- China

- /

- Diversified Financial

- /

- SZSE:002316

Global's Top Penny Stocks To Watch In June 2025

Reviewed by Simply Wall St

Global markets have been navigating a complex landscape, with U.S. stocks showing resilience amid trade policy uncertainties and inflation easing to its slowest pace in four years. Against this backdrop, investors might find opportunities in penny stocks—an investment area that, despite its somewhat outdated name, remains relevant for those seeking growth potential in smaller or newer companies. These stocks can offer surprising value when backed by strong financial health, presenting a mix of value and growth that larger firms might overlook.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.50 | A$71.94M | ✅ 4 ⚠️ 2 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.14 | HK$725.59M | ✅ 4 ⚠️ 2 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.96 | £445.67M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.61 | SEK270.7M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.44 | SGD178.33M | ✅ 4 ⚠️ 3 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.67 | A$453.46M | ✅ 5 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$3.08 | A$716.16M | ✅ 3 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.31 | SGD9.09B | ✅ 5 ⚠️ 0 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.39 | HK$50.15B | ✅ 4 ⚠️ 1 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 5,587 stocks from our Global Penny Stocks screener.

We'll examine a selection from our screener results.

Shenzhen Asia Link Technology DevelopmentLtd (SZSE:002316)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shenzhen Asia Link Technology Development Co., Ltd. operates in the technology sector with a market capitalization of CN¥1.66 billion.

Operations: No specific revenue segments have been reported for this company.

Market Cap: CN¥1.66B

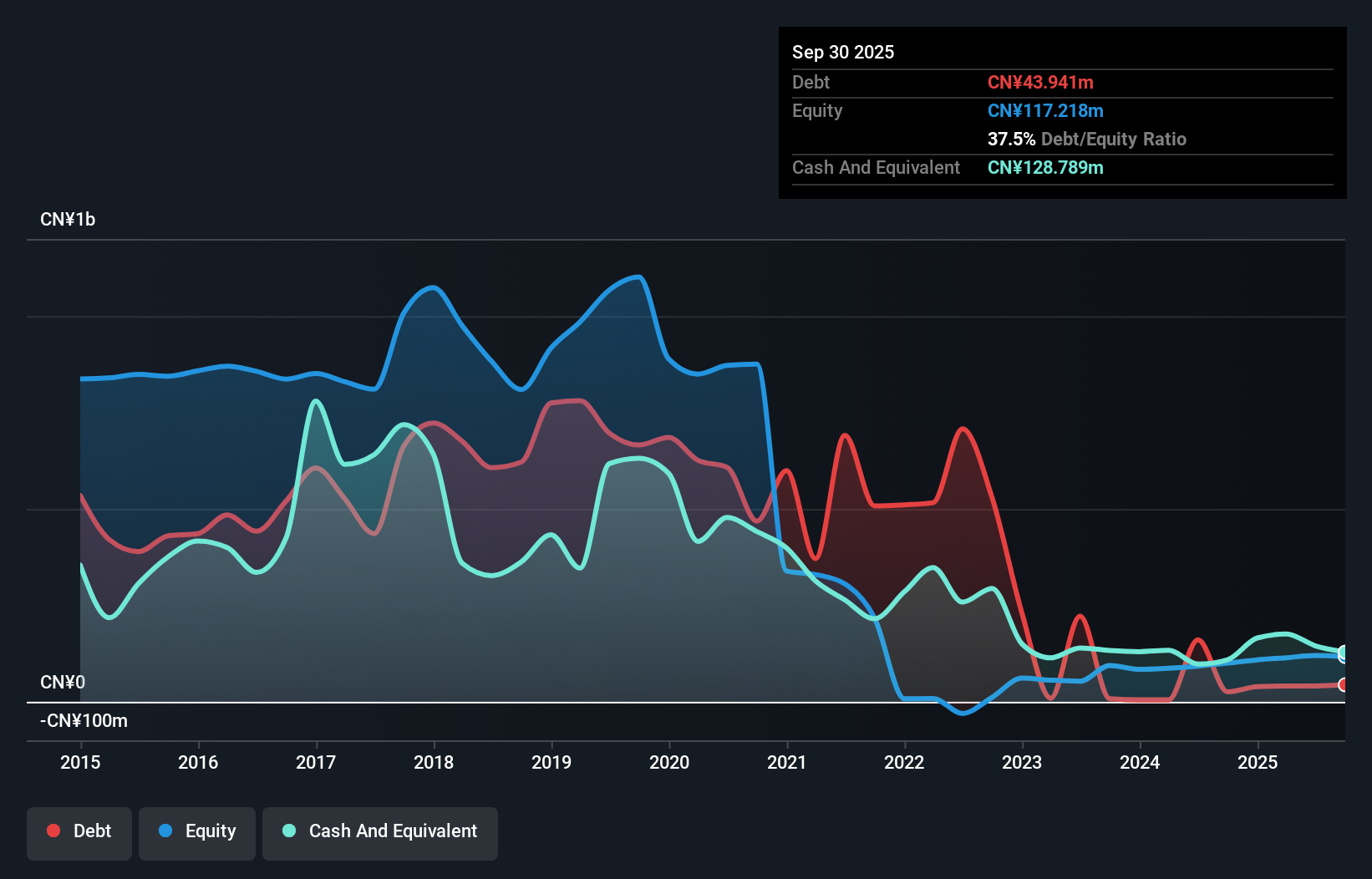

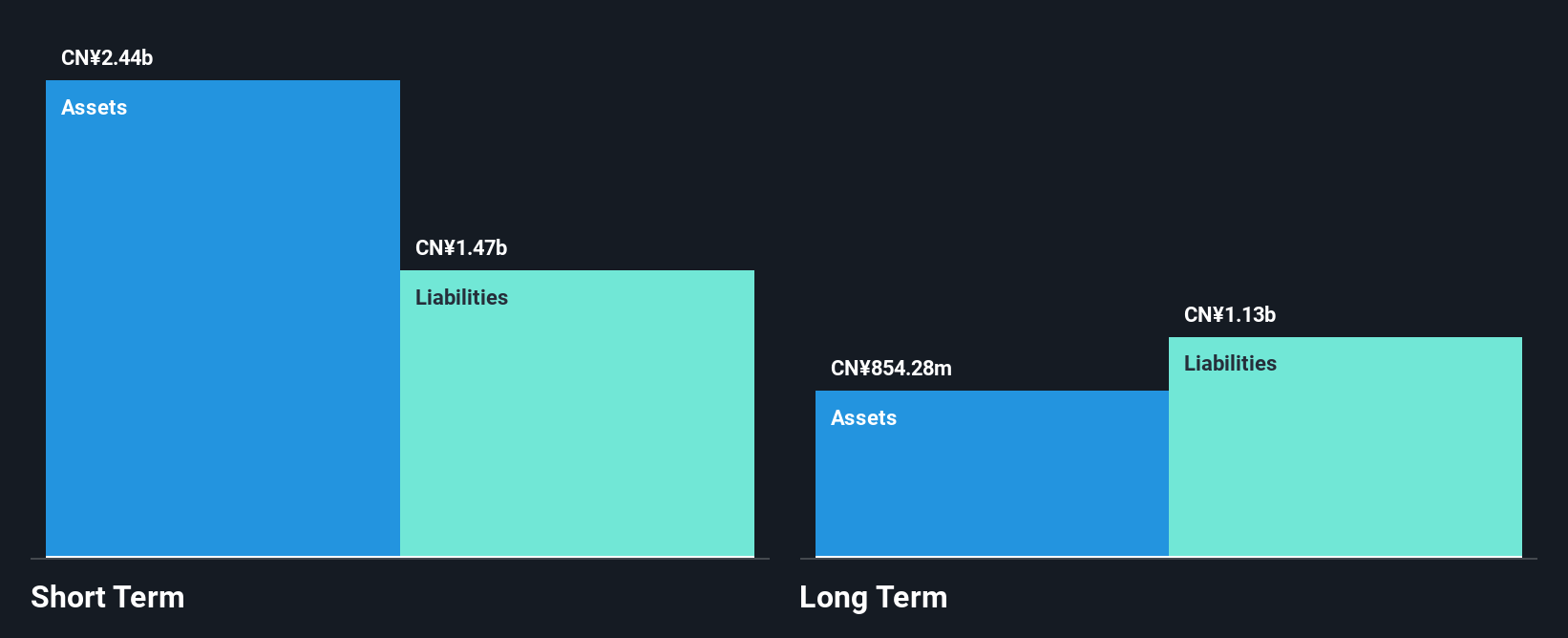

Shenzhen Asia Link Technology Development Co., Ltd. is navigating the penny stock landscape with a market cap of CN¥1.66 billion, demonstrating resilience through its substantial cash runway exceeding three years at current free cash flow levels. Despite being unprofitable with negative return on equity, it has reduced losses by 24.7% annually over five years and boasts a seasoned management team and board of directors. Recent earnings reveal improved financial performance, with Q1 2025 revenues rising to CN¥104.95 million from CN¥83.29 million year-over-year, indicating potential growth amidst existing short-term liabilities challenges and stable debt levels relative to assets.

- Unlock comprehensive insights into our analysis of Shenzhen Asia Link Technology DevelopmentLtd stock in this financial health report.

- Gain insights into Shenzhen Asia Link Technology DevelopmentLtd's past trends and performance with our report on the company's historical track record.

Guizhou Bailing Group Pharmaceutical (SZSE:002424)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Guizhou Bailing Group Pharmaceutical Co., Ltd. operates in the pharmaceutical industry, focusing on the development, production, and sale of traditional Chinese medicine products, with a market cap of CN¥5.65 billion.

Operations: No specific revenue segments have been reported for the company.

Market Cap: CN¥5.65B

Guizhou Bailing Group Pharmaceutical Co., Ltd. is navigating financial challenges with a market cap of CN¥5.65 billion, having recently turned profitable despite a significant earnings decline over five years. The company reported Q1 2025 revenues of CN¥760.59 million, down from the previous year, and net income of CN¥24.17 million. Its debt management shows improvement with a reduced debt-to-equity ratio and satisfactory net debt levels supported by operating cash flow covering 23% of its debt. However, short-term liabilities match short-term assets, posing liquidity concerns amidst stable weekly volatility and experienced management oversight.

- Jump into the full analysis health report here for a deeper understanding of Guizhou Bailing Group Pharmaceutical.

- Examine Guizhou Bailing Group Pharmaceutical's past performance report to understand how it has performed in prior years.

Hainan RuiZe New Building MaterialLtd (SZSE:002596)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hainan RuiZe New Building Material Co., Ltd operates in China, focusing on the production and sale of commercial concrete and municipal sanitation services, with a market cap of CN¥3.98 billion.

Operations: The company generates revenue primarily from its operations in China, amounting to CN¥1.23 billion.

Market Cap: CN¥3.98B

Hainan RuiZe New Building Material Co., Ltd, with a market cap of CN¥3.98 billion, faces financial challenges as it remains unprofitable with increasing losses over the past five years. Despite reporting sales of CN¥1.28 billion for 2024, revenue declined from the previous year, and net losses persisted at CN¥241.53 million. The company's high net debt to equity ratio of 175.8% raises concerns about its financial leverage, although it maintains a stable cash runway due to positive free cash flow growth. Additionally, short-term assets exceed both short and long-term liabilities, providing some balance sheet strength amidst volatility stability.

- Navigate through the intricacies of Hainan RuiZe New Building MaterialLtd with our comprehensive balance sheet health report here.

- Learn about Hainan RuiZe New Building MaterialLtd's historical performance here.

Seize The Opportunity

- Take a closer look at our Global Penny Stocks list of 5,587 companies by clicking here.

- Contemplating Other Strategies? Explore 22 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002316

Shenzhen Asia Link Technology DevelopmentLtd

Shenzhen Asia Link Technology Development Co.,Ltd.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives