Stock Analysis

- China

- /

- Life Sciences

- /

- SHSE:688114

Exploring Undervalued Chinese Stocks On The Exchange With Discounts Ranging From 31% To 43.2%

Reviewed by Simply Wall St

Amidst a landscape of fluctuating global markets, Chinese equities have shown resilience with the Shanghai Composite Index experiencing modest gains. This context sets the stage for investors to consider the potential of undervalued stocks in China, which may present compelling opportunities given current economic conditions and market dynamics.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Imeik Technology DevelopmentLtd (SZSE:300896) | CN¥161.43 | CN¥322.03 | 49.9% |

| Beijing Kawin Technology Share-Holding (SHSE:688687) | CN¥23.70 | CN¥45.95 | 48.4% |

| Naipu Mining Machinery (SZSE:300818) | CN¥21.33 | CN¥41.93 | 49.1% |

| Guangdong Shenling Environmental Systems (SZSE:301018) | CN¥19.33 | CN¥38.26 | 49.5% |

| Shenzhen Ridge Engineering Consulting (SZSE:300977) | CN¥15.39 | CN¥29.83 | 48.4% |

| Thunder Software TechnologyLtd (SZSE:300496) | CN¥44.07 | CN¥84.08 | 47.6% |

| China Film (SHSE:600977) | CN¥10.27 | CN¥20.30 | 49.4% |

| INKON Life Technology (SZSE:300143) | CN¥7.62 | CN¥14.64 | 48% |

| Seres GroupLtd (SHSE:601127) | CN¥76.15 | CN¥149.33 | 49% |

| Beijing Aosaikang Pharmaceutical (SZSE:002755) | CN¥9.97 | CN¥18.84 | 47.1% |

Let's dive into some prime choices out of from the screener.

MGI Tech (SHSE:688114)

Overview: MGI Tech Co., Ltd. specializes in the development and sale of DNA sequencing instruments and reagents for sectors like precision medicine and agriculture, with a market capitalization of CN¥18.10 billion.

Operations: The company generates revenue primarily through the sale of DNA sequencing instruments and reagents, catering to industries such as precision medicine and agriculture.

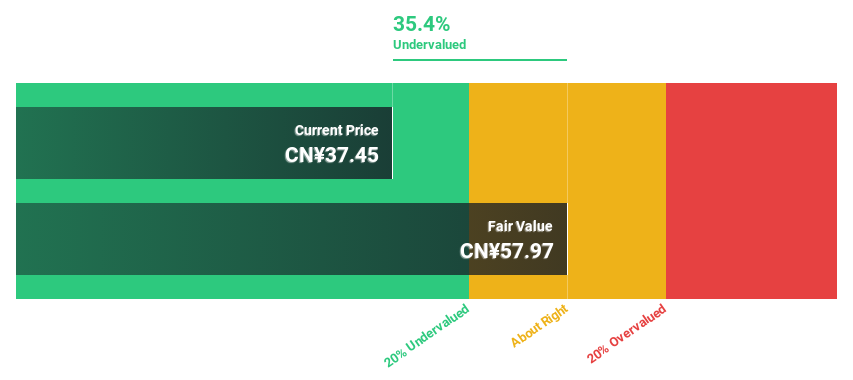

Estimated Discount To Fair Value: 43.2%

MGI Tech Co., Ltd., a company trading at CN¥43.93, significantly below the estimated fair value of CN¥77.39, appears undervalued based on cash flows. Despite a challenging financial period with a reported net loss of CN¥200.99 million in Q1 2024, MGI is poised for substantial growth with earnings expected to increase by 125.31% annually. Recent strategic alliances and product launches, such as the collaboration with Predica Diagnostics and the introduction of DNBSEQ-G400RS FluoXpert, demonstrate MGI's commitment to expanding its technological capabilities and market reach, potentially enhancing future revenue streams which are forecasted to grow at 16.7% per year.

- In light of our recent growth report, it seems possible that MGI Tech's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of MGI Tech.

Doctorglasses ChainLtd (SZSE:300622)

Overview: Doctorglasses Chain Co., Ltd. operates as a retailer of eyewear in China, with a market capitalization of approximately CN¥2.29 billion.

Operations: The company generates CN¥1.16 billion from its specialty retail segment focused on eyewear.

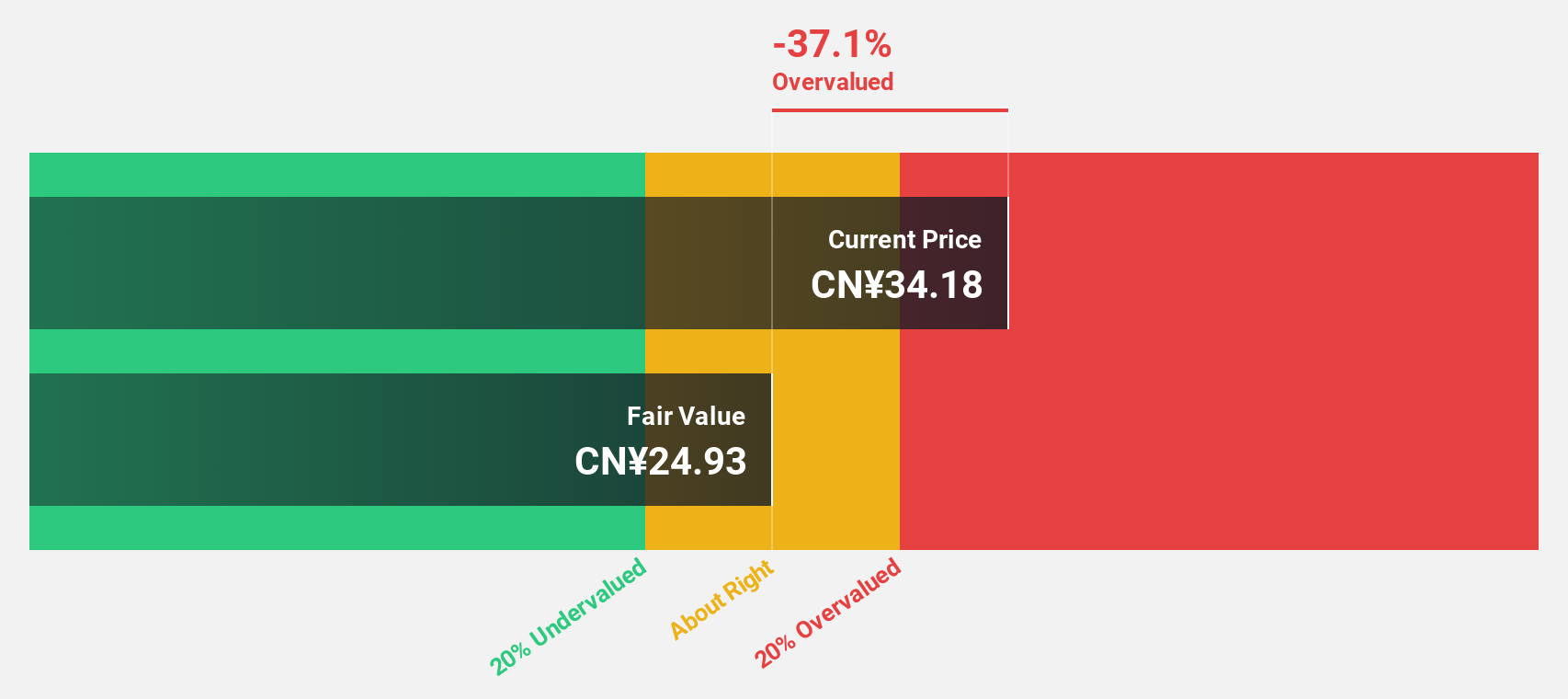

Estimated Discount To Fair Value: 32.6%

Doctorglasses Chain Co.,Ltd., priced at CN¥13.15, is trading below its fair value of CN¥19.51, indicating potential undervaluation based on cash flow analysis. Despite recent dividends and changes to company bylaws enhancing shareholder returns, its dividend coverage remains weak with earnings growth projected to lag slightly behind the broader Chinese market at 21.6% annually compared to 22.2%. However, revenue forecasts are more optimistic, expected to outpace the market with a 16% annual increase.

- Our comprehensive growth report raises the possibility that Doctorglasses ChainLtd is poised for substantial financial growth.

- Take a closer look at Doctorglasses ChainLtd's balance sheet health here in our report.

Sailvan Times (SZSE:301381)

Overview: Sailvan Times Co., Ltd. operates by selling lifestyle products through third-party e-commerce platforms, both domestically in China and internationally, with a market capitalization of approximately CN¥9.39 billion.

Operations: The company generates its revenue by offering lifestyle products on various third-party e-commerce platforms across global markets.

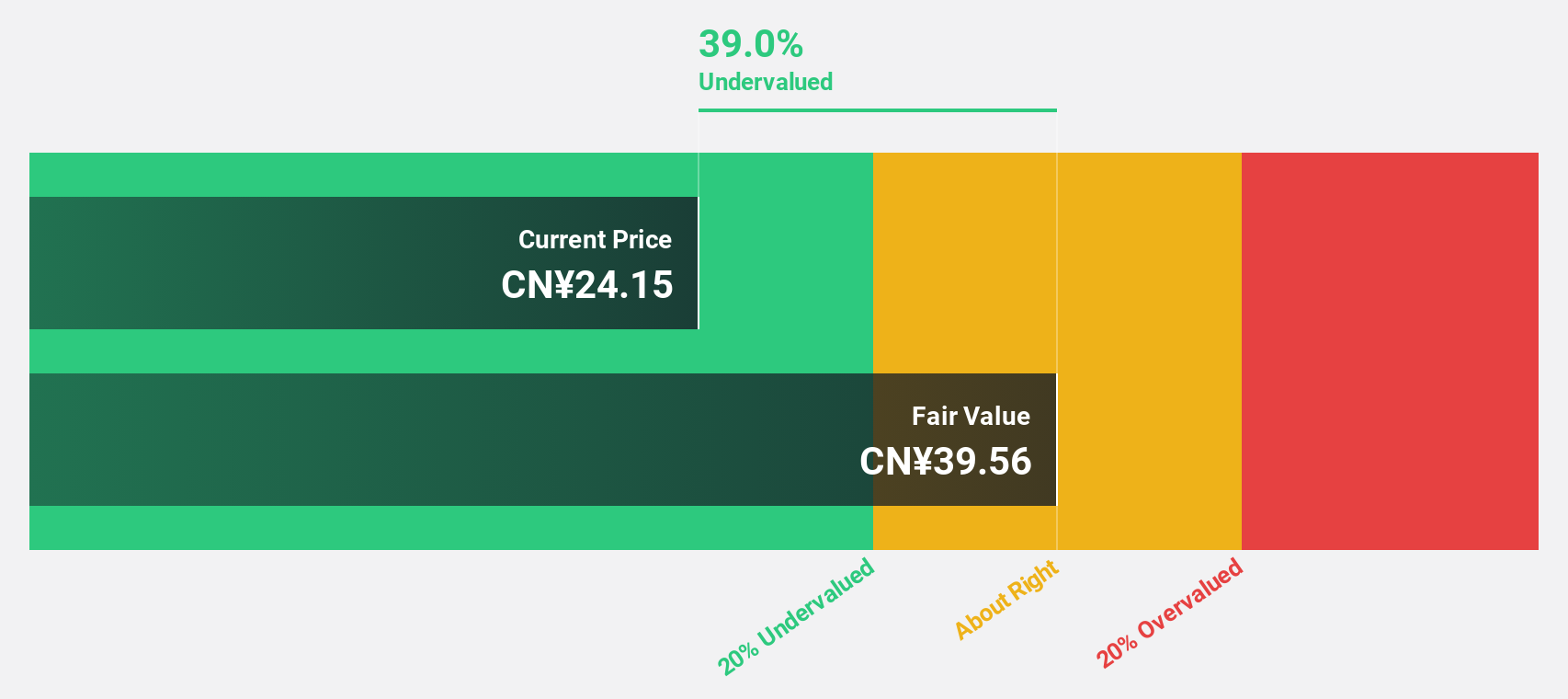

Estimated Discount To Fair Value: 31%

Sailvan Times Co., Ltd. is currently undervalued, with its stock price at CN¥23.48, significantly below the estimated fair value of CN¥34.01. This discrepancy highlights potential growth, supported by a robust revenue increase forecast at 21.1% annually and earnings expected to rise by 23.84% per year. Despite these positives, the company has a shaky dividend history and a low forecasted return on equity of 17.7%. Recent consistent dividend payments suggest an attempt to stabilize shareholder returns amidst this growth phase.

- According our earnings growth report, there's an indication that Sailvan Times might be ready to expand.

- Navigate through the intricacies of Sailvan Times with our comprehensive financial health report here.

Make It Happen

- Investigate our full lineup of 100 Undervalued Chinese Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688114

MGI Tech

Engages in the research, development, production, and sale of DNA sequencing instruments, reagents, and related products for precision medicine, agriculture, healthcare, and other relevant industries.

Reasonable growth potential with adequate balance sheet.