- China

- /

- Real Estate

- /

- SHSE:600223

Lushang Freda PharmaceuticalLtd (SHSE:600223) stock falls 5.8% in past week as three-year earnings and shareholder returns continue downward trend

For many investors, the main point of stock picking is to generate higher returns than the overall market. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. Unfortunately, that's been the case for longer term Lushang Freda Pharmaceutical Co.,Ltd. (SHSE:600223) shareholders, since the share price is down 47% in the last three years, falling well short of the market decline of around 14%. The more recent news is of little comfort, with the share price down 33% in a year. And the share price decline continued over the last week, dropping some 5.8%. However, this move may have been influenced by the broader market, which fell 3.9% in that time.

Since Lushang Freda PharmaceuticalLtd has shed CN¥427m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for Lushang Freda PharmaceuticalLtd

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

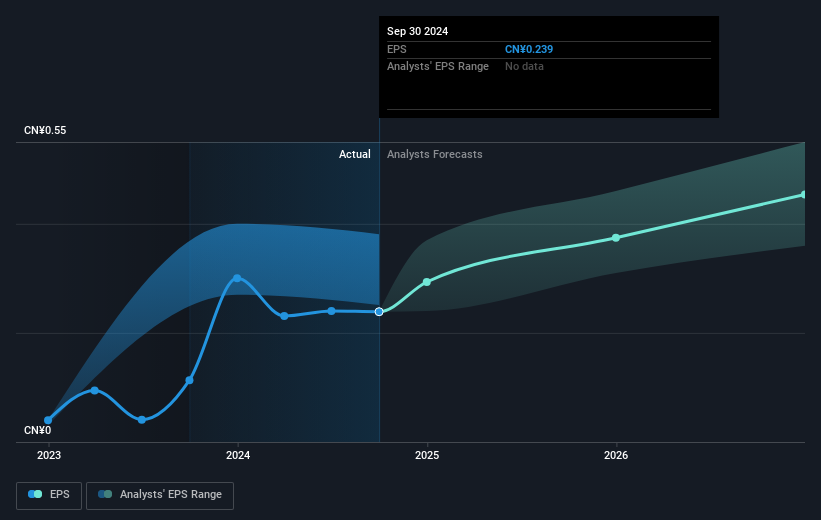

Lushang Freda PharmaceuticalLtd saw its EPS decline at a compound rate of 32% per year, over the last three years. In comparison the 19% compound annual share price decline isn't as bad as the EPS drop-off. So, despite the prior disappointment, shareholders must have some confidence the situation will improve, longer term.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Lushang Freda PharmaceuticalLtd has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Lushang Freda PharmaceuticalLtd will grow revenue in the future.

A Different Perspective

While the broader market gained around 6.2% in the last year, Lushang Freda PharmaceuticalLtd shareholders lost 31% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 5% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Lushang Freda PharmaceuticalLtd , and understanding them should be part of your investment process.

But note: Lushang Freda PharmaceuticalLtd may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600223

Lushang Freda PharmaceuticalLtd

Engages in the production and sales of pharmaceuticals, raw materials, and additives in China.

Flawless balance sheet with reasonable growth potential.