- China

- /

- General Merchandise and Department Stores

- /

- SZSE:301001

Undiscovered Gems to Explore in February 2025

Reviewed by Simply Wall St

As February 2025 unfolds, global markets are navigating a complex landscape marked by tariff uncertainties and fluctuating economic indicators. With U.S. job growth slowing and manufacturing showing signs of recovery, investors are closely watching small-cap stocks for potential opportunities amidst broader market volatility. In this environment, identifying promising small-cap stocks requires a keen eye for companies that demonstrate resilience and adaptability in the face of economic shifts. These undiscovered gems often possess unique value propositions or operate in niche markets that can thrive despite broader challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Boursa Kuwait Securities Company K.P.S.C | NA | 14.28% | 2.26% | ★★★★★★ |

| Interactive Digital Technologies | 1.30% | 6.10% | 4.63% | ★★★★★☆ |

| Berger Paints Bangladesh | 3.72% | 10.32% | 7.30% | ★★★★★☆ |

| Eclatorq Technology | 37.47% | 8.43% | 18.41% | ★★★★★☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Sipef (ENXTBR:SIP)

Simply Wall St Value Rating: ★★★★★★

Overview: Sipef NV is an agro-industrial company with a market capitalization of €605.24 million.

Operations: Sipef generates its revenue primarily through its agro-industrial activities, with a market capitalization of €605.24 million. The company's financial performance is influenced by various cost components associated with these operations.

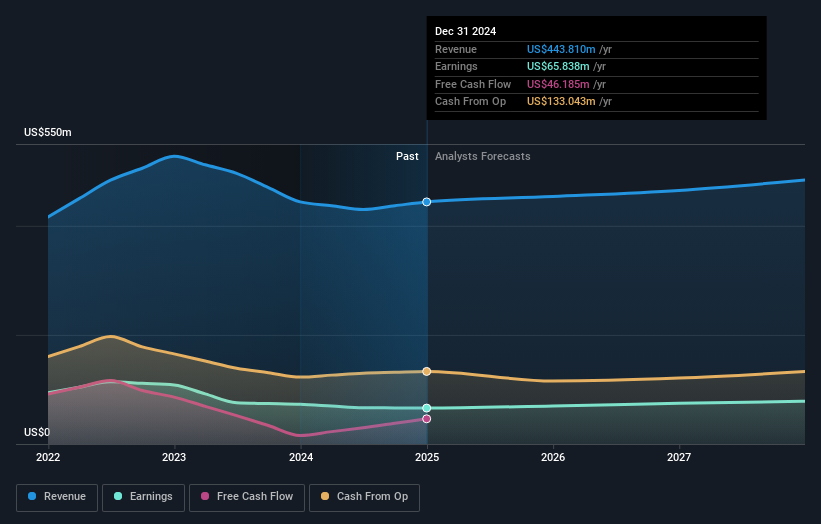

Sipef, a small player in its sector, showcases some intriguing financial characteristics. The company is debt-free, having reduced its debt to equity ratio from 26% five years ago. Despite this, Sipef's earnings growth took a hit with a negative 9.5% compared to the food industry average of 9.9%. On the bright side, it trades at nearly 20% below its estimated fair value and maintains high-quality past earnings. Recent results show sales at US$443.81 million and net income at US$65.84 million for the year ending December 2024, reflecting slight dips from previous figures but still solid performance metrics overall.

- Get an in-depth perspective on Sipef's performance by reading our health report here.

Explore historical data to track Sipef's performance over time in our Past section.

Shanghai Kaytune IndustrialLtd (SZSE:301001)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Kaytune Industrial Co., Ltd specializes in e-commerce and customer relationship management services for enterprises, with a market cap of CN¥3.18 billion.

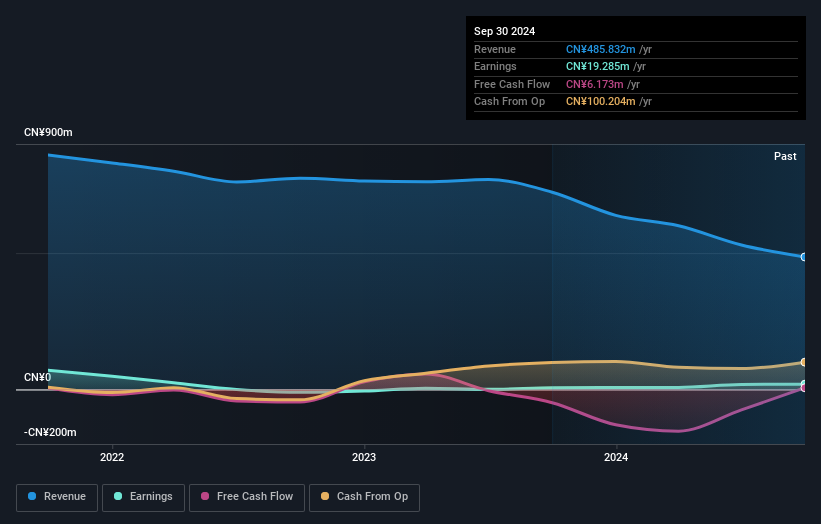

Operations: Kaytune Industrial reported revenue of CN¥485.83 million from its e-commerce segment.

Shanghai Kaytune Industrial Ltd. showcases intriguing attributes for potential investors, with its earnings surging by 228% last year, outpacing the industry average of -5%. Despite a past annual earnings decline of 46%, the company has effectively reduced its debt to equity ratio from 18.3 to 4.7 over five years, indicating improved financial health. The firm trades at a significant discount of 43% below estimated fair value, suggesting potential undervaluation in the market. However, recent volatility in share prices and large one-off gains impacting results warrant cautious optimism regarding future stability and growth prospects within this dynamic sector.

Oita Bank (TSE:8392)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Oita Bank, Ltd. offers a range of banking products and services to individual and corporate clients mainly in Japan, with a market cap of ¥53.13 billion.

Operations: Oita Bank generates revenue through its diverse range of banking products and services tailored for both individual and corporate clients in Japan. The bank's financial performance is influenced by various factors, including interest income from loans and deposits, as well as fees from its service offerings. It is important to analyze the net profit margin trends over time to understand profitability dynamics within this sector.

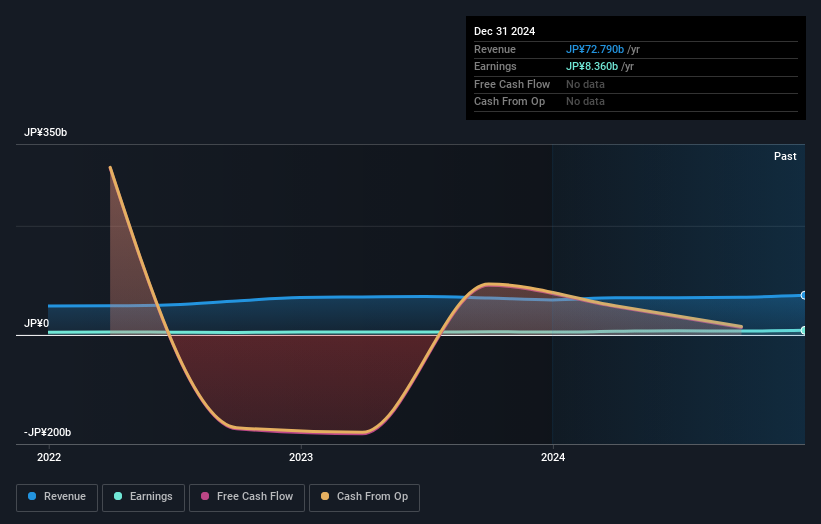

Oita Bank, a smaller player in the banking sector, showcases robust financial health with total assets of ¥4,544.2 billion and equity amounting to ¥214.5 billion. It primarily relies on low-risk customer deposits for funding, accounting for 83% of liabilities. Despite an insufficient allowance for bad loans at 1.9% of total loans, it maintains an appropriate level of non-performing loans under 2%. The bank's earnings surged by 58.7% last year, outpacing the industry growth rate of 19.9%. Recently announced share repurchase plans aim to enhance shareholder value by buying back up to 300,000 shares worth ¥850 million by March 2025.

- Delve into the full analysis health report here for a deeper understanding of Oita Bank.

Understand Oita Bank's track record by examining our Past report.

Key Takeaways

- Delve into our full catalog of 4701 Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301001

Shanghai Kaytune IndustrialLtd

Provides e-commerce and customer relationship management services to enterprises.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives