The past one-year earnings decline for ApicHope Pharmaceutical (SZSE:300723) likely explains shareholders long-term losses

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Investors in ApicHope Pharmaceutical Co., Ltd (SZSE:300723) have tasted that bitter downside in the last year, as the share price dropped 44%. That contrasts poorly with the market decline of 14%. However, the longer term returns haven't been so bad, with the stock down 29% in the last three years. Furthermore, it's down 26% in about a quarter. That's not much fun for holders.

While the last year has been tough for ApicHope Pharmaceutical shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

See our latest analysis for ApicHope Pharmaceutical

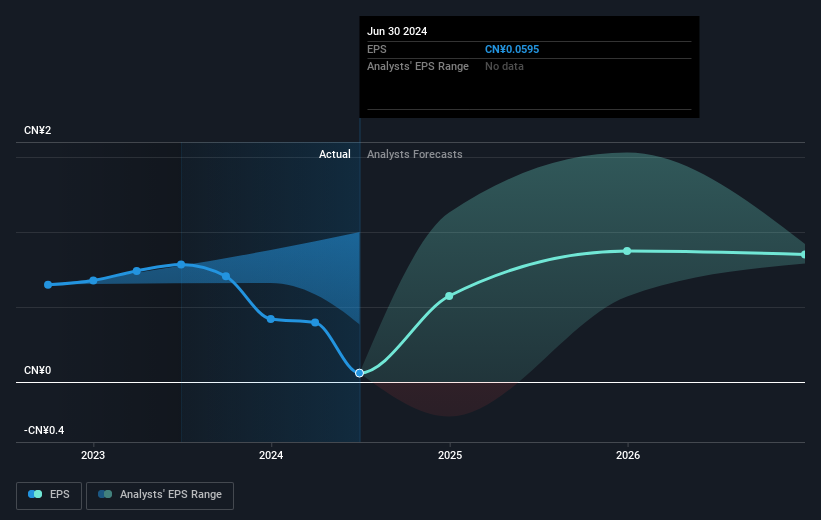

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unfortunately ApicHope Pharmaceutical reported an EPS drop of 92% for the last year. The share price fall of 44% isn't as bad as the reduction in earnings per share. So the market may not be too worried about the EPS figure, at the moment -- or it may have expected earnings to drop faster. With a P/E ratio of 248.61, it's fair to say the market sees an EPS rebound on the cards.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on ApicHope Pharmaceutical's earnings, revenue and cash flow.

A Different Perspective

We regret to report that ApicHope Pharmaceutical shareholders are down 43% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 14%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 0.9% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for ApicHope Pharmaceutical (of which 1 shouldn't be ignored!) you should know about.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300723

ApicHope Pharmaceutical

Engages in the research and development, production, and sale of pharmaceutical drugs.

Reasonable growth potential with adequate balance sheet.