- China

- /

- Semiconductors

- /

- SHSE:600703

Investors in Sanan OptoelectronicsLtd (SHSE:600703) have unfortunately lost 61% over the last three years

While it may not be enough for some shareholders, we think it is good to see the Sanan Optoelectronics Co.,Ltd (SHSE:600703) share price up 28% in a single quarter. But over the last three years we've seen a quite serious decline. In that time, the share price dropped 61%. So it's good to see it climbing back up. The rise has some hopeful, but turnarounds are often precarious.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

Check out our latest analysis for Sanan OptoelectronicsLtd

We don't think that Sanan OptoelectronicsLtd's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over three years, Sanan OptoelectronicsLtd grew revenue at 7.3% per year. That's not a very high growth rate considering it doesn't make profits. It's likely this weak growth has contributed to an annualised return of 17% for the last three years. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term). After all, growing a business isn't easy, and the process will not always be smooth.

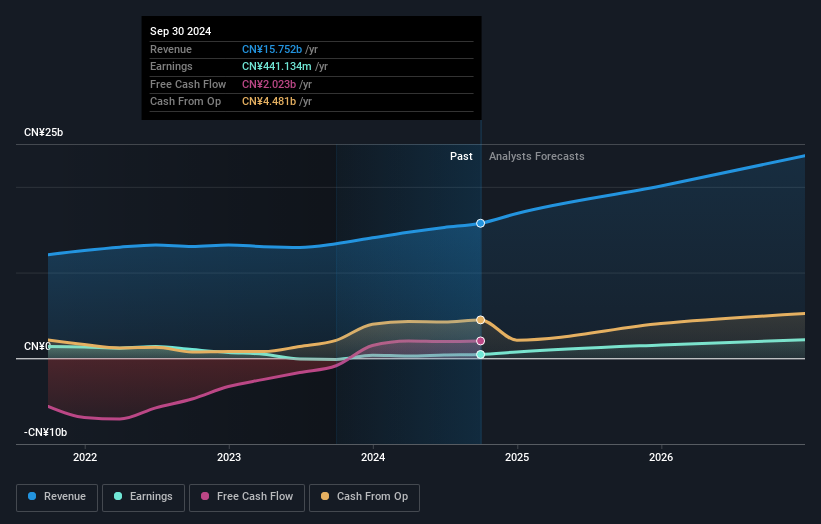

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that Sanan OptoelectronicsLtd has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on Sanan OptoelectronicsLtd

A Different Perspective

Sanan OptoelectronicsLtd shareholders are down 4.9% for the year (even including dividends), but the market itself is up 7.8%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 4% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with Sanan OptoelectronicsLtd .

We will like Sanan OptoelectronicsLtd better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600703

Sanan OptoelectronicsLtd

Engages in the research, development, production, and sale of LED epitaxial wafers and chips, compound semiconductors, semiconductor and communication chips, and sapphire substrates in China and internationally.

Reasonable growth potential with adequate balance sheet.