- China

- /

- Specialty Stores

- /

- SHSE:603214

Undiscovered Gems with Potential for February 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and cooling job growth, small-cap stocks have shown resilience, with indices like the S&P 600 offering a glimpse into potential opportunities despite broader market fluctuations. In this environment, identifying undiscovered gems requires a keen eye for companies that demonstrate robust fundamentals and adaptability to shifting economic landscapes.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Golden House | 32.13% | -0.58% | 14.32% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Terminal X Online | 20.33% | 18.40% | 20.81% | ★★★★★☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Shanghai AiyingshiLtd (SHSE:603214)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Aiyingshi Ltd operates in China, focusing on providing maternal and child products and services, with a market capitalization of approximately CN¥3.06 billion.

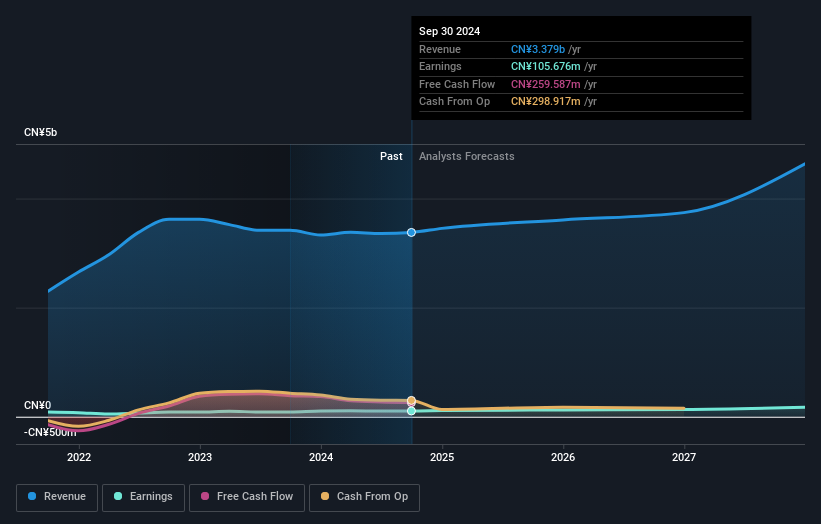

Operations: Shanghai Aiyingshi Ltd generates revenue primarily through the sale of maternal and infant products and related services, amounting to CN¥3.38 billion.

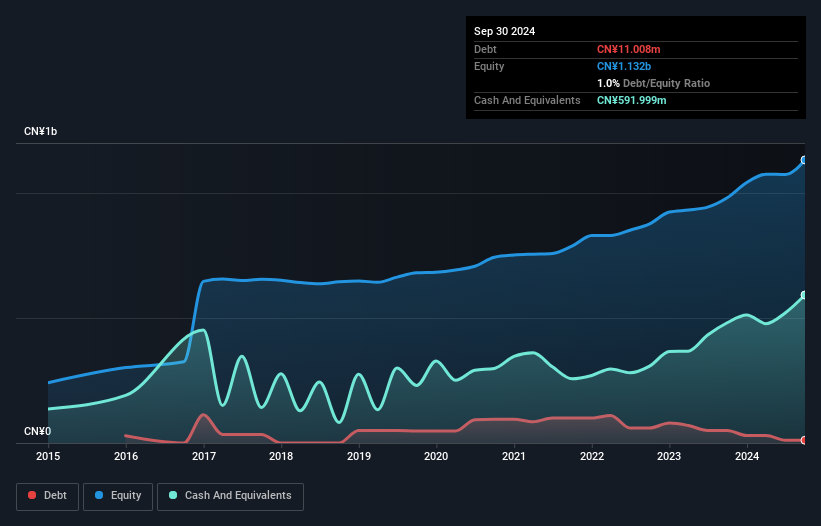

Shanghai Aiyingshi Ltd, a smaller player in the market, has experienced notable earnings growth of 20.1% over the past year, outpacing its industry peers. Despite a significant one-off gain of CN¥47 million impacting recent financial results, it remains free cash flow positive and holds more cash than total debt. However, the company's debt-to-equity ratio has increased from 11% to 31.4% over five years, indicating rising leverage concerns. With a price-to-earnings ratio of 31.8x below the Chinese market average of 36.3x, it presents an interesting valuation prospect despite recent share price volatility.

- Delve into the full analysis health report here for a deeper understanding of Shanghai AiyingshiLtd.

Shenzhen TVT Digital Technology (SZSE:002835)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen TVT Digital Technology Co., Ltd. is a company specializing in digital security solutions with a market capitalization of CN¥4.28 billion.

Operations: TVT Digital Technology generates revenue primarily from the security industry, amounting to CN¥1.19 billion.

Shenzhen TVT Digital Technology, a company in the electronics sector, stands out with a price-to-earnings ratio of 22.6x, notably below the CN market average of 36.3x. Over the past year, its earnings surged by 52%, outpacing the broader industry growth of just 3%. The firm has effectively managed its debts over five years, reducing its debt-to-equity ratio from 7.1% to a mere 1%. With more cash than total debt and positive free cash flow standing at CNY207 million as of September last year, TVT Digital showcases strong financial health and potential for continued growth in its niche market.

- Dive into the specifics of Shenzhen TVT Digital Technology here with our thorough health report.

Understand Shenzhen TVT Digital Technology's track record by examining our Past report.

CyberLink (TWSE:5203)

Simply Wall St Value Rating: ★★★★★★

Overview: CyberLink Corp. is a multimedia software and AI facial recognition technology company that designs and sells video entertainment and media creation software across Taiwan, the United States, Japan, and internationally, with a market cap of NT$8.88 billion.

Operations: The company generates revenue primarily from its Digital Creation segment, which accounts for NT$1.56 billion, and the Audio-Visual Entertainment segment, contributing NT$493.88 million.

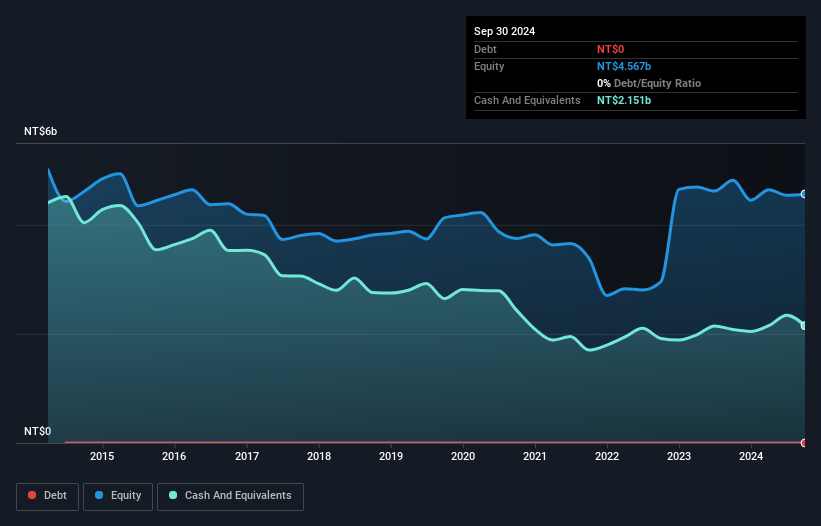

CyberLink, a nimble player in the tech space, has been making waves with its innovative AI-driven solutions. The company recently unveiled FaceMe Security 8.0, enhancing its security offerings with real-time facial recognition and improved integration capabilities. Despite a 10% earnings dip annually over five years, CyberLink's recent annual growth of 46% outpaces the software sector's average of 16.8%. Notably debt-free for half a decade and boasting high-quality earnings alongside positive free cash flow, CyberLink seems poised to leverage its robust product lineup for future growth opportunities in AI technology.

- Click here to discover the nuances of CyberLink with our detailed analytical health report.

Evaluate CyberLink's historical performance by accessing our past performance report.

Next Steps

- Navigate through the entire inventory of 4717 Undiscovered Gems With Strong Fundamentals here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603214

Shanghai AiyingshiLtd

Provides maternal and child products and services primarily in China.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives