- China

- /

- Real Estate

- /

- SZSE:000931

Beijing Centergate Technologies (holding) Co., Ltd.'s (SZSE:000931) Shares Climb 27% But Its Business Is Yet to Catch Up

Those holding Beijing Centergate Technologies (holding) Co., Ltd. (SZSE:000931) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 35% in the last twelve months.

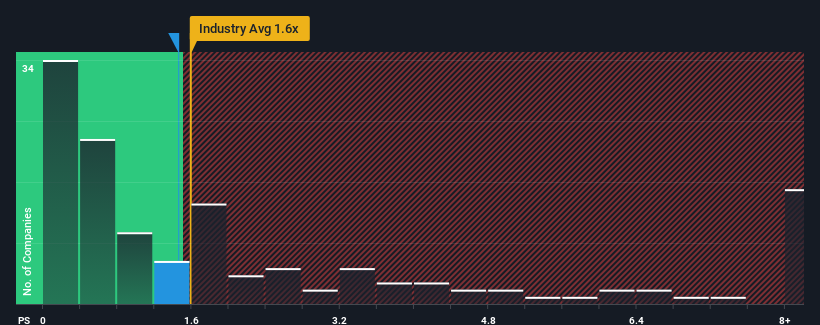

In spite of the firm bounce in price, there still wouldn't be many who think Beijing Centergate Technologies (holding)'s price-to-sales (or "P/S") ratio of 1.5x is worth a mention when the median P/S in China's Real Estate industry is similar at about 1.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Beijing Centergate Technologies (holding)

How Has Beijing Centergate Technologies (holding) Performed Recently?

The revenue growth achieved at Beijing Centergate Technologies (holding) over the last year would be more than acceptable for most companies. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. Those who are bullish on Beijing Centergate Technologies (holding) will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Beijing Centergate Technologies (holding), take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Beijing Centergate Technologies (holding)?

The only time you'd be comfortable seeing a P/S like Beijing Centergate Technologies (holding)'s is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.2% last year. The solid recent performance means it was also able to grow revenue by 20% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 11% shows it's noticeably less attractive.

With this in mind, we find it intriguing that Beijing Centergate Technologies (holding)'s P/S is comparable to that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On Beijing Centergate Technologies (holding)'s P/S

Its shares have lifted substantially and now Beijing Centergate Technologies (holding)'s P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Beijing Centergate Technologies (holding)'s average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

Before you take the next step, you should know about the 1 warning sign for Beijing Centergate Technologies (holding) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Beijing Centergate Technologies (holding) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000931

Beijing Centergate Technologies (holding)

Beijing Centergate Technologies (holding) Co., Ltd.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success