The Market Lifts Tianjin Ringpu Bio-Technology Co.,Ltd. (SZSE:300119) Shares 36% But It Can Do More

Tianjin Ringpu Bio-Technology Co.,Ltd. (SZSE:300119) shareholders would be excited to see that the share price has had a great month, posting a 36% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 9.0% over the last year.

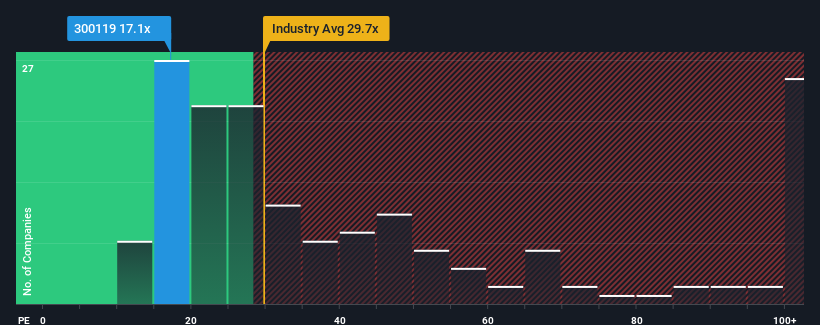

Even after such a large jump in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 34x, you may still consider Tianjin Ringpu Bio-TechnologyLtd as an attractive investment with its 17.1x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Tianjin Ringpu Bio-TechnologyLtd has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Tianjin Ringpu Bio-TechnologyLtd

Is There Any Growth For Tianjin Ringpu Bio-TechnologyLtd?

In order to justify its P/E ratio, Tianjin Ringpu Bio-TechnologyLtd would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a worthy increase of 13%. However, this wasn't enough as the latest three year period has seen an unpleasant 18% overall drop in EPS. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 19% per year over the next three years. With the market predicted to deliver 19% growth each year, the company is positioned for a comparable earnings result.

With this information, we find it odd that Tianjin Ringpu Bio-TechnologyLtd is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Tianjin Ringpu Bio-TechnologyLtd's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Tianjin Ringpu Bio-TechnologyLtd's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Tianjin Ringpu Bio-TechnologyLtd that you need to be mindful of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Tianjin Ringpu Bio-TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300119

Tianjin Ringpu Bio-TechnologyLtd

Engages in the research and development, production, and sale of veterinary raw materials, drug preparation, functional additives, and veterinary biological products.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives