3 Growth Companies With High Insider Ownership Growing Earnings At 55%

Reviewed by Simply Wall St

As global markets navigate the impact of rising U.S. Treasury yields and a cautious economic outlook, growth stocks have demonstrated resilience, with the tech-heavy Nasdaq Composite Index showing slight gains despite broader market pressures. In this environment, companies with high insider ownership that are experiencing robust earnings growth can be particularly appealing to investors seeking long-term potential amidst fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Pharma Mar (BME:PHM) | 11.8% | 55.1% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

Here's a peek at a few of the choices from the screener.

Hanza (OM:HANZA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hanza AB (publ) offers manufacturing solutions and has a market cap of SEK 3.03 billion.

Operations: Revenue segments for the company include manufacturing solutions.

Insider Ownership: 37.8%

Earnings Growth Forecast: 32.1% p.a.

HANZA has seen substantial insider buying over the past three months, signaling confidence in its growth prospects. Despite a forecasted revenue growth of 9.7% annually, which is slower than the desired 20%, it surpasses the Swedish market's growth rate. Earnings are expected to grow significantly at 32.1% annually, outpacing the market average. Recent strategic agreements with Mitel and a German company aim to enhance supply chain efficiency and sustainability, potentially boosting future revenues despite current profit margin declines.

- Unlock comprehensive insights into our analysis of Hanza stock in this growth report.

- Our valuation report here indicates Hanza may be undervalued.

China Ruyi Holdings (SEHK:136)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Ruyi Holdings Limited is an investment holding company involved in content production and online streaming across the People's Republic of China, Hong Kong, Europe, and other international markets with a market cap of HK$24.38 billion.

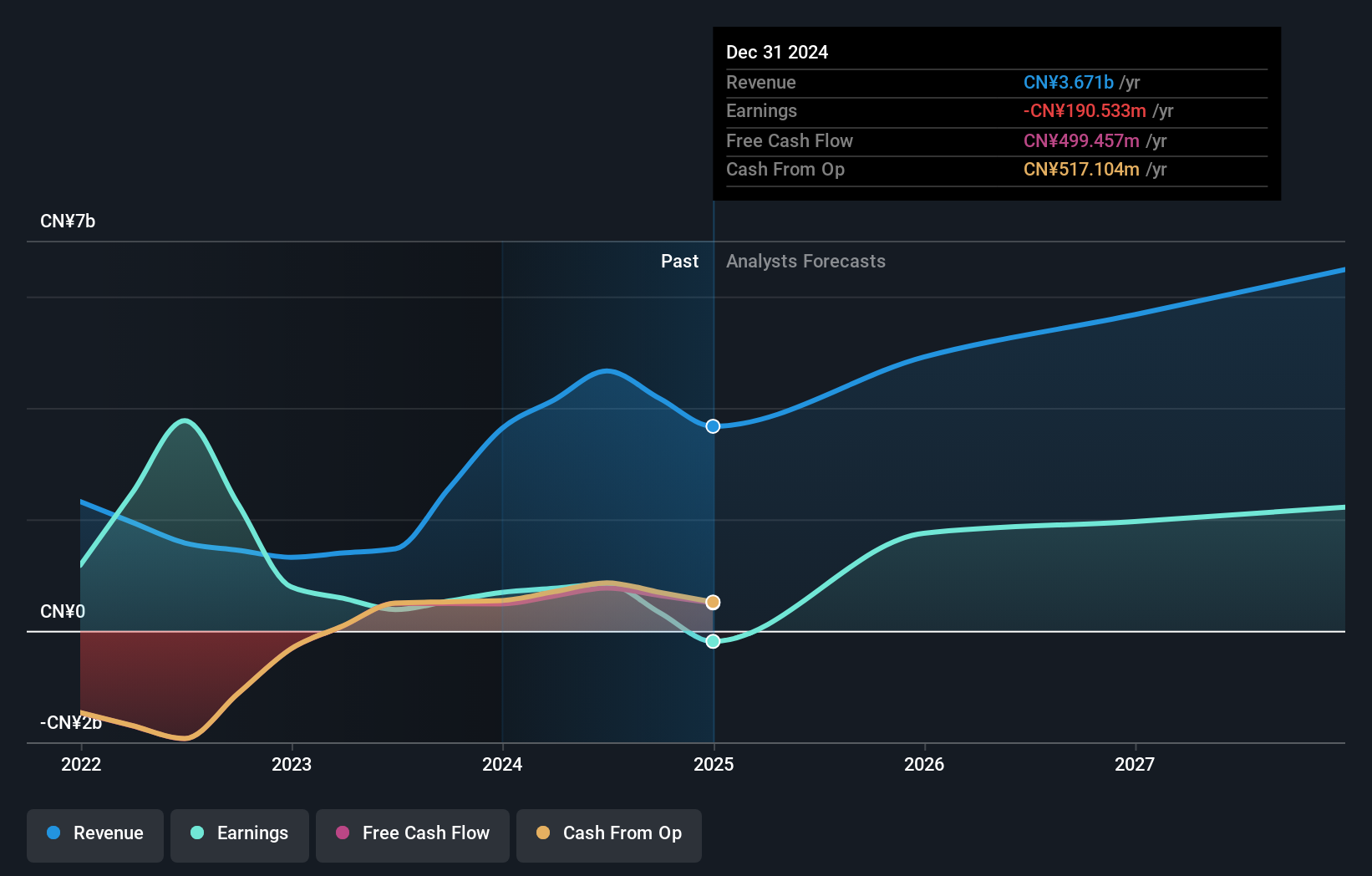

Operations: The company's revenue is primarily derived from its content production business, generating CN¥1.63 billion, and its online streaming and gaming businesses, which contribute CN¥3.01 billion.

Insider Ownership: 15.1%

Earnings Growth Forecast: 18.4% p.a.

China Ruyi Holdings shows promising growth prospects with its revenue expected to increase by 22.7% annually, outpacing the Hong Kong market. Recent earnings results reflect a substantial sales increase to CNY 1.84 billion, though net loss remains at CNY 114.65 million. Despite past shareholder dilution and lower profit margins compared to last year, the company trades significantly below estimated fair value, suggesting potential upside if forecasted growth materializes and financial stability improves over time.

- Click here and access our complete growth analysis report to understand the dynamics of China Ruyi Holdings.

- Our valuation report unveils the possibility China Ruyi Holdings' shares may be trading at a premium.

Shandong Sito Bio-technology (SZSE:300583)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shandong Sito Bio-technology Co., Ltd. focuses on researching and developing new steroid biomedicine intermediates, with a market cap of CN¥4.85 billion.

Operations: The company generates revenue primarily from its development of innovative steroid biomedicine intermediates.

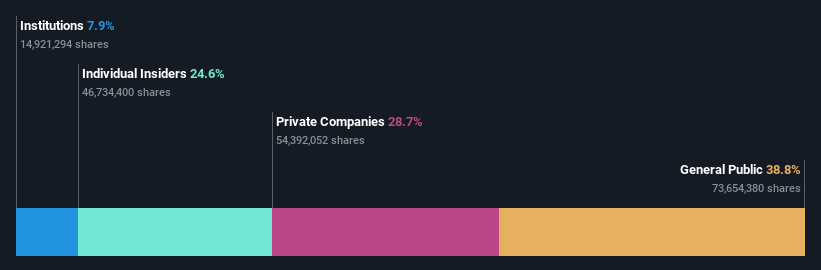

Insider Ownership: 24.6%

Earnings Growth Forecast: 55.6% p.a.

Shandong Sito Bio-technology faces challenges with declining sales and net income, reporting CNY 765.03 million in sales and CNY 14.72 million in net income for the first nine months of 2024. Despite this, earnings are forecast to grow by 55.6% annually, and revenue growth is expected to outpace the Chinese market at 14.4% per year. However, its share price has been highly volatile recently, and return on equity is projected to remain low at 3.8%.

- Navigate through the intricacies of Shandong Sito Bio-technology with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Shandong Sito Bio-technology implies its share price may be too high.

Make It Happen

- Get an in-depth perspective on all 1463 Fast Growing Companies With High Insider Ownership by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300583

Shandong Sito Bio-technology

Researches and develops new steroid biomedicine intermediates.

Flawless balance sheet with reasonable growth potential.