- China

- /

- Metals and Mining

- /

- SZSE:002545

3 Dividend Stocks Offering Yields From 3% To 4.4% For Your Portfolio

Reviewed by Simply Wall St

In a week marked by geopolitical tensions and consumer spending concerns, major U.S. stock indexes experienced declines despite early gains, reflecting broader uncertainties in the global economy. Amid these fluctuations, dividend stocks can offer a measure of stability and income potential for investors seeking to navigate volatile markets.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.43% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.61% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.03% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.75% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.24% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.06% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.92% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.90% | ★★★★★★ |

Click here to see the full list of 2008 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Jiangnan Mould & Plastic Technology (SZSE:000700)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jiangnan Mould & Plastic Technology Co., Ltd. operates in the manufacturing sector, focusing on the production of moulds and plastic products, with a market cap of CN¥6.33 billion.

Operations: Jiangnan Mould & Plastic Technology Co., Ltd. generates its revenue primarily through the production of moulds and plastic products.

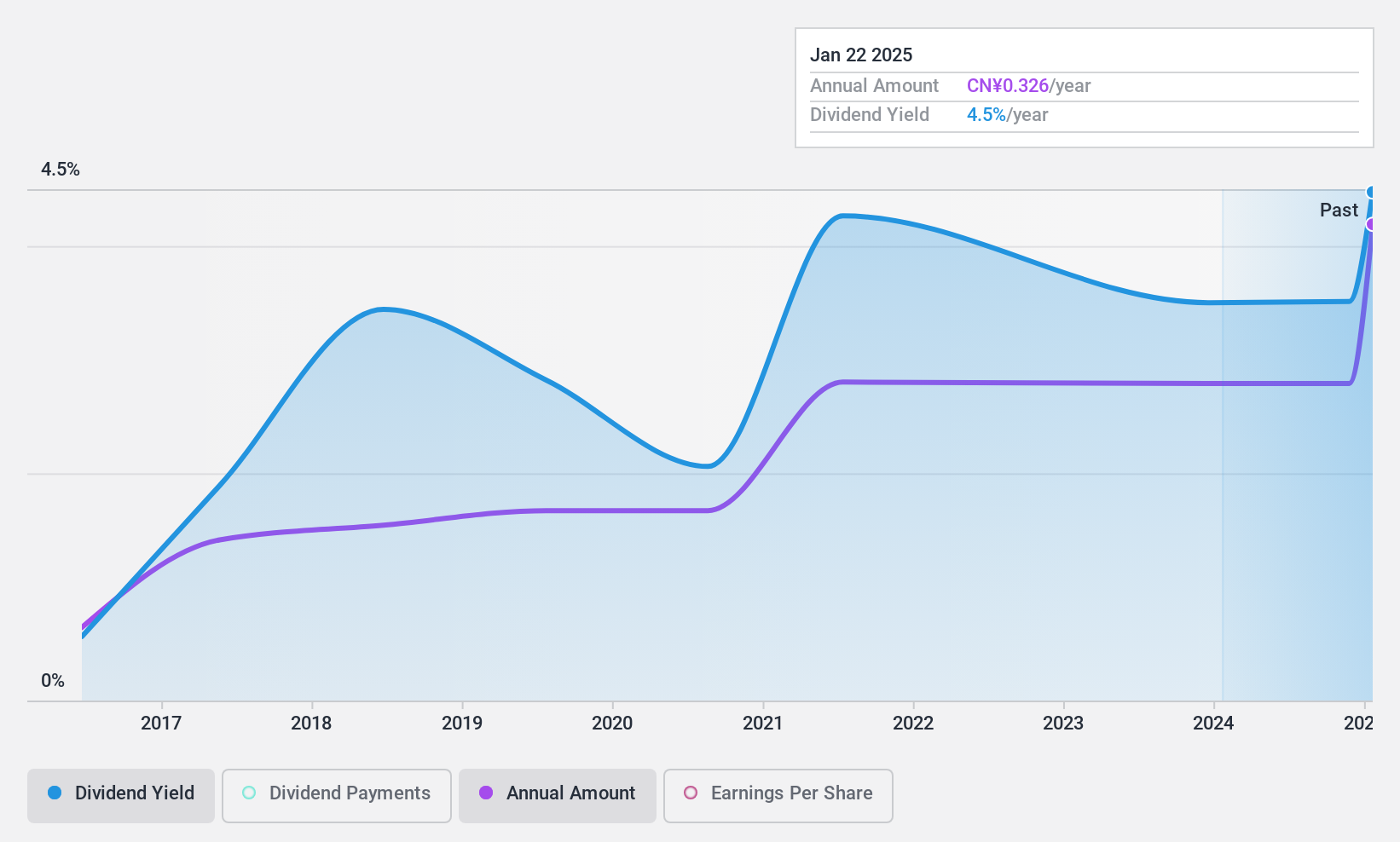

Dividend Yield: 4.5%

Jiangnan Mould & Plastic Technology recently affirmed a cash dividend of CNY 2.17 per ten shares for Q3 2024. While its dividends have been volatile over the past decade, recent increases suggest growth potential. The company's dividend yield is in the top quartile of CN market payers, and payouts are well-covered by earnings and cash flows with payout ratios at 52.1% and 29.6%, respectively. However, large one-off items have impacted financial results, affecting earnings quality.

- Navigate through the intricacies of Jiangnan Mould & Plastic Technology with our comprehensive dividend report here.

- Our valuation report unveils the possibility Jiangnan Mould & Plastic Technology's shares may be trading at a discount.

Qingdao East Steel Tower StockLtd (SZSE:002545)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Qingdao East Steel Tower Stock Co.Ltd, with a market cap of CN¥8.90 billion, manufactures and markets steel structure products in the People’s Republic of China.

Operations: Qingdao East Steel Tower Stock Co.Ltd generates its revenue from the production and sale of steel structure products within China.

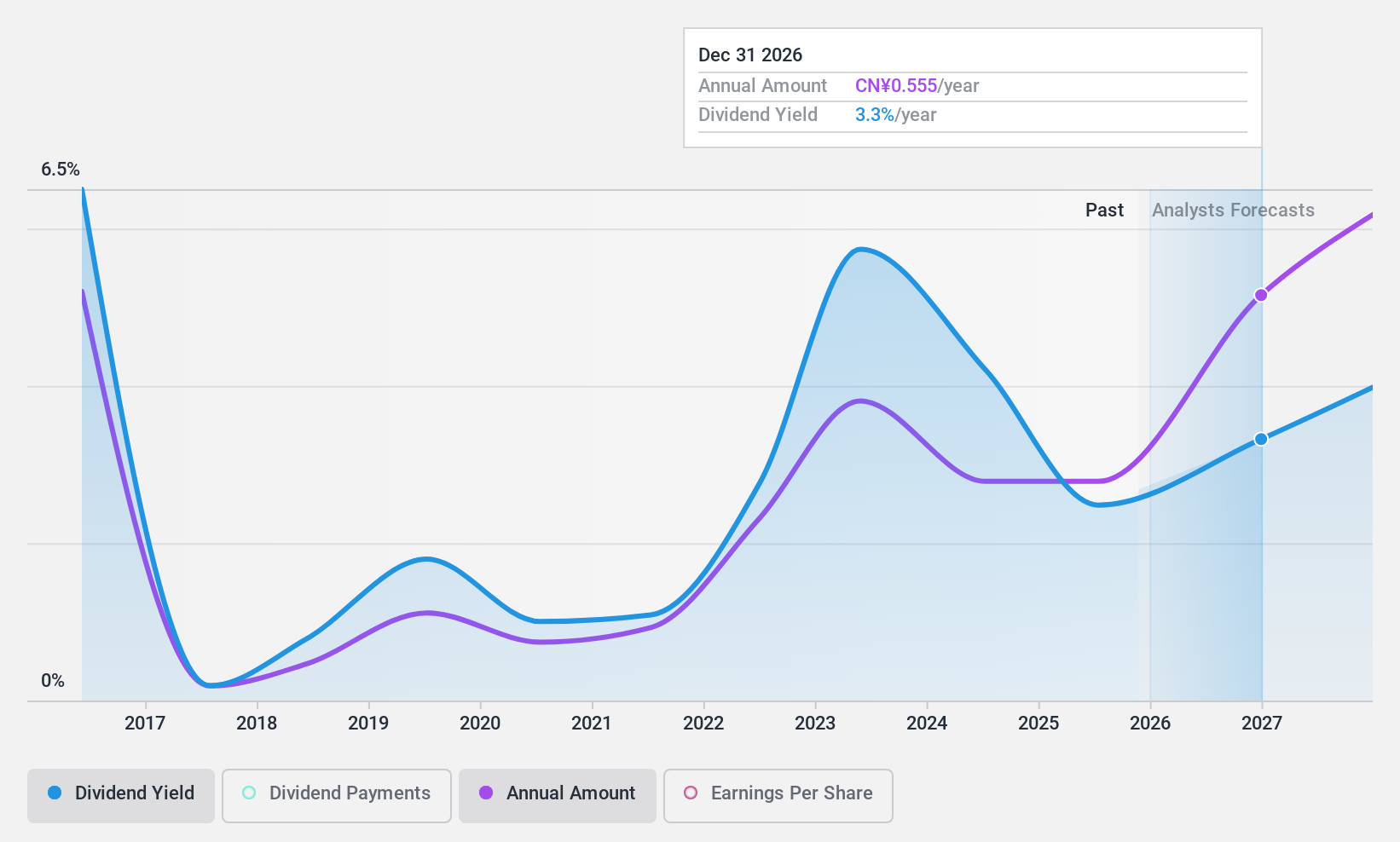

Dividend Yield: 3.9%

Qingdao East Steel Tower Stock Ltd. offers a compelling dividend yield of 3.91%, placing it in the top 25% of CN market payers, supported by a payout ratio of 63.1% and a cash payout ratio of 40%. Despite trading at good value with a P/E ratio below the market average, its dividends have been volatile over the past decade, indicating an unstable track record which may concern some investors seeking reliable income streams.

- Click here and access our complete dividend analysis report to understand the dynamics of Qingdao East Steel Tower StockLtd.

- In light of our recent valuation report, it seems possible that Qingdao East Steel Tower StockLtd is trading behind its estimated value.

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Jolly Pharmaceutical Co., LTD focuses on the research, production, and marketing of Chinese medicinal products both domestically in China and internationally, with a market cap of CN¥9.89 billion.

Operations: Zhejiang Jolly Pharmaceutical Co., LTD's revenue is derived from its operations in the research, production, and marketing of Chinese medicinal products.

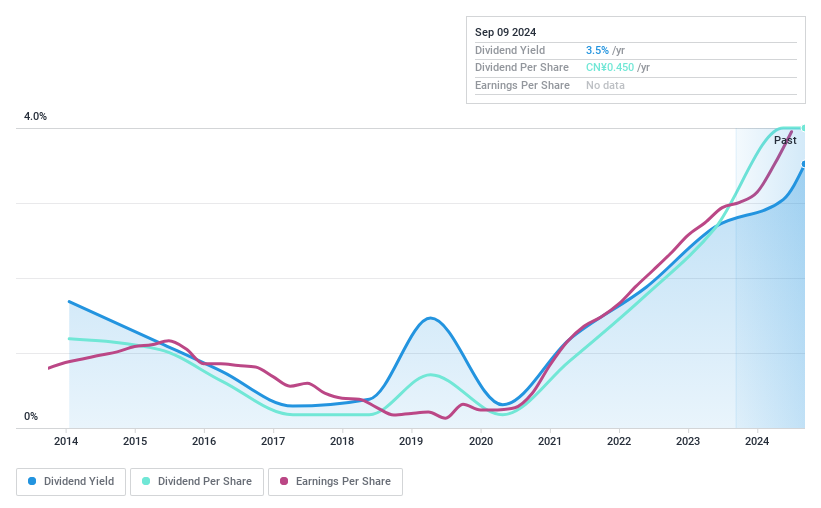

Dividend Yield: 3%

Zhejiang Jolly Pharmaceutical Ltd. offers a dividend yield of 3.01%, ranking in the top 25% of CN market payers, yet its sustainability is questionable due to a high cash payout ratio of 265.5%. Despite earnings growth and trading at a significant discount to estimated fair value, its dividends have been volatile over the past decade, reflecting an unreliable history that may deter investors prioritizing consistent income.

- Get an in-depth perspective on Zhejiang Jolly PharmaceuticalLTD's performance by reading our dividend report here.

- Our expertly prepared valuation report Zhejiang Jolly PharmaceuticalLTD implies its share price may be lower than expected.

Where To Now?

- Click here to access our complete index of 2008 Top Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qingdao East Steel Tower StockLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002545

Qingdao East Steel Tower StockLtd

Manufactures and markets steel structure products in the People’s Republic of China.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success