- China

- /

- Real Estate

- /

- SHSE:600696

The Price Is Right For Shanghai Guijiu Co.,Ltd (SHSE:600696) Even After Diving 30%

Shanghai Guijiu Co.,Ltd (SHSE:600696) shareholders that were waiting for something to happen have been dealt a blow with a 30% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 67% loss during that time.

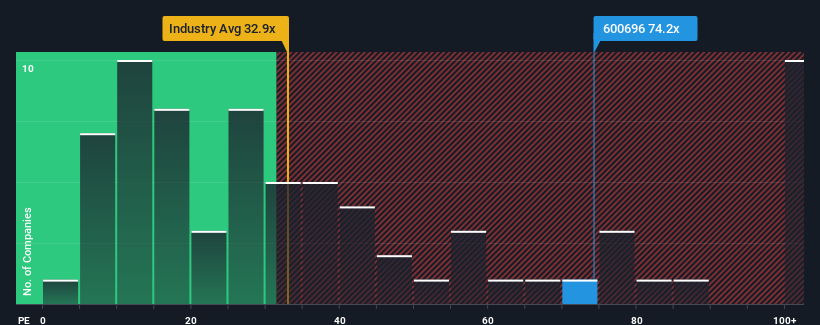

In spite of the heavy fall in price, Shanghai GuijiuLtd's price-to-earnings (or "P/E") ratio of 74.2x might still make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 30x and even P/E's below 19x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

For instance, Shanghai GuijiuLtd's receding earnings in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

See our latest analysis for Shanghai GuijiuLtd

Does Growth Match The High P/E?

Shanghai GuijiuLtd's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 36%. Still, the latest three year period has seen an excellent 201% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Comparing that to the market, which is only predicted to deliver 38% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

In light of this, it's understandable that Shanghai GuijiuLtd's P/E sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

Even after such a strong price drop, Shanghai GuijiuLtd's P/E still exceeds the rest of the market significantly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Shanghai GuijiuLtd revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Shanghai GuijiuLtd (1 doesn't sit too well with us) you should be aware of.

If you're unsure about the strength of Shanghai GuijiuLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600696

Mediocre balance sheet with minimal risk.

Market Insights

Community Narratives