Ever Sunshine Services Group And 2 Other Penny Stocks Worth Watching

Reviewed by Simply Wall St

As global markets navigate a complex economic landscape, with notable shifts in interest rates and sector performances, investors are increasingly exploring diverse opportunities. Penny stocks, although an older term, still represent a segment of smaller or emerging companies that can offer significant value potential when chosen wisely. By focusing on those with strong financials and growth prospects, investors may find promising opportunities among these lesser-known equities.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.19 | MYR334.96M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.595 | MYR2.96B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.875 | £189.41M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.77 | MYR133.38M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.78 | HK$495.14M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.28 | CN¥2.1B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.93 | MYR308.7M | ★★★★★★ |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR3.58 | MYR2.59B | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.795 | A$126.84M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.095 | £402.8M | ★★★★☆☆ |

Click here to see the full list of 5,780 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Ever Sunshine Services Group (SEHK:1995)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ever Sunshine Services Group Limited is an investment holding company that offers property management services in the People's Republic of China, with a market capitalization of HK$4.22 billion.

Operations: The company generates revenue from its property management services segment, which amounts to CN¥6.72 billion.

Market Cap: HK$4.22B

Ever Sunshine Services Group, with a market cap of HK$4.22 billion, has shown robust financial health and growth potential. The company reported CN¥3.37 billion in sales for the first half of 2024, with net income rising to CN¥265.05 million from the previous year. Its debt is well covered by operating cash flow, and it holds more cash than total debt, indicating strong liquidity management. Despite a low return on equity at 10.5%, its earnings have grown significantly over the past year and are expected to continue growing at 10.3% annually. Recent inclusion in the S&P Global BMI Index highlights its market relevance.

- Take a closer look at Ever Sunshine Services Group's potential here in our financial health report.

- Learn about Ever Sunshine Services Group's future growth trajectory here.

Xiwang FoodstuffsLtd (SZSE:000639)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Xiwang Foodstuffs Co., Ltd., along with its subsidiaries, operates in China focusing on the research, development, production, and sales of edible vegetable oils, sports nutrition products, and nutritional supplements with a market capitalization of CN¥3.22 billion.

Operations: The company's revenue is primarily derived from its Edible Vegetable Oil Business, which generated CN¥3.17 billion, and its Sports Nutrition Business, contributing CN¥2.40 billion.

Market Cap: CN¥3.22B

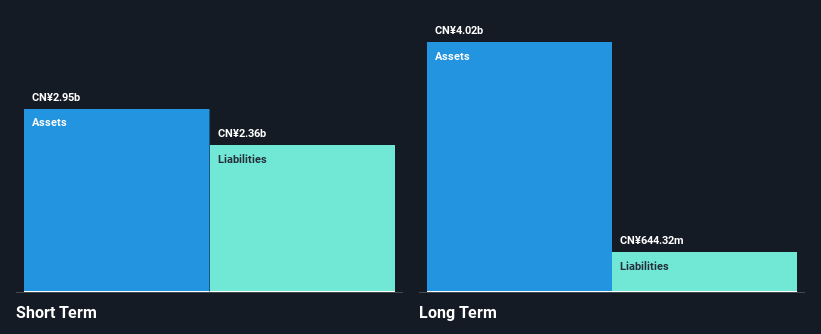

Xiwang Foodstuffs Co., Ltd. has a market cap of CN¥3.22 billion and recently reported improved financials, transitioning from a net loss to a net income of CN¥40.65 million for the first half of 2024. The company's short-term assets (CN¥2.9 billion) comfortably cover both its short-term liabilities (CN¥2.4 billion) and long-term liabilities (CN¥644.3 million). However, its debt is not well covered by operating cash flow, with interest payments only 2.3 times covered by EBIT, indicating potential liquidity challenges despite becoming profitable this year after previous declines in earnings over five years at an annual rate of 5.5%.

- Jump into the full analysis health report here for a deeper understanding of Xiwang FoodstuffsLtd.

- Gain insights into Xiwang FoodstuffsLtd's past trends and performance with our report on the company's historical track record.

Hunan Er-Kang Pharmaceutical (SZSE:300267)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hunan Er-Kang Pharmaceutical Co., Ltd manufactures and sells APIs, finished drug products, and pharmaceutical excipients both in China and internationally, with a market cap of CN¥5.94 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥5.94B

Hunan Er-Kang Pharmaceutical Co., Ltd. has a market cap of CN¥5.94 billion and recently reported a decline in revenue to CN¥621.35 million for the first half of 2024, compared to CN¥1,050.16 million the previous year, with net income dropping significantly to CN¥6.3 million from CN¥51.95 million. Despite having more cash than total debt and short-term assets exceeding liabilities, the company remains unprofitable with increasing losses over five years at an annual rate of 33%. Its share price has been highly volatile recently, though it trades slightly below estimated fair value without significant shareholder dilution this year.

- Get an in-depth perspective on Hunan Er-Kang Pharmaceutical's performance by reading our balance sheet health report here.

- Assess Hunan Er-Kang Pharmaceutical's previous results with our detailed historical performance reports.

Make It Happen

- Reveal the 5,780 hidden gems among our Penny Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000639

Xiwang FoodstuffsLtd

Engages in the research and development, production, and sales of edible vegetable oils, sports nutrition products, and nutritional supplements in China.

Adequate balance sheet and slightly overvalued.