- China

- /

- Semiconductors

- /

- SHSE:600770

Discover 3 Asian Penny Stocks With At Least US$700M Market Cap

Reviewed by Simply Wall St

As Asian markets navigate a landscape marked by evolving trade policies and economic uncertainties, investors are increasingly exploring diverse opportunities for growth. Penny stocks, while traditionally seen as speculative, continue to offer potential value in the form of smaller or newer companies with promising financial health. In this article, we will highlight three such penny stocks that combine robust balance sheets with the potential for long-term growth.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Advice IT Infinite (SET:ADVICE) | THB4.80 | THB2.98B | ✅ 4 ⚠️ 3 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.36 | THB2.62B | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.43 | SGD174.27M | ✅ 4 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.191 | SGD38.05M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.06 | SGD8.11B | ✅ 5 ⚠️ 0 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.90 | HK$3.28B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.00 | HK$45.79B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.09 | HK$687.74M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.17 | HK$1.95B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$1.98 | HK$1.65B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,168 stocks from our Asian Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

LifeTech Scientific (SEHK:1302)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: LifeTech Scientific Corporation is an investment holding company that develops, manufactures, and trades interventional medical devices for cardiovascular and peripheral vascular diseases globally, with a market cap of HK$7.27 billion.

Operations: The company's revenue is primarily derived from its Peripheral Vascular Diseases Business at CN¥751.11 million, followed by the Structural Heart Diseases Business at CN¥527.58 million, and the Cardiac Pacing and Electrophysiology Business contributing CN¥25.01 million.

Market Cap: HK$7.27B

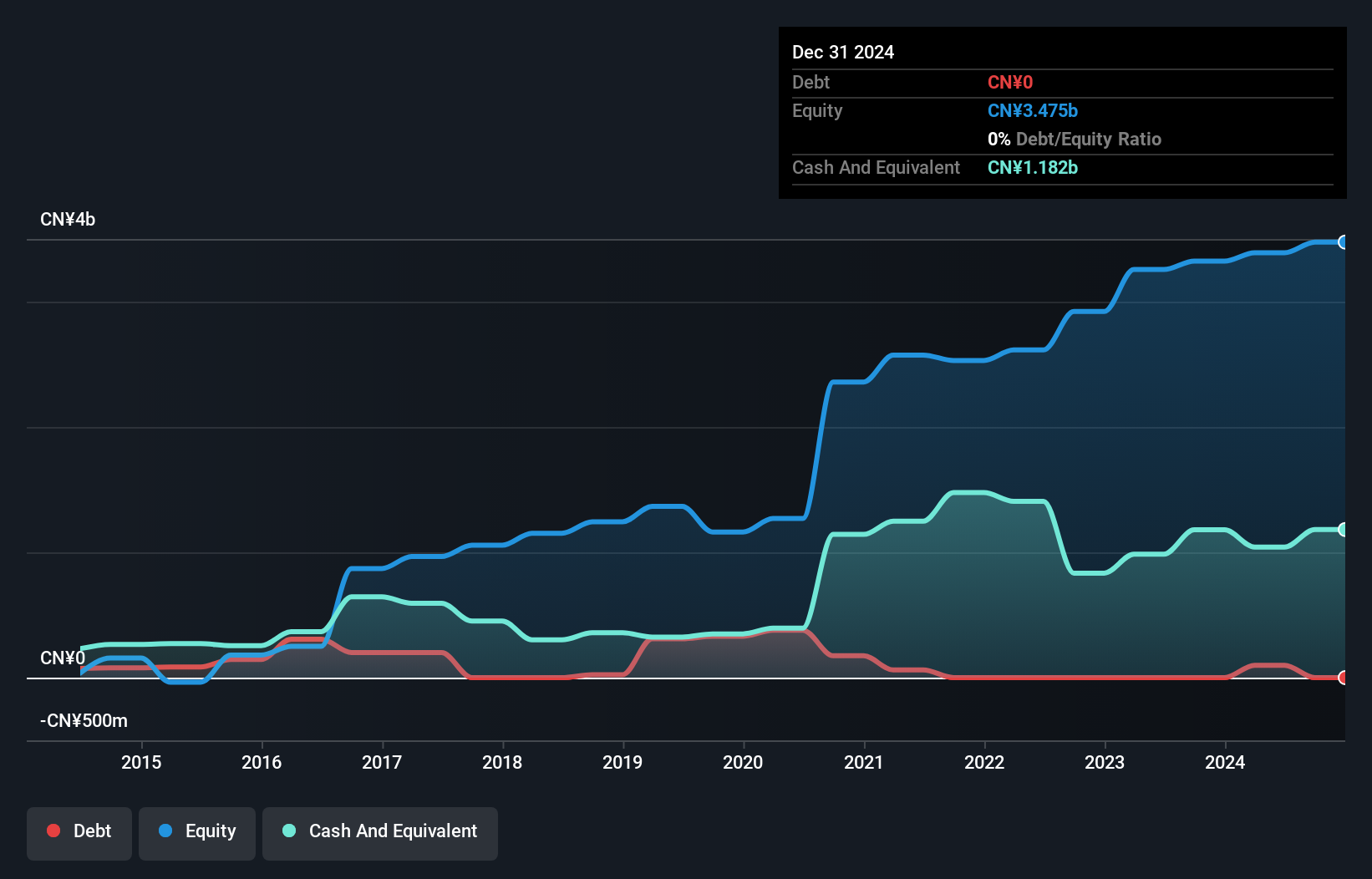

LifeTech Scientific Corporation, with a market cap of HK$7.27 billion, has shown mixed financial performance recently. Despite a decline in net profit margins from 20.8% to 17.1%, the company remains debt-free and maintains high-quality earnings with no recent shareholder dilution. While its earnings growth over the past year was negative at -15.5%, it has achieved an average annual profit growth of 7.9% over five years, indicating some resilience in its business model. Recent developments include obtaining US medical insurance coverage for its LAmbre TM Plus device trial and NMPA approval for the Ankura Aortic Stent Graft System in China, potentially enhancing future revenue streams and international presence.

- Click here and access our complete financial health analysis report to understand the dynamics of LifeTech Scientific.

- Gain insights into LifeTech Scientific's past trends and performance with our report on the company's historical track record.

Lepu Biopharma (SEHK:2157)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lepu Biopharma Co., Ltd. is a biopharmaceutical company engaged in the discovery, development, and commercialization of cancer targeted therapy and immunotherapy drugs both in China and internationally, with a market cap of HK$8.35 billion.

Operations: The company generates revenue of CN¥367.79 million from the sales of pharmaceutical products and the research and development of new drugs.

Market Cap: HK$8.35B

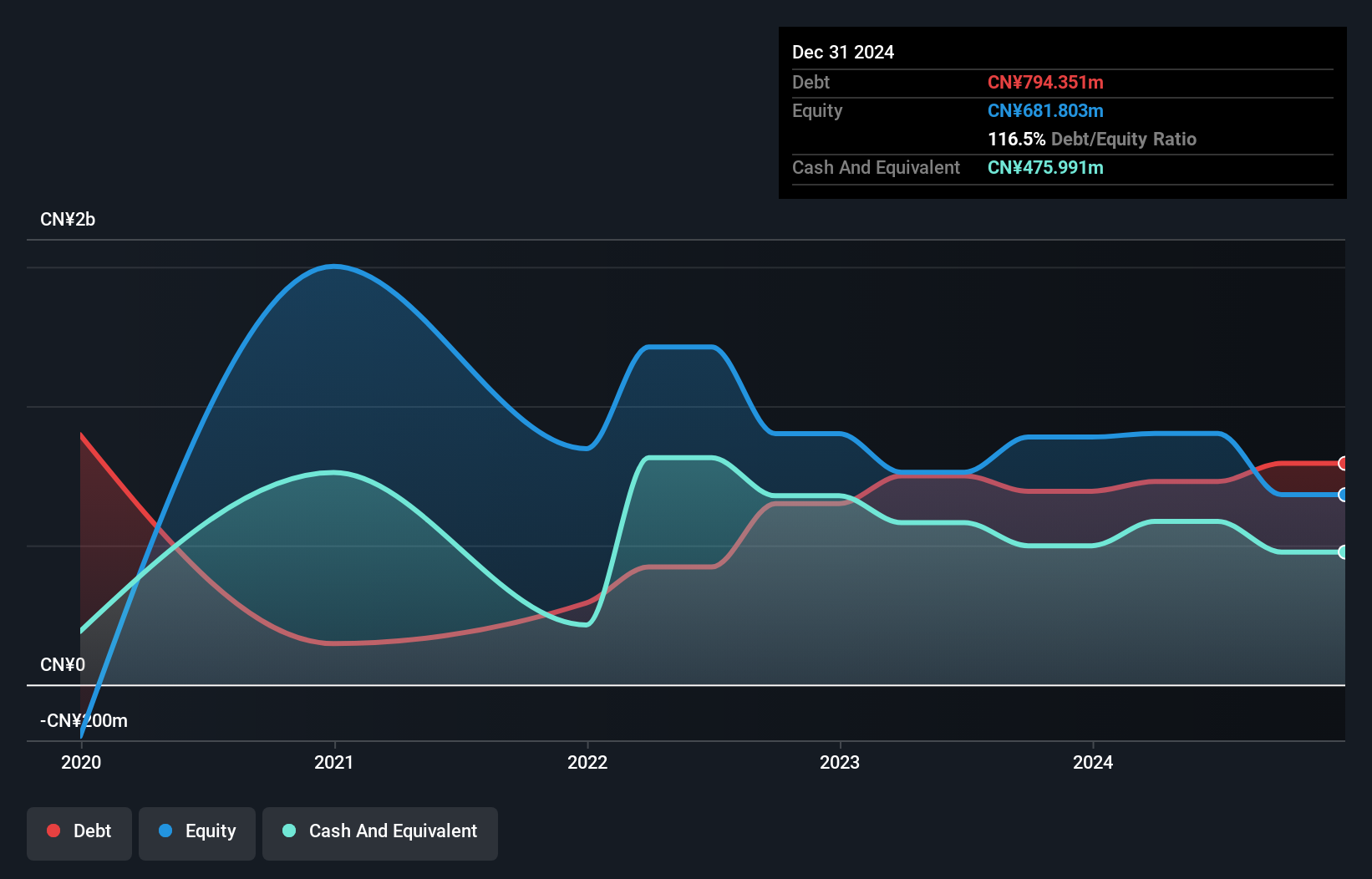

Lepu Biopharma, with a market cap of HK$8.35 billion, is navigating the volatile landscape of biopharmaceuticals with a focus on cancer therapies. Despite generating CN¥367.79 million in revenue, the company remains unprofitable, reporting a net loss of CN¥411.38 million for 2024. The company's financial stability is challenged by high debt levels and short-term liabilities exceeding its assets. However, Lepu's innovative drug candidate MRG003 has gained attention after being selected for presentation at the ASCO Annual Meeting and granted priority review by China's NMPA, signaling potential future breakthroughs despite current financial hurdles.

- Jump into the full analysis health report here for a deeper understanding of Lepu Biopharma.

- Examine Lepu Biopharma's past performance report to understand how it has performed in prior years.

Jiangsu ZongyiLTD (SHSE:600770)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jiangsu Zongyi Co., LTD operates in the clean energy, advanced technology, and integrated finance sectors with a market capitalization of approximately CN¥5.42 billion.

Operations: Jiangsu Zongyi Co., LTD has not reported specific revenue segments.

Market Cap: CN¥5.42B

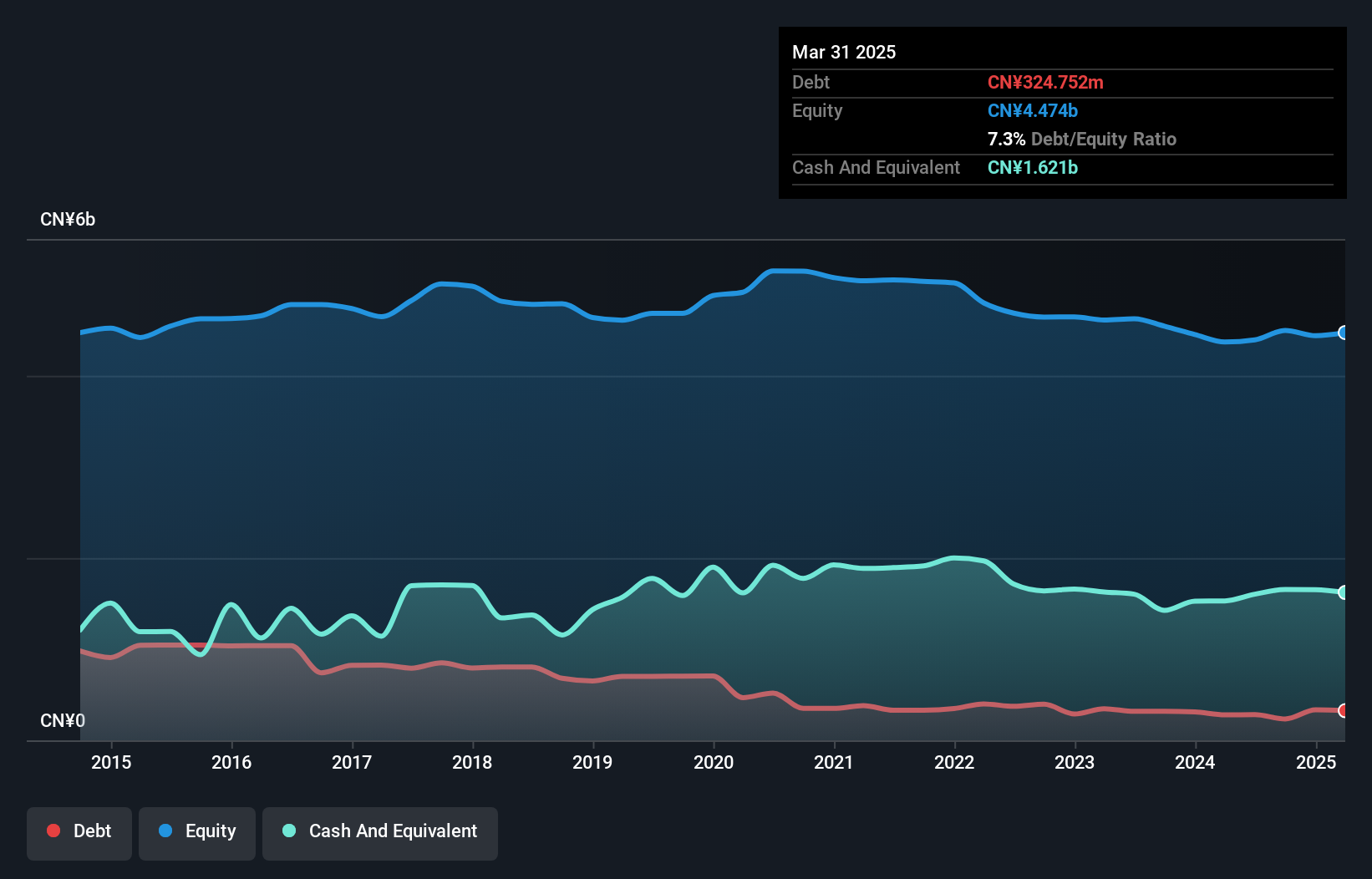

Jiangsu Zongyi Co., LTD, with a market capitalization of CN¥5.42 billion, has shown recent financial improvement, transitioning to profitability last year. The company's first-quarter 2025 revenue increased to CN¥101.7 million from CN¥63.35 million a year prior, although it reported a net loss of CN¥6.49 million compared to the previous year's larger loss of CN¥42.31 million. Its short-term assets significantly exceed both its short and long-term liabilities, indicating solid financial stability despite low return on equity and reliance on large one-off gains impacting earnings quality over the past year.

- Click to explore a detailed breakdown of our findings in Jiangsu ZongyiLTD's financial health report.

- Learn about Jiangsu ZongyiLTD's historical performance here.

Make It Happen

- Discover the full array of 1,168 Asian Penny Stocks right here.

- Seeking Other Investments? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600770

Jiangsu ZongyiLTD

Engages in the clean energy, advanced technology, and integrated finance businesses.

Proven track record with mediocre balance sheet.

Market Insights

Community Narratives