- China

- /

- Real Estate

- /

- SHSE:600515

Shareholders in Hainan Airport Infrastructure (SHSE:600515) have lost 50%, as stock drops 13% this past week

Hainan Airport Infrastructure Co., Ltd (SHSE:600515) shareholders should be happy to see the share price up 10% in the last month. But that doesn't help the fact that the three year return is less impressive. After all, the share price is down 50% in the last three years, significantly under-performing the market.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

View our latest analysis for Hainan Airport Infrastructure

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Hainan Airport Infrastructure became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

Revenue is actually up 5.1% over the three years, so the share price drop doesn't seem to hinge on revenue, either. This analysis is just perfunctory, but it might be worth researching Hainan Airport Infrastructure more closely, as sometimes stocks fall unfairly. This could present an opportunity.

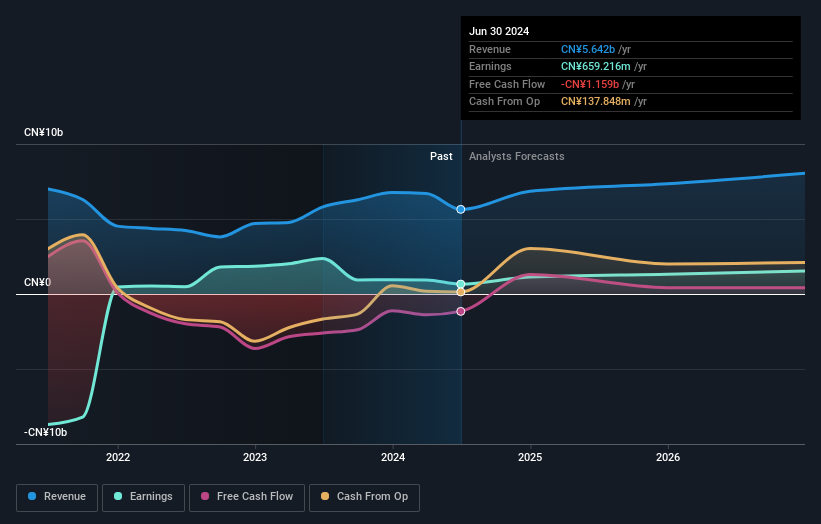

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Hainan Airport Infrastructure has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Hainan Airport Infrastructure's financial health with this free report on its balance sheet.

A Different Perspective

We regret to report that Hainan Airport Infrastructure shareholders are down 9.1% for the year. Unfortunately, that's worse than the broader market decline of 0.6%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 4% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 3 warning signs we've spotted with Hainan Airport Infrastructure (including 1 which shouldn't be ignored) .

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hainan Airport Infrastructure might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600515

Hainan Airport Infrastructure

Engages in the airport management, duty-free and commercial, real estate, property management, hotel, and other businesses.

High growth potential with imperfect balance sheet.

Market Insights

Community Narratives