Stock Analysis

- China

- /

- Real Estate

- /

- SHSE:600848

Shanghai Lingang Holdings Co.,Ltd.'s (SHSE:600848) Stock Has Shown Weakness Lately But Financial Prospects Look Decent: Is The Market Wrong?

Shanghai Lingang HoldingsLtd (SHSE:600848) has had a rough month with its share price down 12%. However, the company's fundamentals look pretty decent, and long-term financials are usually aligned with future market price movements. Specifically, we decided to study Shanghai Lingang HoldingsLtd's ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Put another way, it reveals the company's success at turning shareholder investments into profits.

View our latest analysis for Shanghai Lingang HoldingsLtd

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Shanghai Lingang HoldingsLtd is:

4.9% = CN¥1.6b ÷ CN¥33b (Based on the trailing twelve months to March 2024).

The 'return' is the profit over the last twelve months. Another way to think of that is that for every CN¥1 worth of equity, the company was able to earn CN¥0.05 in profit.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Shanghai Lingang HoldingsLtd's Earnings Growth And 4.9% ROE

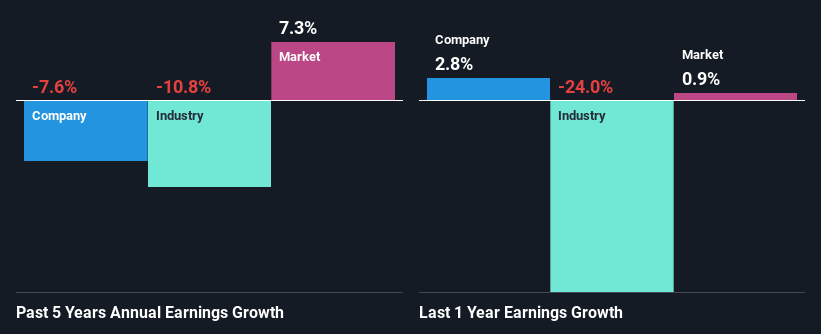

When you first look at it, Shanghai Lingang HoldingsLtd's ROE doesn't look that attractive. However, the fact that the its ROE is quite higher to the industry average of 3.9% doesn't go unnoticed by us. But seeing Shanghai Lingang HoldingsLtd's five year net income decline of 7.6% over the past five years, we might rethink that. Remember, the company's ROE is a bit low to begin with, just that it is higher than the industry average. Therefore, the decline in earnings could also be the result of this.

We then compared Shanghai Lingang HoldingsLtd's performance with the industry and found that the company has shrunk its earnings at a slower rate than the industry earnings which has seen its earnings shrink by 11% in the same 5-year period. This does appease the negative sentiment around the company to a certain extent.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Shanghai Lingang HoldingsLtd is trading on a high P/E or a low P/E, relative to its industry.

Is Shanghai Lingang HoldingsLtd Using Its Retained Earnings Effectively?

Shanghai Lingang HoldingsLtd's declining earnings is not surprising given how the company is spending most of its profits in paying dividends, judging by its three-year median payout ratio of 50% (or a retention ratio of 50%). With only a little being reinvested into the business, earnings growth would obviously be low or non-existent. You can see the 3 risks we have identified for Shanghai Lingang HoldingsLtd by visiting our risks dashboard for free on our platform here.

Moreover, Shanghai Lingang HoldingsLtd has been paying dividends for six years, which is a considerable amount of time, suggesting that management must have perceived that the shareholders prefer consistent dividends even though earnings have been shrinking.

Conclusion

Overall, we feel that Shanghai Lingang HoldingsLtd certainly does have some positive factors to consider. Although, we are disappointed to see a lack of growth in earnings even in spite of a moderate ROE and and a high reinvestment rate. We believe that there might be some outside factors that could be having a negative impact on the business. With that said, we studied the latest analyst forecasts and found that while the company has shrunk its earnings in the past, analysts expect its earnings to grow in the future. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

Valuation is complex, but we're helping make it simple.

Find out whether Shanghai Lingang HoldingsLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Shanghai Lingang HoldingsLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600848

Shanghai Lingang HoldingsLtd

Researches, develops, rents, and sells industrial carriers in China.

Fair value with moderate growth potential.