- China

- /

- Real Estate

- /

- SZSE:002244

Pulling back 4.3% this week, Hangzhou Binjiang Real Estate GroupLtd's SZSE:002244) three-year decline in earnings may be coming into investors focus

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But in contrast you can make much more than 100% if the company does well. For instance the Hangzhou Binjiang Real Estate Group Co.,Ltd (SZSE:002244) share price is 118% higher than it was three years ago. How nice for those who held the stock! In contrast, the stock has fallen 8.2% in the last 30 days. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

Since the long term performance has been good but there's been a recent pullback of 4.3%, let's check if the fundamentals match the share price.

View our latest analysis for Hangzhou Binjiang Real Estate GroupLtd

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over the last three years, Hangzhou Binjiang Real Estate GroupLtd failed to grow earnings per share, which fell 15% (annualized).

Thus, it seems unlikely that the market is focussed on EPS growth at the moment. Therefore, we think it's worth considering other metrics as well.

The modest 1.0% dividend yield is unlikely to be propping up the share price. It may well be that Hangzhou Binjiang Real Estate GroupLtd revenue growth rate of 28% over three years has convinced shareholders to believe in a brighter future. If the company is being managed for the long term good, today's shareholders might be right to hold on.

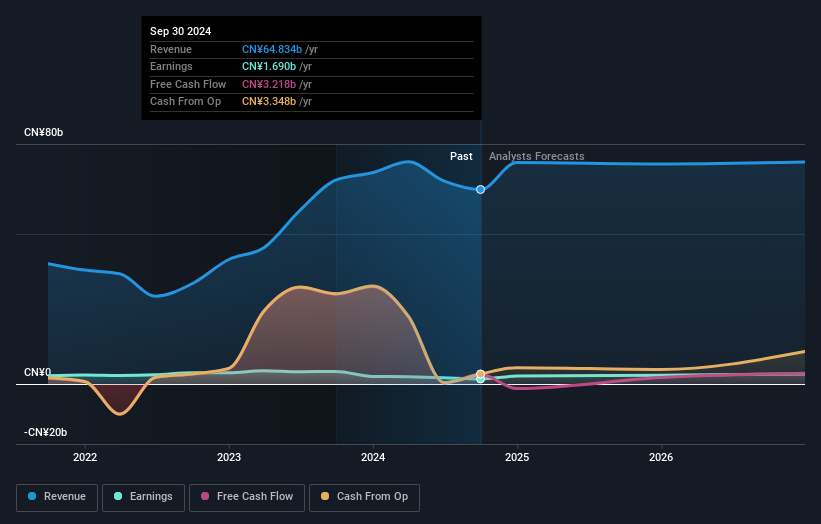

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Hangzhou Binjiang Real Estate GroupLtd is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Hangzhou Binjiang Real Estate GroupLtd stock, you should check out this free report showing analyst consensus estimates for future profits.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Hangzhou Binjiang Real Estate GroupLtd's TSR for the last 3 years was 132%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Hangzhou Binjiang Real Estate GroupLtd shareholders gained a total return of 3.7% during the year. Unfortunately this falls short of the market return. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 19% over five years. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. It's always interesting to track share price performance over the longer term. But to understand Hangzhou Binjiang Real Estate GroupLtd better, we need to consider many other factors. For instance, we've identified 3 warning signs for Hangzhou Binjiang Real Estate GroupLtd (1 is a bit unpleasant) that you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Binjiang Real Estate GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002244

Hangzhou Binjiang Real Estate GroupLtd

Provides real estate development services in China.

Good value with adequate balance sheet and pays a dividend.