Global's June 2025 Select Stocks Priced Below Estimated Intrinsic Value

Reviewed by Simply Wall St

Amidst a backdrop of mixed performances in global markets and economic uncertainties, investors are keeping a close eye on interest rate policies and geopolitical tensions. With the Federal Reserve holding rates steady and retail sales declining, the search for stocks priced below their estimated intrinsic value becomes increasingly relevant as market participants seek opportunities that may offer resilience against volatility. Identifying undervalued stocks involves assessing companies with strong fundamentals that may be temporarily overlooked by the market, presenting potential for long-term growth despite current economic challenges.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Taiwan Union Technology (TPEX:6274) | NT$212.50 | NT$422.19 | 49.7% |

| Sparebank 68° Nord (OB:SB68) | NOK180.00 | NOK357.67 | 49.7% |

| Qt Group Oyj (HLSE:QTCOM) | €54.60 | €108.20 | 49.5% |

| Pansoft (SZSE:300996) | CN¥14.06 | CN¥28.07 | 49.9% |

| Guangdong Zhongsheng Pharmaceutical (SZSE:002317) | CN¥15.60 | CN¥31.12 | 49.9% |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥26.38 | CN¥52.34 | 49.6% |

| Darbond Technology (SHSE:688035) | CN¥39.23 | CN¥78.20 | 49.8% |

| Boreo Oyj (HLSE:BOREO) | €14.85 | €29.49 | 49.7% |

| Alexander Marine (TWSE:8478) | NT$146.00 | NT$290.09 | 49.7% |

| Aidma Holdings (TSE:7373) | ¥1927.00 | ¥3822.62 | 49.6% |

Here we highlight a subset of our preferred stocks from the screener.

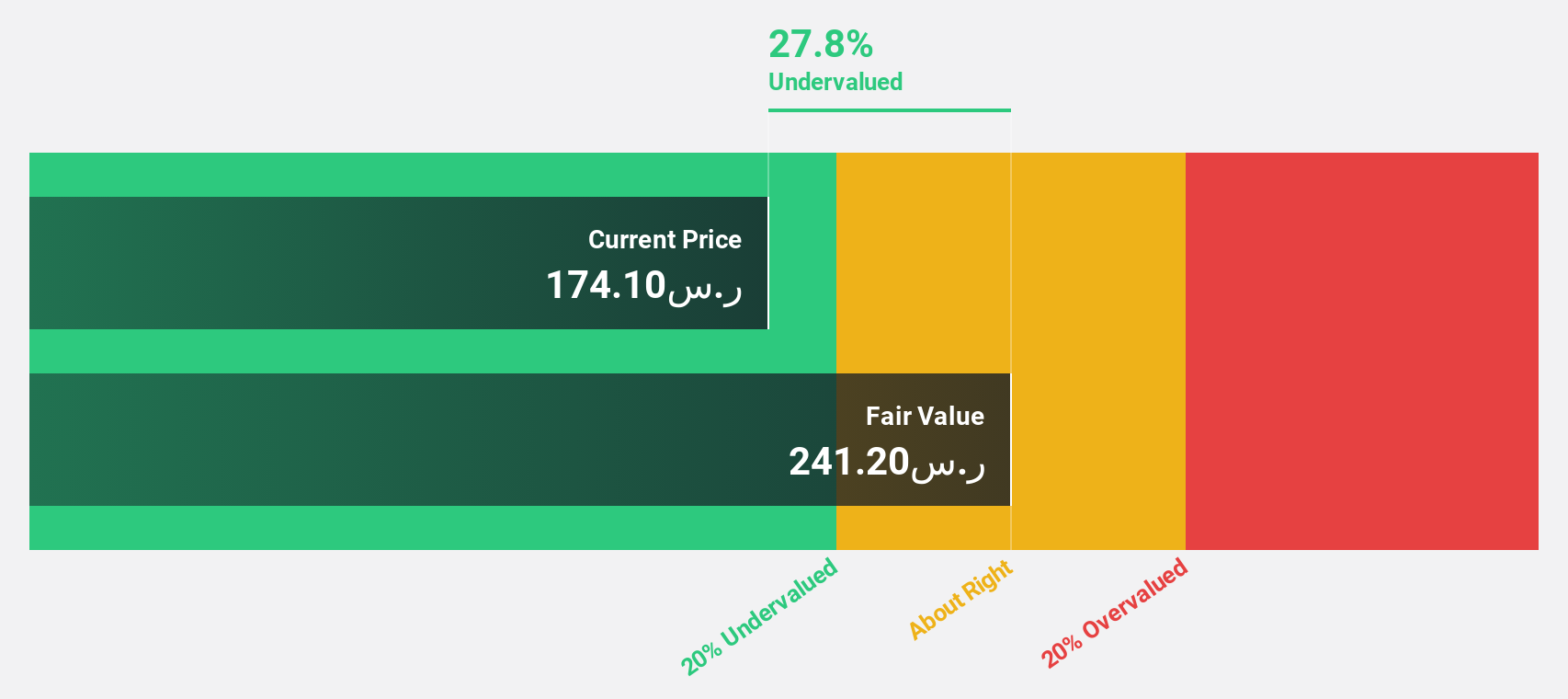

Almoosa Health (SASE:4018)

Overview: Almoosa Health Company operates as a private healthcare provider in Saudi Arabia with a market cap of SAR6.81 billion.

Operations: The company's revenue segments include Rehabilitation at SAR132.77 million, Pharmaceuticals at SAR273.87 million, and Medical Services at SAR841.53 million.

Estimated Discount To Fair Value: 19%

Almoosa Health is trading at SAR 156, below its estimated fair value of SAR 192.52, making it undervalued based on cash flows. Recent earnings growth was strong, with net income rising to SAR 51.13 million from SAR 13.73 million year-over-year. Revenue and earnings are forecast to grow significantly faster than the market over the next three years, enhancing its appeal as an undervalued stock despite a low future return on equity forecast of 12.1%.

- The analysis detailed in our Almoosa Health growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Almoosa Health stock in this financial health report.

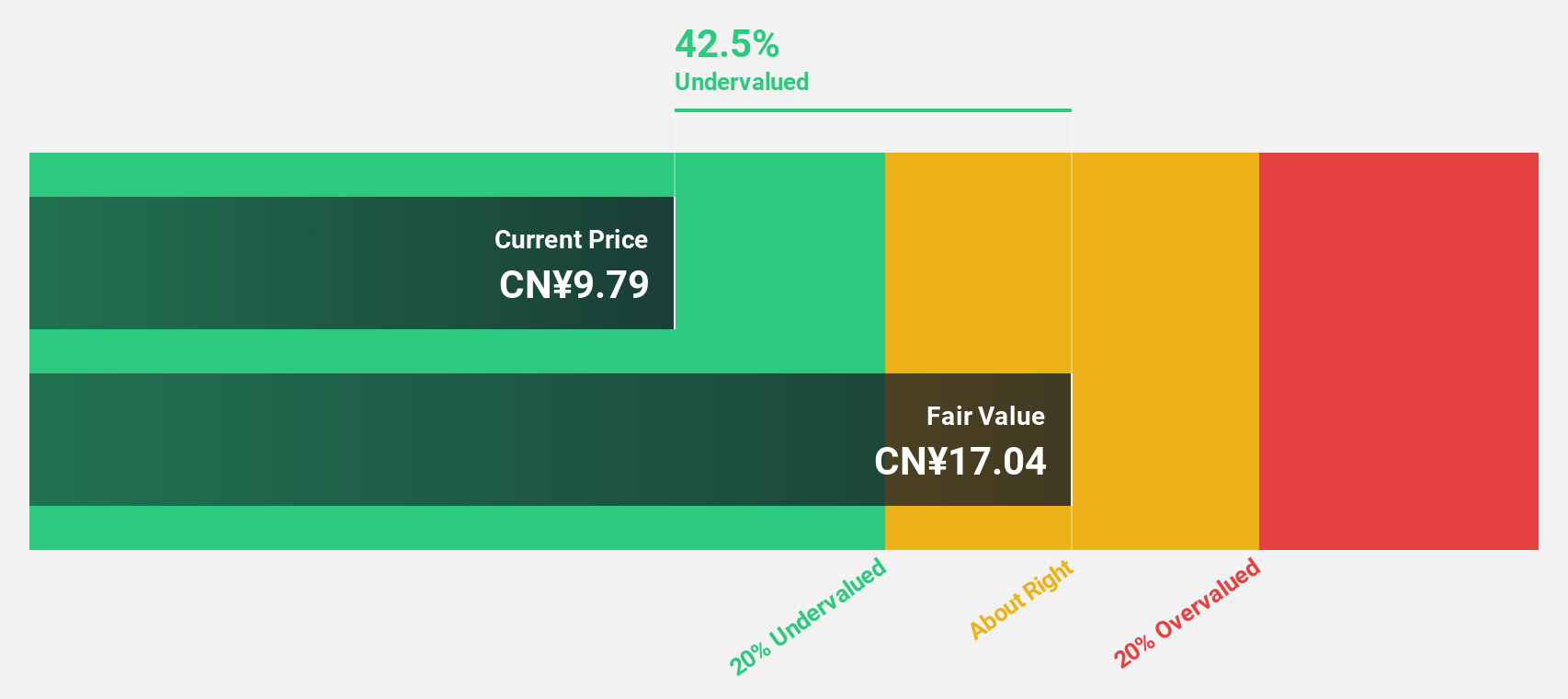

Cofco Sugar HoldingLTD (SHSE:600737)

Overview: Cofco Sugar Holding Co., Ltd. operates in sugar and tomato processing both in China and internationally, with a market capitalization of CN¥19.98 billion.

Operations: Cofco Sugar Holding Co., Ltd. generates revenue through its sugar and tomato processing operations across domestic and international markets.

Estimated Discount To Fair Value: 44.5%

Cofco Sugar Holding LTD is trading at CN¥9.46, significantly below its estimated fair value of CN¥17.04, suggesting it's undervalued based on cash flows. Despite a recent decline in Q1 2025 sales and net income compared to the previous year, earnings are projected to grow significantly faster than the market over the next three years. This growth potential positions Cofco Sugar as an attractive option for investors seeking undervalued opportunities in the sugar industry.

- Insights from our recent growth report point to a promising forecast for Cofco Sugar HoldingLTD's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Cofco Sugar HoldingLTD.

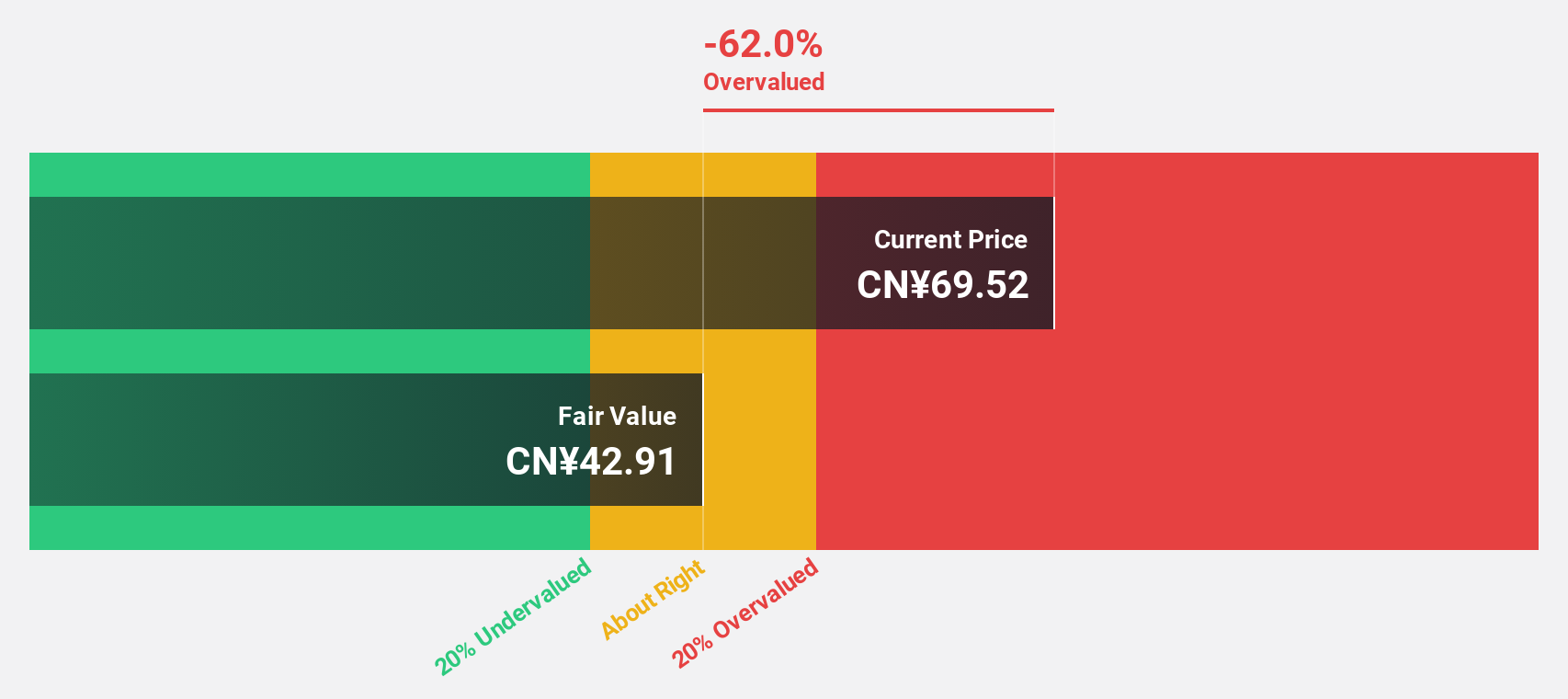

Sinocelltech Group (SHSE:688520)

Overview: Sinocelltech Group Limited is a biotech company focused on the research, development, and industrialization of recombinant proteins, monoclonal antibodies, and innovative vaccines in China with a market cap of approximately CN¥20.11 billion.

Operations: The company's revenue primarily comes from its Biological Drugs segment, which includes drugs and vaccines, amounting to approximately CN¥2.42 billion.

Estimated Discount To Fair Value: 20.6%

Sinocelltech Group, trading at CN¥52.67, is undervalued with an estimated fair value of CN¥66.37. Despite a decline in Q1 2025 sales and net income compared to the previous year, its earnings are forecast to grow significantly faster than the market over the next three years. However, debt coverage by operating cash flow remains a concern. A recent securities purchase agreement aims to raise CN¥900 million through private placements, potentially strengthening its financial position.

- The growth report we've compiled suggests that Sinocelltech Group's future prospects could be on the up.

- Dive into the specifics of Sinocelltech Group here with our thorough financial health report.

Make It Happen

- Discover the full array of 484 Undervalued Global Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688520

Sinocelltech Group

A biotech company, engages in the research and development, and industrialization of recombinant proteins, monoclonal antibodies, and innovative vaccines in China.

Exceptional growth potential and slightly overvalued.

Market Insights

Community Narratives