Raytron TechnologyLtd And 2 Other High Growth Tech Stocks To Watch

Reviewed by Simply Wall St

As global markets continue to experience robust activity, with U.S. small-cap indices like the Russell 2000 reaching record highs, investor sentiment is being shaped by domestic policy shifts and geopolitical developments. In this dynamic environment, high-growth tech stocks such as Raytron Technology Ltd are gaining attention for their potential to capitalize on emerging trends and technological advancements amidst broader market movements.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| CD Projekt | 22.02% | 28.64% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1286 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Raytron TechnologyLtd (SHSE:688002)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Raytron Technology Co., Ltd. specializes in the R&D, design, manufacturing, and sales of uncooled infrared imaging and MEMS sensor technology in China, with a market cap of CN¥21.23 billion.

Operations: Raytron focuses on the development and commercialization of uncooled infrared imaging and MEMS sensor technologies. The company generates revenue through the sale of these advanced technological products, catering primarily to markets in China.

Raytron TechnologyLtd. has demonstrated robust financial performance, with a notable 18% increase in revenue and a growth in net income to CNY 483.4 million this year, up from CNY 386.89 million previously. This surge is supported by a strategic emphasis on R&D, which is evident from the company's recent earnings growth outpacing the broader Electronic industry's average of 1.8%. Furthermore, Raytron's forward-looking revenue and earnings projections are optimistic, with expected annual increases of 17.9% and 26.5%, respectively, surpassing market averages significantly. This commitment to innovation and growth is further underscored by its recent share repurchase initiative, enhancing shareholder value through the buyback of shares worth CNY 49.43 million. Despite challenges such as market volatility highlighted by fluctuating share prices over the past three months, Raytron remains poised for future success due to its aggressive investment in technology development and favorable earnings forecasts that promise continued profitability and market competitiveness.

- Delve into the full analysis health report here for a deeper understanding of Raytron TechnologyLtd.

Assess Raytron TechnologyLtd's past performance with our detailed historical performance reports.

Chongqing Zhifei Biological Products (SZSE:300122)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chongqing Zhifei Biological Products Co., Ltd. specializes in the research, development, production, and sales of vaccines and biological products with a market capitalization of CN¥70.59 billion.

Operations: Zhifei Biological Products generates revenue primarily from its biochemical product segment, which contributed CN¥36.43 billion. The company's focus on vaccines and biological products is central to its business operations.

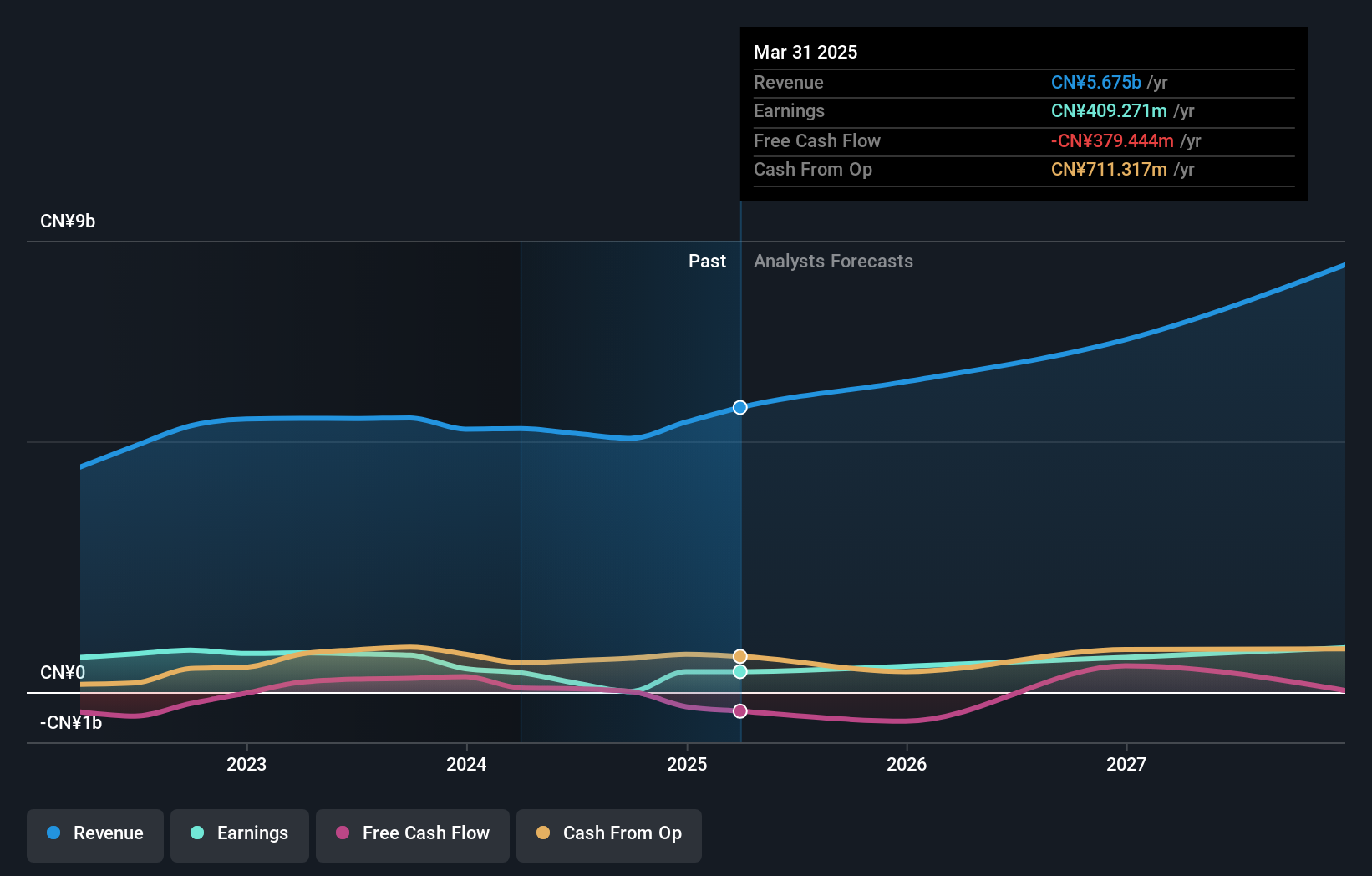

Chongqing Zhifei Biological Products Co., Ltd. is navigating a challenging landscape with its recent financials showing a revenue dip to CNY 22.79 billion from last year's CNY 39.27 billion, alongside a significant decrease in net income from CNY 6.53 billion to CNY 2.15 billion. Despite these hurdles, the company's commitment to innovation remains robust with R&D expenses maintaining a strategic focus; this is critical as earnings are projected to surge by an impressive 43.1% annually. Moreover, with revenue growth forecasted at 14.6% per year—exceeding the market average—Zhifei’s ability to outpace broader market trends highlights its potential resilience and adaptability in the biotech sector.

Thunder Software TechnologyLtd (SZSE:300496)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Thunder Software Technology Co., Ltd. offers operating-system products across various regions including China, Europe, the United States, and Japan, with a market capitalization of CN¥25.44 billion.

Operations: Thunder Software Technology Co., Ltd. specializes in providing operating-system products globally, including key markets such as China, Europe, the United States, and Japan. The company has a market capitalization of CN¥25.44 billion.

Thunder Software TechnologyLtd., amid a challenging tech landscape, continues to innovate and expand its footprint in intelligent mobility solutions. Recently, the company announced a strategic partnership with HERE Technologies to enhance navigation systems using AI, which underscores its commitment to leveraging high-tech advancements for growth. Despite a downturn in earnings with net income dropping to CNY 151.97 million from CNY 605.98 million year-over-year, ThunderSoft's focus on R&D remains aggressive; this is evident from their latest financials where R&D expenses have been significant in proportion to revenue, aligning with industry trends of investing heavily into future capabilities. Furthermore, expected annual earnings growth is an impressive 74.6%, signaling robust future prospects if current strategies persist.

- Take a closer look at Thunder Software TechnologyLtd's potential here in our health report.

Understand Thunder Software TechnologyLtd's track record by examining our Past report.

Turning Ideas Into Actions

- Dive into all 1286 of the High Growth Tech and AI Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300122

Chongqing Zhifei Biological Products

Chongqing Zhifei Biological Products Co., Ltd.

Flawless balance sheet, undervalued and pays a dividend.