Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SHSE:688002

Exploring High Growth Tech Stocks This October 2024

Reviewed by Simply Wall St

As global markets experience significant shifts, with U.S. stocks reaching record highs driven by China's robust stimulus measures and optimism surrounding artificial intelligence, the technology sector has emerged as a standout performer. In this dynamic environment, identifying high-growth tech stocks involves looking for companies that are well-positioned to capitalize on technological advancements and market trends such as AI demand and semiconductor innovations.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Sarepta Therapeutics | 23.58% | 44.12% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Travere Therapeutics | 26.51% | 69.33% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1281 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Raytron TechnologyLtd (SHSE:688002)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Raytron Technology Co., Ltd. focuses on the research and development, design, manufacturing, and sales of uncooled infrared imaging and MEMS sensor technology in China, with a market capitalization of CN¥17.43 billion.

Operations: Raytron Technology Co., Ltd. specializes in the development and production of uncooled infrared imaging and MEMS sensor technology. The company generates revenue primarily through the sales of these advanced technological products, leveraging its expertise in research and design to cater to various industrial applications within China.

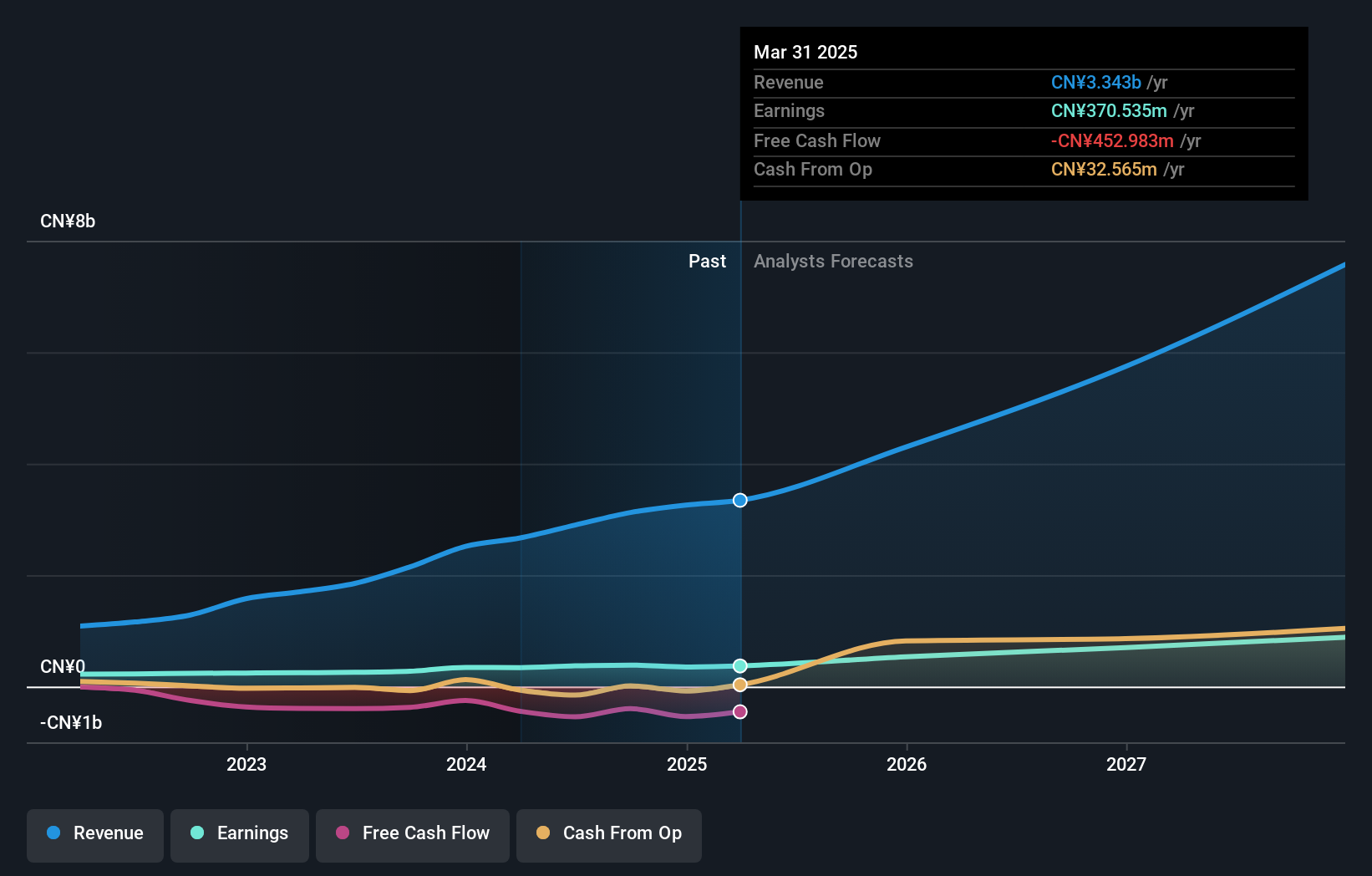

Raytron TechnologyLtd. is navigating a competitive landscape with robust revenue growth of 22.1% per year, outpacing the CN market's 13.2%. This surge is supported by significant R&D investments, which have propelled earnings forecasts to grow by an impressive 32.7% annually, exceeding the broader market's expectation of 23.3%. Despite a slight dip in net income from CNY 257.59 million to CNY 224.34 million in the first half of 2024, Raytron’s strategic focus on innovation and market expansion positions it well for future growth in the tech sector. Recent shareholder meetings and earnings calls underscore management's commitment to transparency and strategic planning amid this high-growth phase. The company’s ability to maintain a steady pace of development amidst industry shifts highlights its potential resilience and adaptability, key traits for thriving in the dynamic tech industry.

Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou Zelgen Biopharmaceuticals Co., Ltd. is a biopharmaceutical company focused on the research, development, and commercialization of innovative drugs, with a market cap of CN¥18.17 billion.

Operations: Zelgen Biopharmaceuticals generates revenue primarily through its pharmaceuticals segment, which brought in CN¥407.21 million. The company's focus is on the research, development, and commercialization of innovative drugs within the biopharmaceutical sector.

Suzhou Zelgen Biopharmaceuticals has shown a promising turnaround with its recent earnings, cutting its net loss significantly to CNY 66.54 million from CNY 114.23 million year-over-year, reflecting a strategic pivot in operational efficiencies and market focus. This improvement accompanies a robust forecast in revenue growth at an annual rate of 58.7%, starkly outpacing the broader CN market's growth rate of 13.2%. Despite current unprofitability, the company is on a trajectory to not only break even but also project earnings growth by an impressive 115.7% annually over the next three years, signaling potential resilience and upward momentum in the high-stakes biotech sector.

- Dive into the specifics of Suzhou Zelgen BiopharmaceuticalsLtd here with our thorough health report.

Geovis TechnologyLtd (SHSE:688568)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Geovis Technology Co., Ltd focuses on the research, development, and industrialization of digital earth products for various sectors in China, with a market cap of CN¥20.35 billion.

Operations: Geovis Technology Co., Ltd specializes in digital earth products, catering to government and enterprise sectors in China. The company's operations are centered around research, development, and industrialization within these fields.

Geovis TechnologyLtd's recent performance underscores its robust position in the tech sector, with a notable revenue surge to CNY 1.1 billion, up from CNY 722.13 million year-over-year, reflecting a growth rate of 28.9%. This uptick is complemented by an increase in net income to CNY 63.59 million from CNY 35.32 million, showcasing effective cost management and operational efficiency. The company's commitment to innovation is evident in its R&D spending trends, which remain aggressive at approximately 34.7% of revenue annually—highlighting a strategic focus on sustaining long-term competitiveness through continuous product development and market adaptation. Despite these gains, the broader market context and internal challenges such as cash flow constraints must be navigated carefully. Geovis TechnologyLtd’s ability to maintain such high levels of R&D investment without compromising financial stability speaks volumes about its potential resilience and adaptability within the dynamic tech landscape; however, it remains crucial for the company to enhance its free cash flows to sustain future growth trajectories effectively.

- Delve into the full analysis health report here for a deeper understanding of Geovis TechnologyLtd.

Explore historical data to track Geovis TechnologyLtd's performance over time in our Past section.

Taking Advantage

- Click here to access our complete index of 1281 High Growth Tech and AI Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688002

Raytron TechnologyLtd

Engages in the research and development, design, manufacturing, and sales of uncooled infrared imagining and MEMS sensor technology in China.