- China

- /

- Real Estate

- /

- SHSE:600708

The Market Doesn't Like What It Sees From Bright Real Estate Group Co.,Limited's (SHSE:600708) Revenues Yet As Shares Tumble 30%

Bright Real Estate Group Co.,Limited (SHSE:600708) shareholders won't be pleased to see that the share price has had a very rough month, dropping 30% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 20% share price drop.

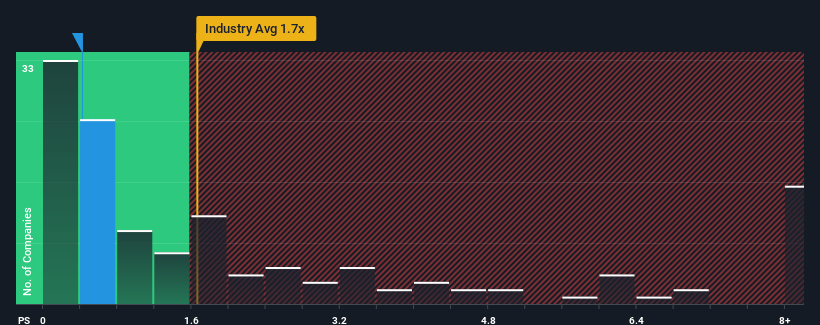

Since its price has dipped substantially, Bright Real Estate GroupLimited's price-to-sales (or "P/S") ratio of 0.4x might make it look like a buy right now compared to the Real Estate industry in China, where around half of the companies have P/S ratios above 1.7x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Bright Real Estate GroupLimited

What Does Bright Real Estate GroupLimited's Recent Performance Look Like?

As an illustration, revenue has deteriorated at Bright Real Estate GroupLimited over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Bright Real Estate GroupLimited will help you shine a light on its historical performance.How Is Bright Real Estate GroupLimited's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Bright Real Estate GroupLimited's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 59%. The last three years don't look nice either as the company has shrunk revenue by 1.2% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 9.0% shows it's an unpleasant look.

In light of this, it's understandable that Bright Real Estate GroupLimited's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Bottom Line On Bright Real Estate GroupLimited's P/S

Bright Real Estate GroupLimited's P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Bright Real Estate GroupLimited confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 2 warning signs for Bright Real Estate GroupLimited that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Bright Real Estate GroupLimited might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600708

Bright Real Estate GroupLimited

Develops residential and commercial real estate properties in China.

Good value with imperfect balance sheet.

Market Insights

Community Narratives