- China

- /

- Real Estate

- /

- SHSE:600533

Nanjing Chixia Development Co.,Ltd. (SHSE:600533) Screens Well But There Might Be A Catch

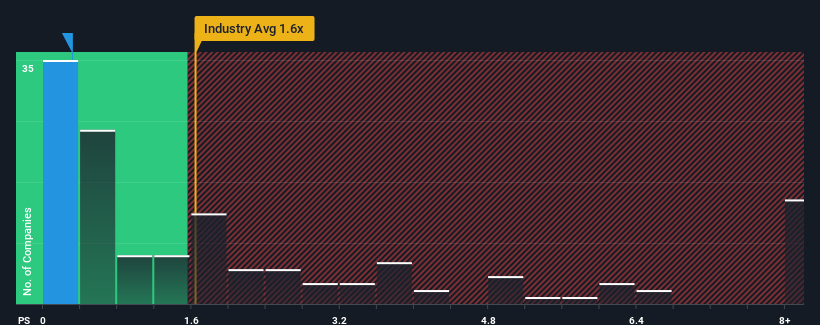

Nanjing Chixia Development Co.,Ltd.'s (SHSE:600533) price-to-sales (or "P/S") ratio of 0.3x might make it look like a buy right now compared to the Real Estate industry in China, where around half of the companies have P/S ratios above 1.6x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Nanjing Chixia DevelopmentLtd

What Does Nanjing Chixia DevelopmentLtd's P/S Mean For Shareholders?

Recent times have been quite advantageous for Nanjing Chixia DevelopmentLtd as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Nanjing Chixia DevelopmentLtd will help you shine a light on its historical performance.How Is Nanjing Chixia DevelopmentLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Nanjing Chixia DevelopmentLtd would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 84%. The latest three year period has also seen an excellent 121% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 4.9%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's peculiar that Nanjing Chixia DevelopmentLtd's P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Nanjing Chixia DevelopmentLtd revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Nanjing Chixia DevelopmentLtd that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Nanjing Chixia DevelopmentLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600533

Nanjing Chixia DevelopmentLtd

Engages in the real estate business in China.

Good value with imperfect balance sheet.

Market Insights

Community Narratives