Stock Analysis

- China

- /

- Auto Components

- /

- SHSE:603348

High Insider Ownership Growth Stocks On Chinese Exchange July 2024

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global indices and deepening trade tensions between the U.S. and China, Chinese equities have shown resilience, with certain sectors demonstrating robust growth despite broader economic challenges. In this context, stocks with high insider ownership in China may offer intriguing opportunities as these insiders often have a deep commitment to their companies' long-term success. In such a market environment, companies with substantial insider ownership can be particularly appealing. Insiders holding a significant stake typically signals confidence in the company's prospects, potentially aligning their interests closely with those of shareholders during turbulent times.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| Anhui Huaheng Biotechnology (SHSE:688639) | 21.7% | 26.5% |

| Ningbo Sunrise Elc TechnologyLtd (SZSE:002937) | 24.3% | 27.7% |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 19% | 27.9% |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 25.4% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| UTour Group (SZSE:002707) | 23% | 33.1% |

Let's take a closer look at a couple of our picks from the screened companies.

Wencan Group (SHSE:603348)

Simply Wall St Growth Rating: ★★★★★☆

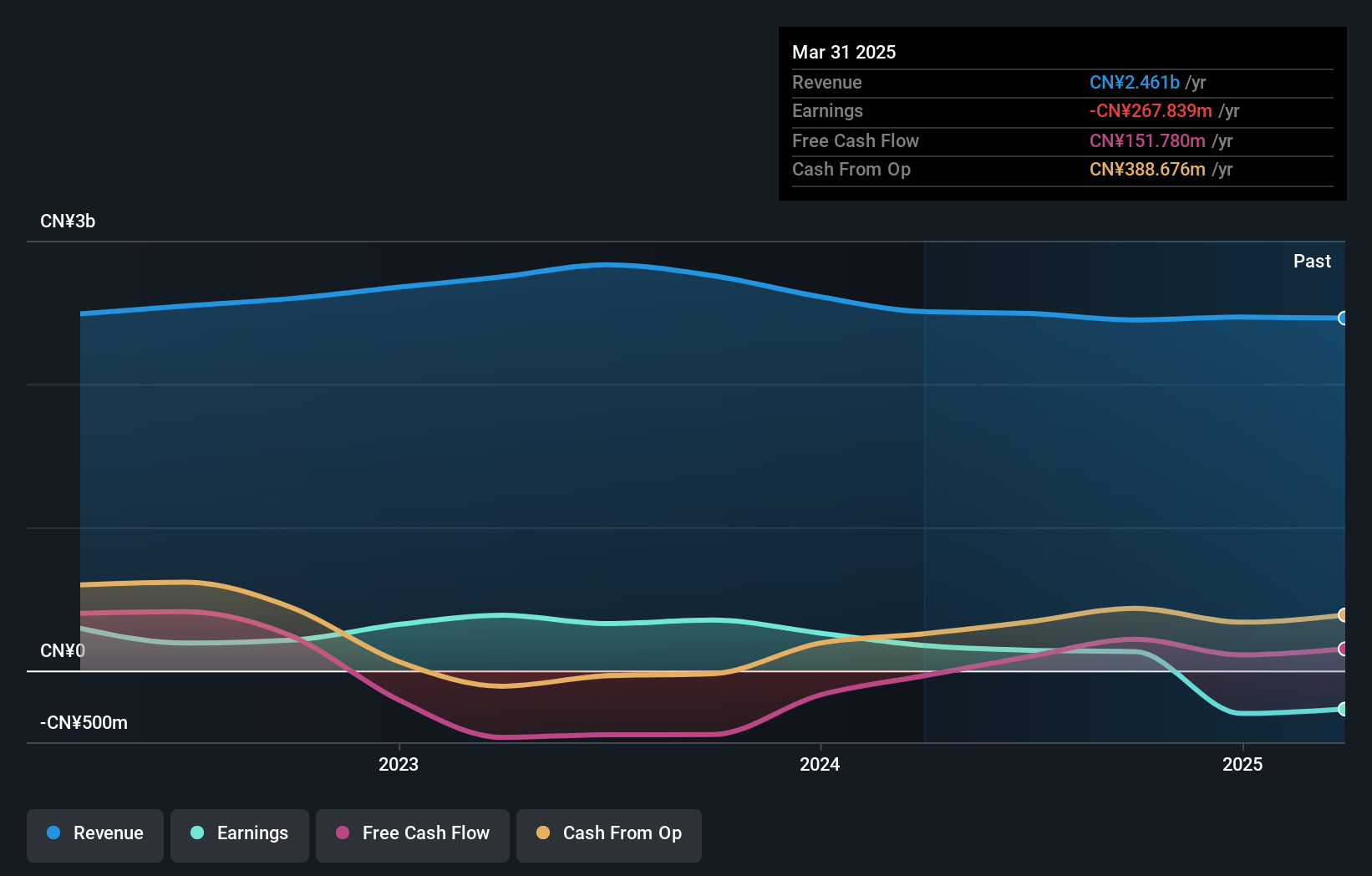

Overview: Wencan Group Co., Ltd. specializes in the research, development, production, and sale of automotive aluminum alloy precision die castings both domestically and internationally, with a market capitalization of approximately CN¥7.48 billion.

Operations: The company primarily generates revenue from the production and sale of automotive aluminum alloy precision die castings.

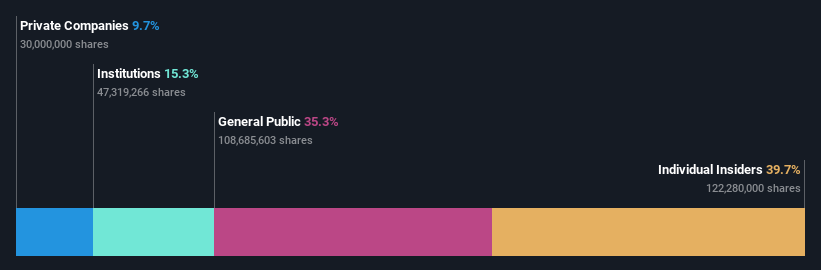

Insider Ownership: 39.7%

Revenue Growth Forecast: 23.8% p.a.

Wencan Group, a Chinese company with significant insider ownership, reported a substantial increase in Q1 earnings for 2024 with net income soaring to CNY 62.06 million from CNY 2.54 million year-over-year; revenue also grew to CNY 1.48 billion. Despite these gains, challenges persist as the company's profit margins have declined and shareholder dilution has occurred over the past year. Forecasts suggest robust annual earnings growth of approximately 46.7%, outpacing the broader Chinese market projections.

- Get an in-depth perspective on Wencan Group's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Wencan Group is priced higher than what may be justified by its financials.

Guangdong Zhongsheng Pharmaceutical (SZSE:002317)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guangdong Zhongsheng Pharmaceutical Co., Ltd. is a pharmaceutical company with operations focused on the research, development, and distribution of medicine, boasting a market capitalization of approximately CN¥9.91 billion.

Operations: The company's revenue is derived primarily from the research, development, and distribution of pharmaceutical products.

Insider Ownership: 27.8%

Revenue Growth Forecast: 17.1% p.a.

Guangdong Zhongsheng Pharmaceutical, despite its insider ownership, faces challenges with a profit margin drop from 14.1% to 7% last year. However, it's poised for substantial growth with earnings expected to increase by 43.26% annually, outperforming the Chinese market's forecast of 22.2%. Recent shareholder meetings have focused on dividends and corporate governance adjustments, reflecting active management engagement. Yet, the dividend coverage by earnings and cash flow remains weak.

- Navigate through the intricacies of Guangdong Zhongsheng Pharmaceutical with our comprehensive analyst estimates report here.

- Our valuation report here indicates Guangdong Zhongsheng Pharmaceutical may be overvalued.

Guangdong Shenling Environmental Systems (SZSE:301018)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Shenling Environmental Systems Co., Ltd. is a company that specializes in the manufacture and sale of environmental control systems, with a market capitalization of approximately CN¥5.34 billion.

Operations: The company's revenue is generated from the manufacture and sale of environmental control systems.

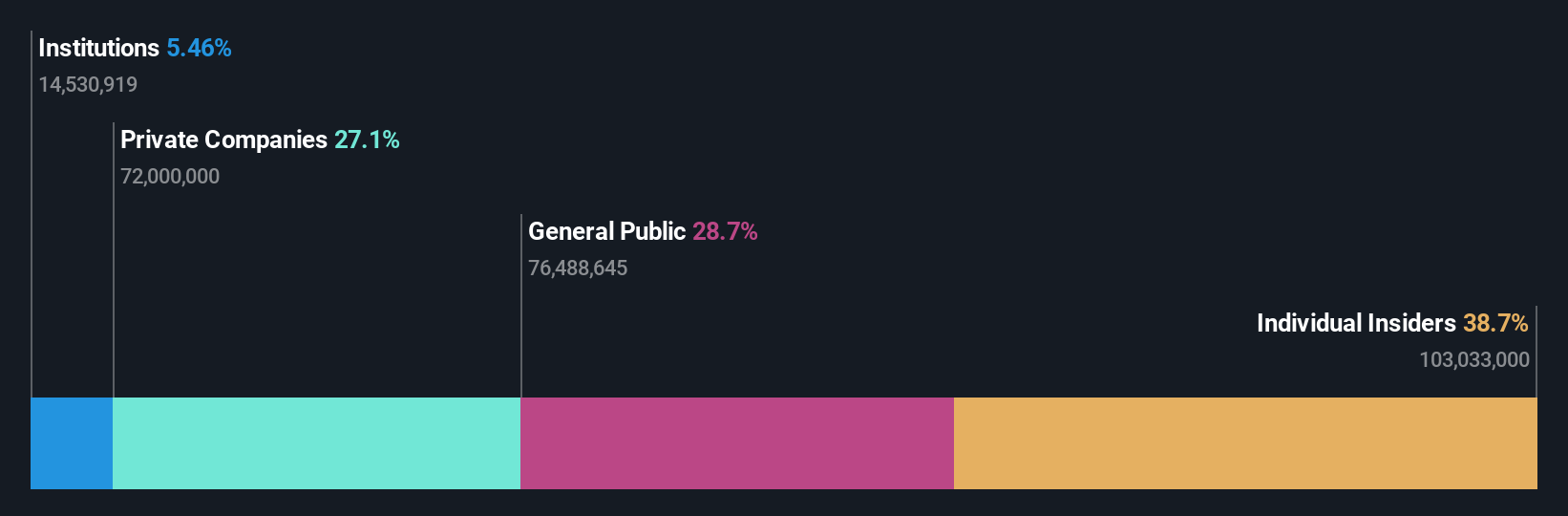

Insider Ownership: 38.7%

Revenue Growth Forecast: 26.4% p.a.

Guangdong Shenling Environmental Systems Co., Ltd. is trading 47.8% below its estimated fair value, signaling potential undervaluation despite a profit margin decline to 4.5% from last year's 7.6%. The company's earnings are expected to grow by a significant 45.2% annually, outstripping the Chinese market's average of 22.2%. This growth is mirrored in its revenue projections, set to increase by 26.4% yearly, also above the market pace of 13.7%. Recent dividend adjustments and an active annual general meeting agenda suggest engaged corporate oversight but raise concerns about dividend coverage sustainability.

- Click here to discover the nuances of Guangdong Shenling Environmental Systems with our detailed analytical future growth report.

- According our valuation report, there's an indication that Guangdong Shenling Environmental Systems' share price might be on the expensive side.

Turning Ideas Into Actions

- Access the full spectrum of 364 Fast Growing Chinese Companies With High Insider Ownership by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Wencan Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603348

Wencan Group

Engages in the research and development, production, and sale of automotive aluminum alloy precision die castings in China and internationally.

High growth potential low.