In the wake of a "red sweep" in the U.S. elections, global markets have seen significant shifts, with major indices like the S&P 500 reaching record highs amid expectations of growth-friendly policies and tax cuts. As investors navigate these evolving conditions, dividend stocks offer a compelling option for those seeking income stability; they can provide consistent returns even amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.03% | ★★★★★★ |

| Globeride (TSE:7990) | 4.02% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.17% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.57% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.92% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.53% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.83% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

Click here to see the full list of 1939 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Zhengzhou Coal Mining Machinery Group (SHSE:601717)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zhengzhou Coal Mining Machinery Group Company Limited, along with its subsidiaries, manufactures and sells coal mining and excavating equipment in China, Germany, and internationally, with a market cap of CN¥23.08 billion.

Operations: The company's revenue is primarily derived from its coal manufacturing segment, which generates CN¥19.18 billion, and its automotive parts board segment, contributing CN¥17.81 billion.

Dividend Yield: 6.2%

Zhengzhou Coal Mining Machinery Group's dividend payments have been volatile over the past decade, reflecting an unstable track record. However, dividends are well-covered by earnings and cash flows, with a payout ratio of 38.6% and a cash payout ratio of 55.2%. Recent earnings growth is notable, with net income rising to CNY 3.06 billion for the nine months ending September 2024. The stock trades at a good value compared to its peers and below estimated fair value.

- Take a closer look at Zhengzhou Coal Mining Machinery Group's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Zhengzhou Coal Mining Machinery Group is trading behind its estimated value.

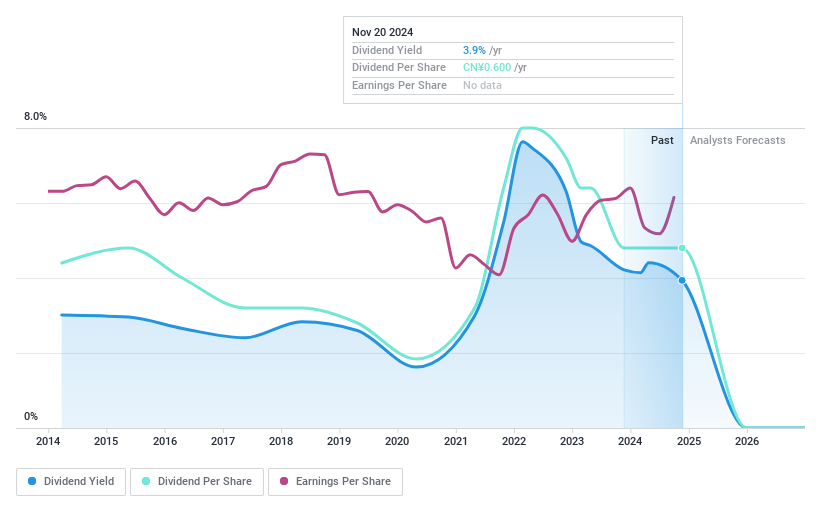

Guilin Sanjin Pharmaceutical (SZSE:002275)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Guilin Sanjin Pharmaceutical Co., Ltd. focuses on the research, production, and sale of traditional Chinese and natural medicines in China, with a market cap of CN¥8.96 billion.

Operations: Guilin Sanjin Pharmaceutical Co., Ltd. generates its revenue primarily from the research, production, and sale of traditional Chinese and natural medicines within China.

Dividend Yield: 3.9%

Guilin Sanjin Pharmaceutical's dividend payments have been volatile over the past decade, though they are covered by earnings and cash flows with a payout ratio of 43.4% and a cash payout ratio of 72.5%. The company recently affirmed a cash dividend for Q3 2024, despite declining net income to CNY 383.88 million compared to last year. Trading below estimated fair value, its dividend yield is among the top tier in China's market.

- Delve into the full analysis dividend report here for a deeper understanding of Guilin Sanjin Pharmaceutical.

- Upon reviewing our latest valuation report, Guilin Sanjin Pharmaceutical's share price might be too pessimistic.

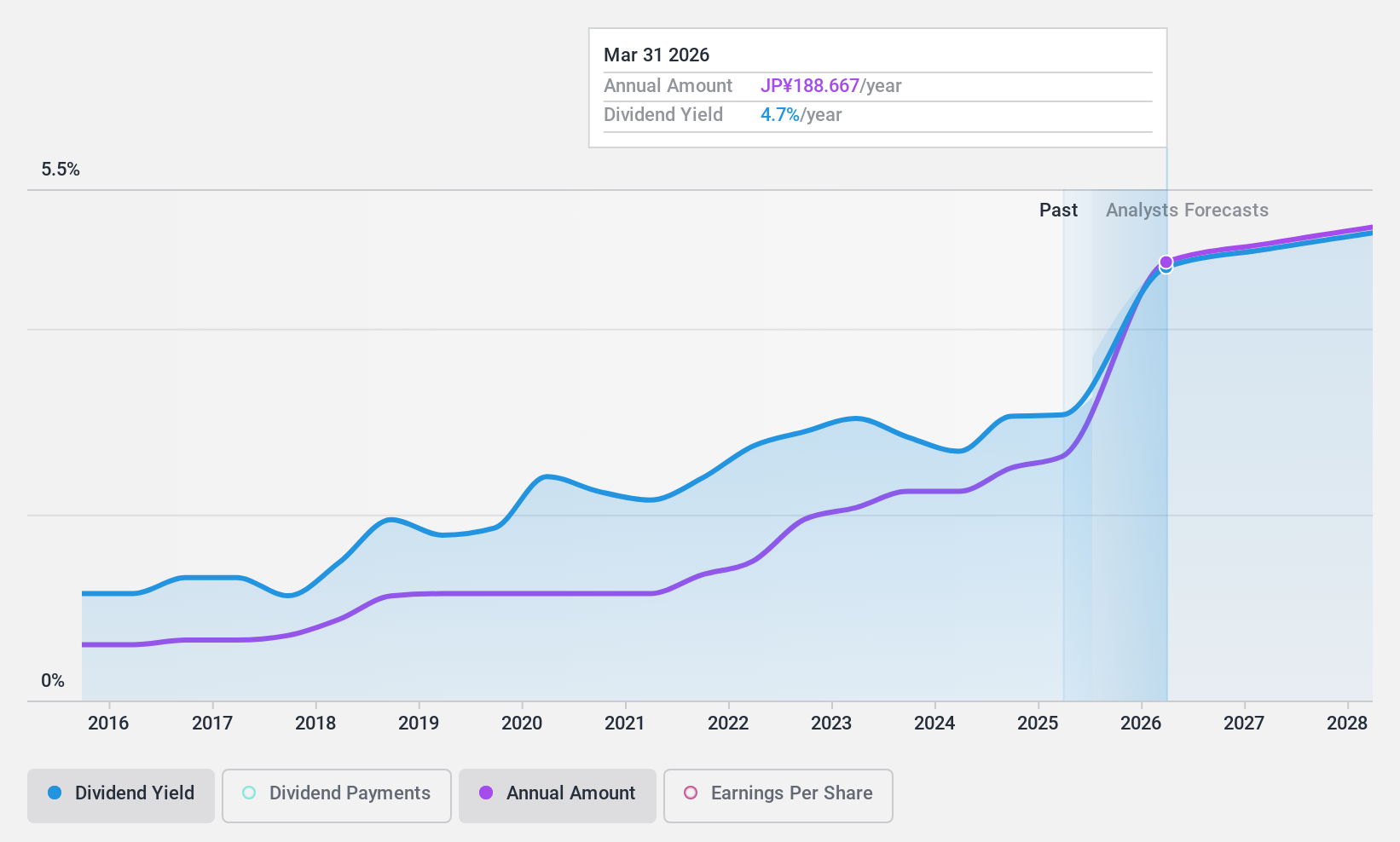

Kamigumi (TSE:9364)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kamigumi Co., Ltd. offers integrated logistics services both in Japan and internationally, with a market cap of ¥343.24 billion.

Operations: Kamigumi Co., Ltd.'s revenue is primarily derived from its Logistics Business, which generated ¥232.65 billion.

Dividend Yield: 3.1%

Kamigumi's dividend payments have been volatile over the past decade, though they are well covered by earnings and cash flows with payout ratios of 41.5% and 29.3%, respectively. Despite a lower dividend yield compared to top Japanese payers, recent buyback plans worth ¥17 billion may enhance shareholder value. However, earnings growth is expected to decline slightly in the coming years, which could impact future dividends' stability and growth potential.

- Dive into the specifics of Kamigumi here with our thorough dividend report.

- Our valuation report unveils the possibility Kamigumi's shares may be trading at a premium.

Seize The Opportunity

- Explore the 1939 names from our Top Dividend Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002275

Guilin Sanjin Pharmaceutical

Engages in the research, production, and sale of traditional Chinese and natural medicines in China.

Excellent balance sheet established dividend payer.