Stock Analysis

- China

- /

- General Merchandise and Department Stores

- /

- SHSE:600729

Chongqing Department StoreLtd's (SHSE:600729) earnings growth rate lags the 1.9% CAGR delivered to shareholders

The main aim of stock picking is to find the market-beating stocks. But in any portfolio, there will be mixed results between individual stocks. So we wouldn't blame long term Chongqing Department Store Co.,Ltd. (SHSE:600729) shareholders for doubting their decision to hold, with the stock down 19% over a half decade.

Since Chongqing Department StoreLtd has shed CN¥553m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for Chongqing Department StoreLtd

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

While the share price declined over five years, Chongqing Department StoreLtd actually managed to increase EPS by an average of 7.9% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Or possibly, the market was previously very optimistic, so the stock has disappointed, despite improving EPS.

It is unusual to see such modest share price growth in the face of sustained EPS improvements. We can look to other metrics to try to understand the situation better.

We note that the dividend has remained healthy, so that wouldn't really explain the share price drop. It could be that the revenue decline of 15% per year is viewed as evidence that Chongqing Department StoreLtd is shrinking. With revenue weak, and increased payouts of cash, the market might be taking the view that its best days are behind it.

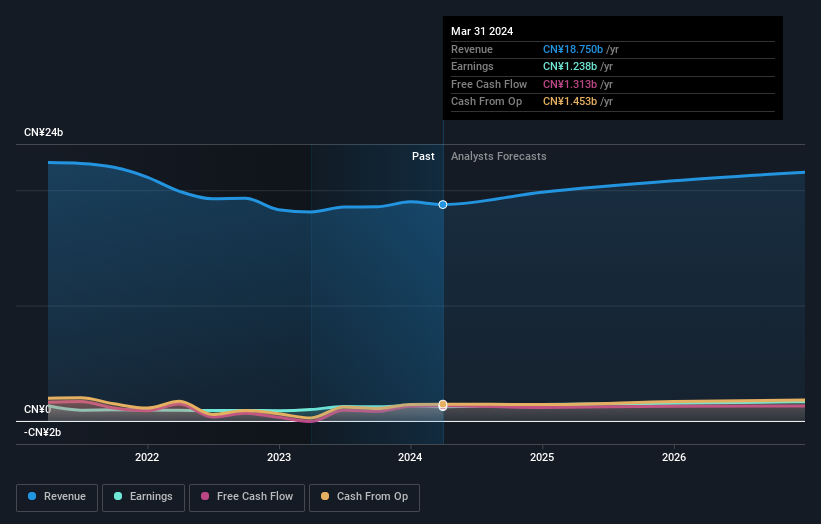

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Chongqing Department StoreLtd has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Chongqing Department StoreLtd in this interactive graph of future profit estimates.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Chongqing Department StoreLtd the TSR over the last 5 years was 9.6%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

The total return of 14% received by Chongqing Department StoreLtd shareholders over the last year isn't far from the market return of -14%. Longer term investors wouldn't be so upset, since they would have made 1.9%, each year, over five years. If the fundamental data remains strong, and the share price is simply down on sentiment, then this could be an opportunity worth investigating. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Chongqing Department StoreLtd has 2 warning signs we think you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Chongqing Department StoreLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Chongqing Department StoreLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600729

Chongqing Department StoreLtd

Operates department stores, supermarkets, and electrical appliances stores in the People's Republic of China.

Very undervalued with solid track record and pays a dividend.