenue Growth Forecast: 29.3% p.a.

JHT Design Ltd. shows promising growth potential with forecasted earnings and revenue increases of 33.93% and 29.3% annually, surpassing the broader CN market's growth rates. Its P/E ratio of 59.7x is below the semiconductor industry average, indicating potential undervaluation within its sector. Despite significant one-off items affecting results, insider ownership remains stable with no substantial recent trading activity noted ahead of their upcoming shareholders meeting in Shanghai on December 27, 2024.

- Take a closer look at JHT DesignLtd's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, JHT DesignLtd's share price might be too optimistic.

Luoyang Jianlong Micro-nano New Material (SHSE:688357)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Luoyang Jianlong Micro-nano New Material Co., Ltd specializes in the manufacturing and sale of molecular sieves in China, with a market capitalization of CN¥2.36 billion.

Operations: The company's revenue primarily comes from its Chemical Raw Materials and Chemical Products Manufacturing segment, amounting to CN¥737.86 million.

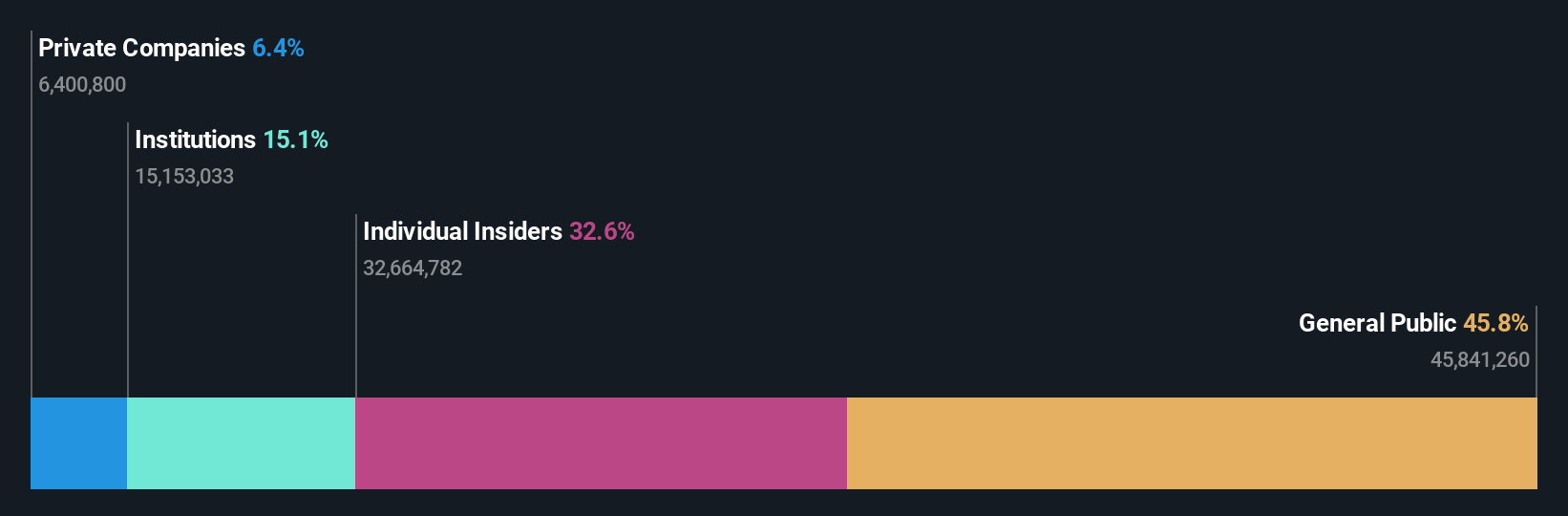

Insider Ownership: 32.7%

Revenue Growth Forecast: 24.1% p.a.

Luoyang Jianlong Micro-nano New Material is poised for significant growth, with earnings expected to rise 34.95% annually and revenue projected to grow at 24.1% per year, outpacing the broader CN market. Its P/E ratio of 30.8x suggests potential undervaluation compared to the market average of 38x. However, profit margins have declined from last year, and Return on Equity is forecasted to be low at 8.7%. No recent insider trading activity was noted ahead of their February shareholders meeting in Luoyang, China.

- Navigate through the intricacies of Luoyang Jianlong Micro-nano New Material with our comprehensive analyst estimates report here.

- Our valuation report here indicates Luoyang Jianlong Micro-nano New Material may be overvalued.

Seize The Opportunity

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1453 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688357

Luoyang Jianlong Micro-nano New Material

Manufactures and sells molecular sieves in China.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives