- China

- /

- General Merchandise and Department Stores

- /

- SHSE:600814

Hangzhou Jiebai Group Co., Limited (SHSE:600814) Looks Inexpensive But Perhaps Not Attractive Enough

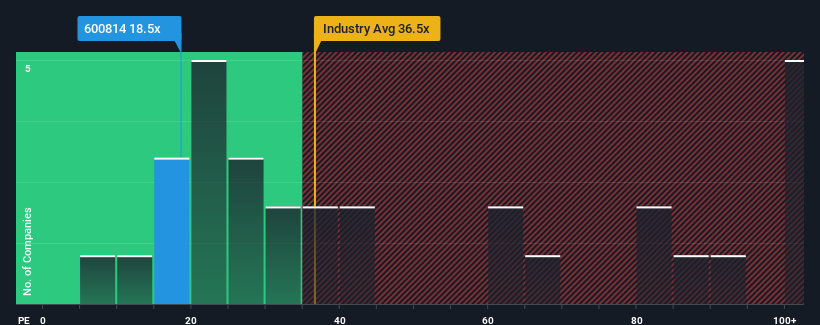

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 34x, you may consider Hangzhou Jiebai Group Co., Limited (SHSE:600814) as an attractive investment with its 18.5x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For example, consider that Hangzhou Jiebai Group's financial performance has been pretty ordinary lately as earnings growth is non-existent. It might be that many expect the uninspiring earnings performance to worsen, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Hangzhou Jiebai Group

Is There Any Growth For Hangzhou Jiebai Group?

The only time you'd be truly comfortable seeing a P/E as low as Hangzhou Jiebai Group's is when the company's growth is on track to lag the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with earnings down 33% overall from three years ago. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 37% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's understandable that Hangzhou Jiebai Group's P/E would sit below the majority of other companies. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Hangzhou Jiebai Group maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 1 warning sign for Hangzhou Jiebai Group that you need to take into consideration.

You might be able to find a better investment than Hangzhou Jiebai Group. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Jiebai Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600814

Hangzhou Jiebai Group

Engages in the department store and shopping mall business in China.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives