3 Growth Companies With High Insider Ownership Growing Earnings At 34%

Reviewed by Simply Wall St

In a week marked by downside economic surprises and a sharp pullback in major U.S. indices, investors are increasingly looking for resilient growth opportunities amid broader market volatility. One key indicator of potential stability and long-term success is high insider ownership, which often signals confidence from those who know the company best. In this article, we will explore three growth companies with significant insider ownership that are currently growing earnings at an impressive rate of 34%.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 30.1% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 28.4% |

| Gaming Innovation Group (OB:GIG) | 26.7% | 37.4% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.1% | 36.4% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.8% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| Vow (OB:VOW) | 31.7% | 97.7% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

We'll examine a selection from our screener results.

China Transinfo Technology (SZSE:002373)

Simply Wall St Growth Rating: ★★★★☆☆

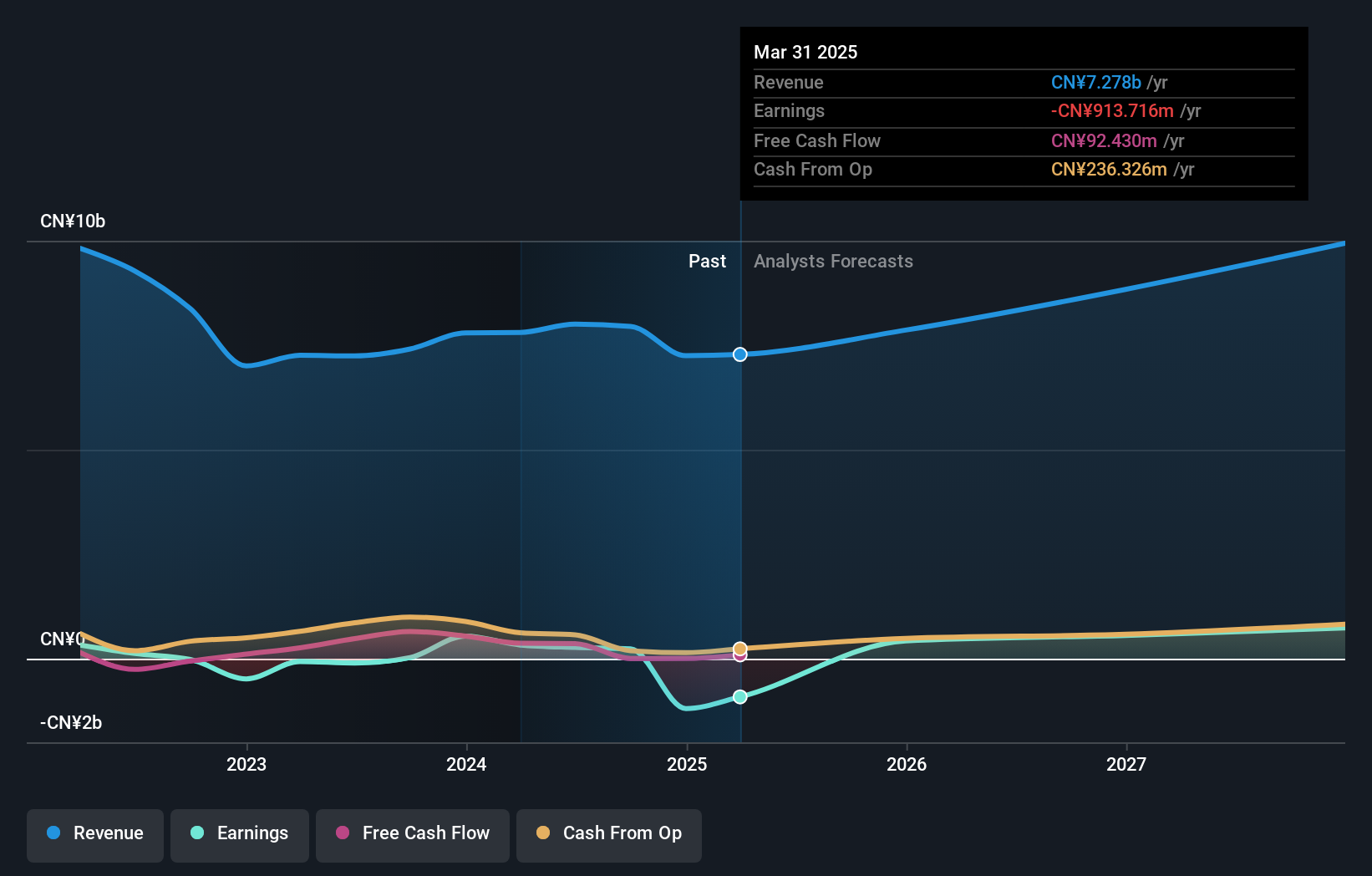

Overview: China Transinfo Technology Co., Ltd. operates in the transportation and IoT sectors with a market cap of CN¥13.67 billion.

Operations: The company generates revenue from its transportation and IoT businesses.

Insider Ownership: 17.2%

Earnings Growth Forecast: 34.3% p.a.

China Transinfo Technology has shown significant growth potential with earnings forecasted to grow 34.29% annually, outpacing the CN market's 22.2%. Despite a volatile share price recently, its revenue is expected to increase by 17.8% per year. The company completed a share buyback worth CNY 80.13 million and became profitable this year, though its Return on Equity is projected to remain low at 6.3%.

- Navigate through the intricacies of China Transinfo Technology with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of China Transinfo Technology shares in the market.

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Jolly Pharmaceutical Co., LTD specializes in the research, production, and marketing of Chinese medicinal products both domestically and internationally, with a market cap of CN¥10.25 billion.

Operations: Revenue Segments (in millions of CN¥): The company generates revenue through the research, production, and marketing of Chinese medicinal products in both domestic and international markets.

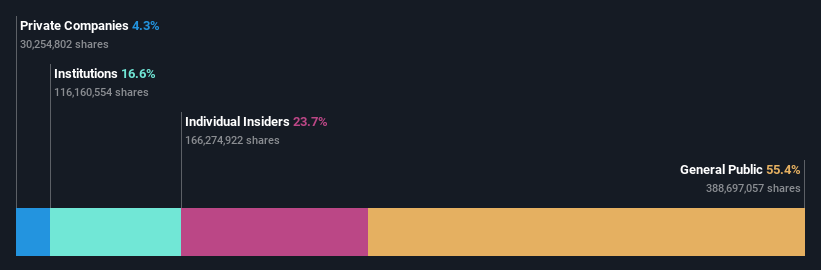

Insider Ownership: 23.7%

Earnings Growth Forecast: 20.8% p.a.

Zhejiang Jolly Pharmaceutical has demonstrated robust growth, with earnings increasing by 43.3% over the past year and revenue rising to CNY 1.43 billion for H1 2024. The company recently announced a share repurchase program worth up to CNY 300 million, reflecting strong insider confidence. Despite a dividend yield of 3.08%, it is not well covered by free cash flow. Future revenue and earnings are forecasted to grow at rates surpassing market averages, indicating continued expansion potential.

- Get an in-depth perspective on Zhejiang Jolly PharmaceuticalLTD's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Zhejiang Jolly PharmaceuticalLTD shares in the market.

Shenzhen Sunline Tech (SZSE:300348)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Sunline Tech Co., Ltd. provides banking software and technology services to banking and finance customers worldwide, with a market cap of CN¥6.13 billion.

Operations: The company's revenue segments include banking software and technology services for the global banking and finance sector.

Insider Ownership: 22.7%

Earnings Growth Forecast: 33.8% p.a.

Shenzhen Sunline Tech is forecasted to grow its revenue by 15.9% annually and earnings by 33.8%, both outpacing the broader CN market. Despite trading at a significant discount to its fair value, it has experienced shareholder dilution over the past year and maintains a highly volatile share price. The company recently approved a cash dividend of CNY 0.10 per 10 shares for 2023, reflecting steady financial health but limited recent insider trading activity.

- Click here and access our complete growth analysis report to understand the dynamics of Shenzhen Sunline Tech.

- In light of our recent valuation report, it seems possible that Shenzhen Sunline Tech is trading behind its estimated value.

Summing It All Up

- Click this link to deep-dive into the 1450 companies within our Fast Growing Companies With High Insider Ownership screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002373

China Transinfo Technology

Engages in the transportation and IoT businesses.

Excellent balance sheet with reasonable growth potential.