3 Leading Growth Stocks With Insider Ownership As High As 36%

Reviewed by Simply Wall St

Global markets have recently experienced a mix of trends, with major benchmarks showing varied performances amid fluctuating inflation rates and economic policies. Particularly, growth shares have faced challenges, highlighting the importance of strategic investment choices during uncertain times. In this context, companies with high insider ownership can be particularly intriguing as they often signal strong confidence from those closest to the business. This alignment of interests between insiders and external shareholders might offer some resilience in turbulent market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Gaming Innovation Group (OB:GIG) | 22.1% | 36.2% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 50.3% |

| Elliptic Laboratories (OB:ELABS) | 31.6% | 124.6% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 15.2% | 85.2% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.7% |

| Vow (OB:VOW) | 31.8% | 97.6% |

| Adocia (ENXTPA:ADOC) | 12.4% | 104.5% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 24.9% | 92.9% |

Underneath we present a selection of stocks filtered out by our screen.

Shanghai Putailai New Energy TechnologyLtd (SHSE:603659)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shanghai Putailai New Energy Technology Co., Ltd. focuses on developing and selling lithium-ion battery materials and automation equipment in China, with a market capitalization of approximately CN¥34.43 billion.

Operations: The company generates its revenue primarily from the development and sales of lithium-ion battery materials and automation equipment.

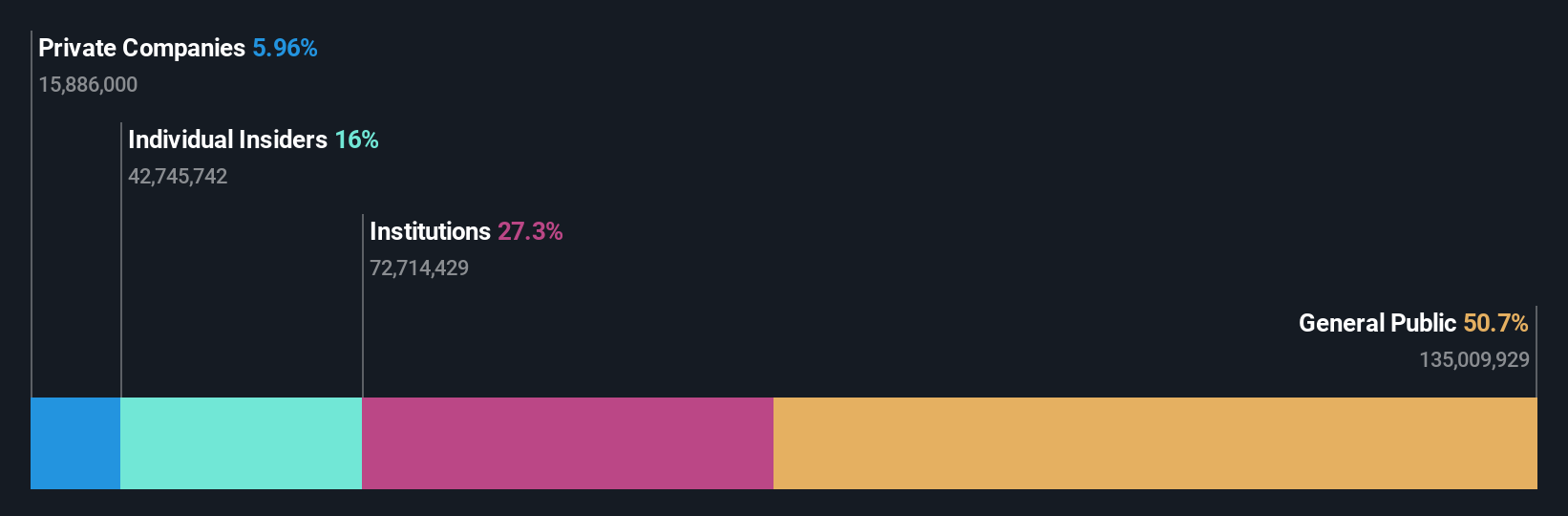

Insider Ownership: 36.5%

Shanghai Putailai New Energy Technology Co., Ltd. has shown a mixed financial performance with recent quarterly earnings showing a decline from CNY 3.7 billion to CNY 3.03 billion year-over-year, and net income dropping from CNY 702 million to CNY 445 million. Despite this, the company's forecasted earnings growth is robust at an annual rate of 26.1%, outpacing the broader CN market projection of 23.1%. However, investor caution may be advised due to its highly volatile share price and lower profit margins compared to the previous year. The company's Price-To-Earnings ratio stands favorable at 21.2x against the market average of 30.7x, suggesting a relatively good value in its sector.

- Unlock comprehensive insights into our analysis of Shanghai Putailai New Energy TechnologyLtd stock in this growth report.

- Upon reviewing our latest valuation report, Shanghai Putailai New Energy TechnologyLtd's share price might be too pessimistic.

China Transinfo Technology (SZSE:002373)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Transinfo Technology Co., Ltd. operates in the transportation and IoT sectors with a market capitalization of approximately CN¥14.34 billion.

Operations: The company's revenue is derived primarily from the transportation and IoT sectors.

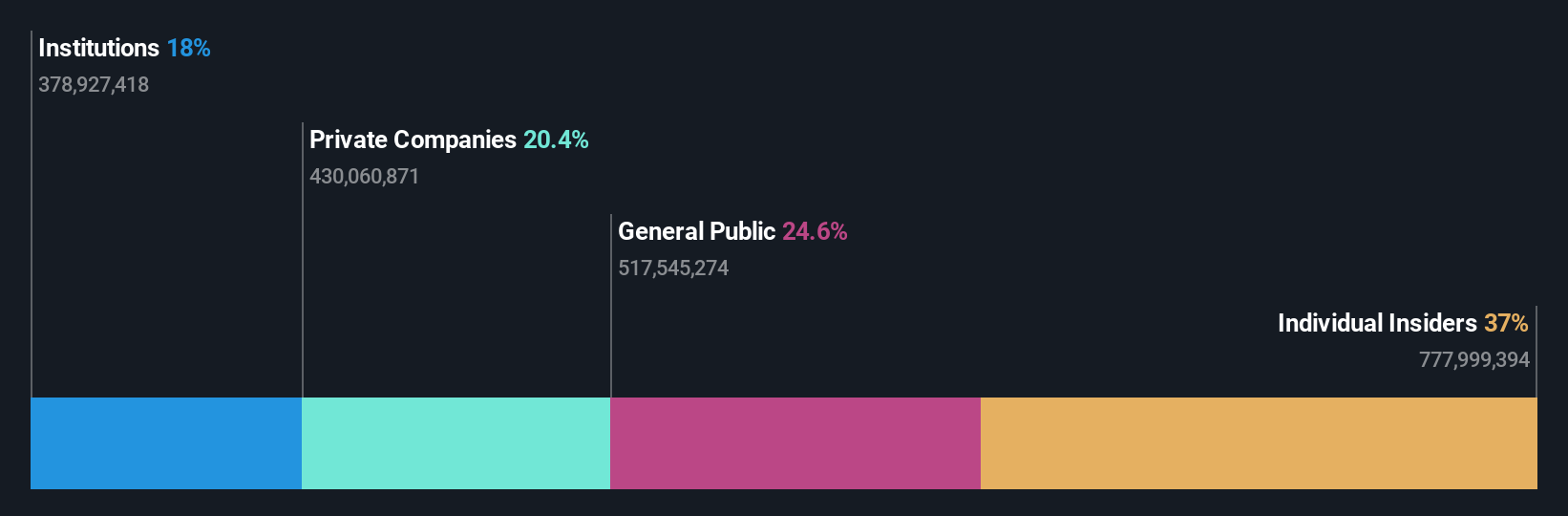

Insider Ownership: 18.1%

China Transinfo Technology Co., Ltd, despite a challenging quarter with a net loss of CNY 57.85 million, has shown promising signs of recovery and growth. The company's earnings are expected to grow by 34.3% annually over the next three years, outpacing the CN market forecast of 23.1%. Additionally, revenue is projected to increase at 17.5% per year, also above the market average. However, its return on equity is anticipated to remain low at 6.2%, which could concern investors focusing on long-term profitability and financial stability.

- Get an in-depth perspective on China Transinfo Technology's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that China Transinfo Technology is trading beyond its estimated value.

Inner Mongolia Furui Medical Science (SZSE:300049)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Inner Mongolia Furui Medical Science Co., Ltd. operates in the healthcare sector, focusing on the development and sale of pharmaceutical products, with a market capitalization of approximately CN¥13.77 billion.

Operations: The company generates its revenue primarily from the development and sale of pharmaceutical products.

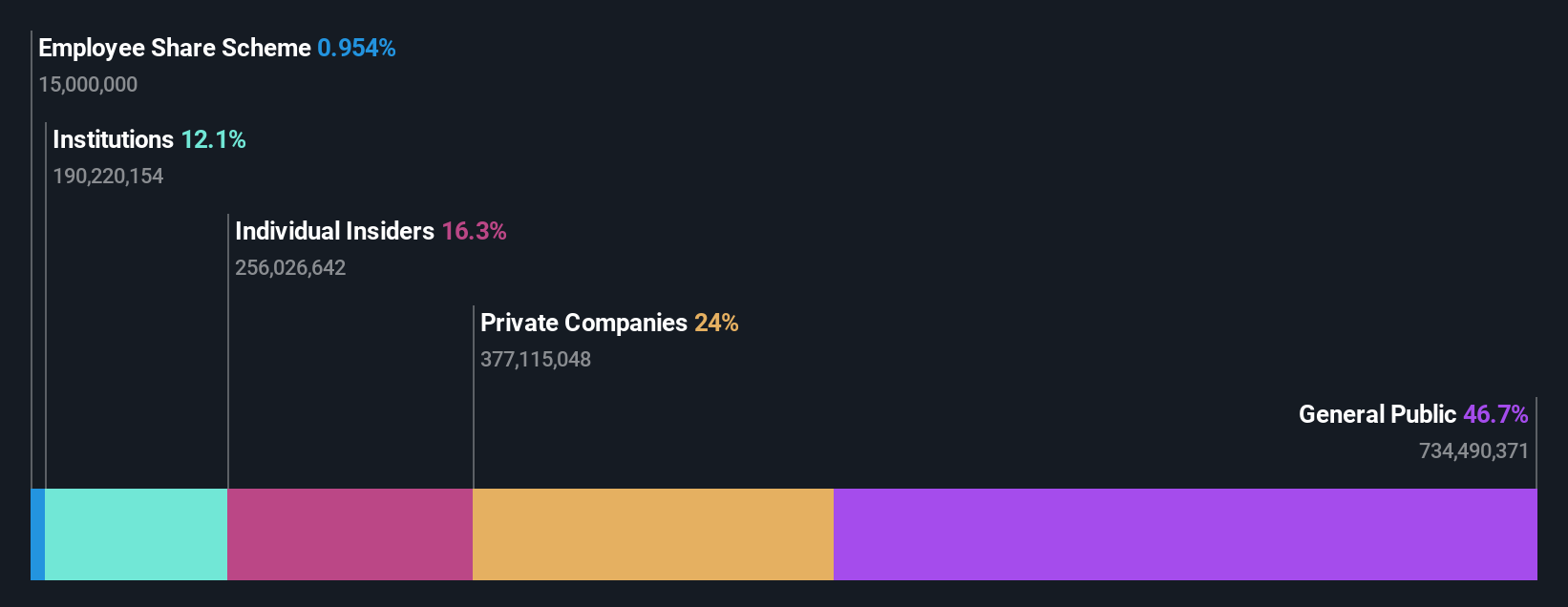

Insider Ownership: 18.2%

Inner Mongolia Furui Medical Science Co., Ltd. is trading at a 6% discount to its estimated fair value, signaling potential undervaluation. The company's revenue and earnings are on a robust growth trajectory, with revenue expected to increase by 28.9% annually and earnings forecasted to surge by 40.52% each year, both metrics outpacing the broader Chinese market averages significantly. Recent corporate actions include amendments to the company's articles of association, reflecting a proactive governance stance which might support sustained growth despite a forecasted low return on equity of 17.5%.

- Take a closer look at Inner Mongolia Furui Medical Science's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Inner Mongolia Furui Medical Science's current price could be inflated.

Turning Ideas Into Actions

- Reveal the 1480 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002373

China Transinfo Technology

Engages in the transportation and IoT businesses.

Flawless balance sheet with reasonable growth potential.