- China

- /

- Life Sciences

- /

- SHSE:688222

Exploring November 2024's Undiscovered Gems on None Exchange

Reviewed by Simply Wall St

In the wake of a significant political shift in the United States, global markets have reacted with optimism, highlighted by a notable rally in U.S. stocks driven by expectations of growth-friendly policies. The small-cap Russell 2000 Index has particularly benefited, surging over 8% for the week as investors anticipate favorable conditions for smaller companies amid potential regulatory and tax changes. In this dynamic environment, identifying promising small-cap stocks requires a keen understanding of market trends and economic indicators that can influence their performance. As we explore November 2024's undiscovered gems on None Exchange, it's essential to focus on companies that are well-positioned to capitalize on these evolving opportunities while navigating potential challenges such as inflationary pressures and shifting trade dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Petrol d.d | 42.18% | 17.56% | -0.49% | ★★★★★★ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret | 15.53% | 54.51% | 76.29% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Tureks Turizm Tasimacilik Anonim Sirketi | 6.86% | 64.15% | 63.49% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Bank MNC Internasional | 11.85% | 4.80% | 43.63% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Van Lanschot Kempen (ENXTAM:VLK)

Simply Wall St Value Rating: ★★★★★☆

Overview: Van Lanschot Kempen NV is a financial services company offering wealth management, investment banking, and asset management services in the Netherlands and internationally, with a market cap of €1.77 billion.

Operations: Van Lanschot Kempen generates revenue primarily from its investment banking clients, amounting to €46.60 million. The company's market capitalization is approximately €1.77 billion.

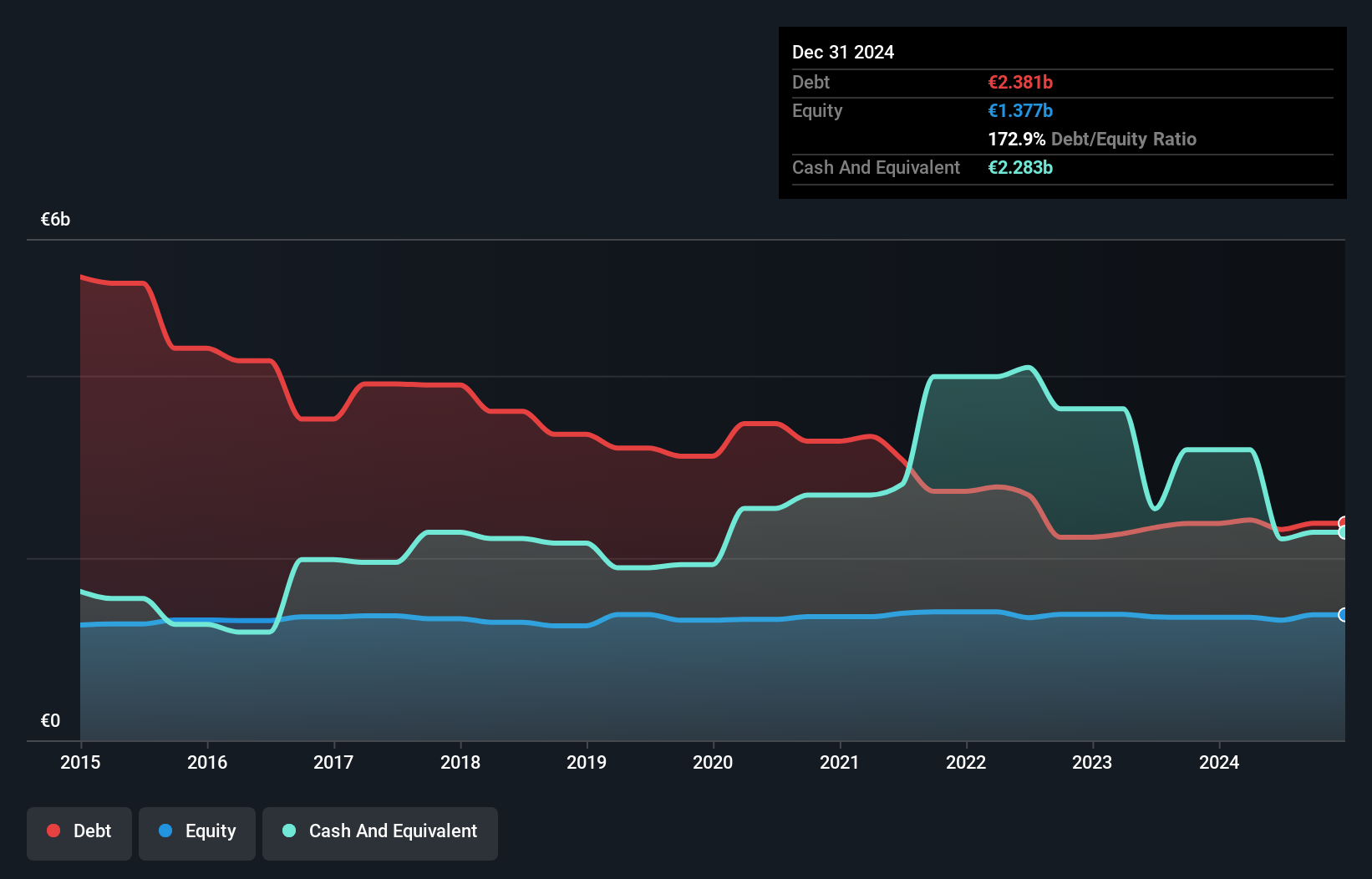

Van Lanschot Kempen, a financial entity with total assets of €16.4 billion and equity of €1.3 billion, boasts a strong position in the industry. Its earnings growth over the past year hit 71%, outpacing the Capital Markets sector's 25%. The company trades at about 9% below its estimated fair value, suggesting potential for investors seeking undervalued opportunities. With an appropriate level of bad loans at 1.4% and primarily low-risk funding sources making up 83% of liabilities, it seems well-positioned financially. Despite this, its allowance for bad loans is relatively low at 30%, which may warrant attention moving forward.

Suntar Environmental Technology (SHSE:688101)

Simply Wall St Value Rating: ★★★★★★

Overview: Suntar Environmental Technology Co., Ltd. operates in the environmental technology sector and has a market capitalization of CN¥4.96 billion.

Operations: The company generates revenue through its operations in the environmental technology sector. It has a market capitalization of CN¥4.96 billion, reflecting its valuation in the industry.

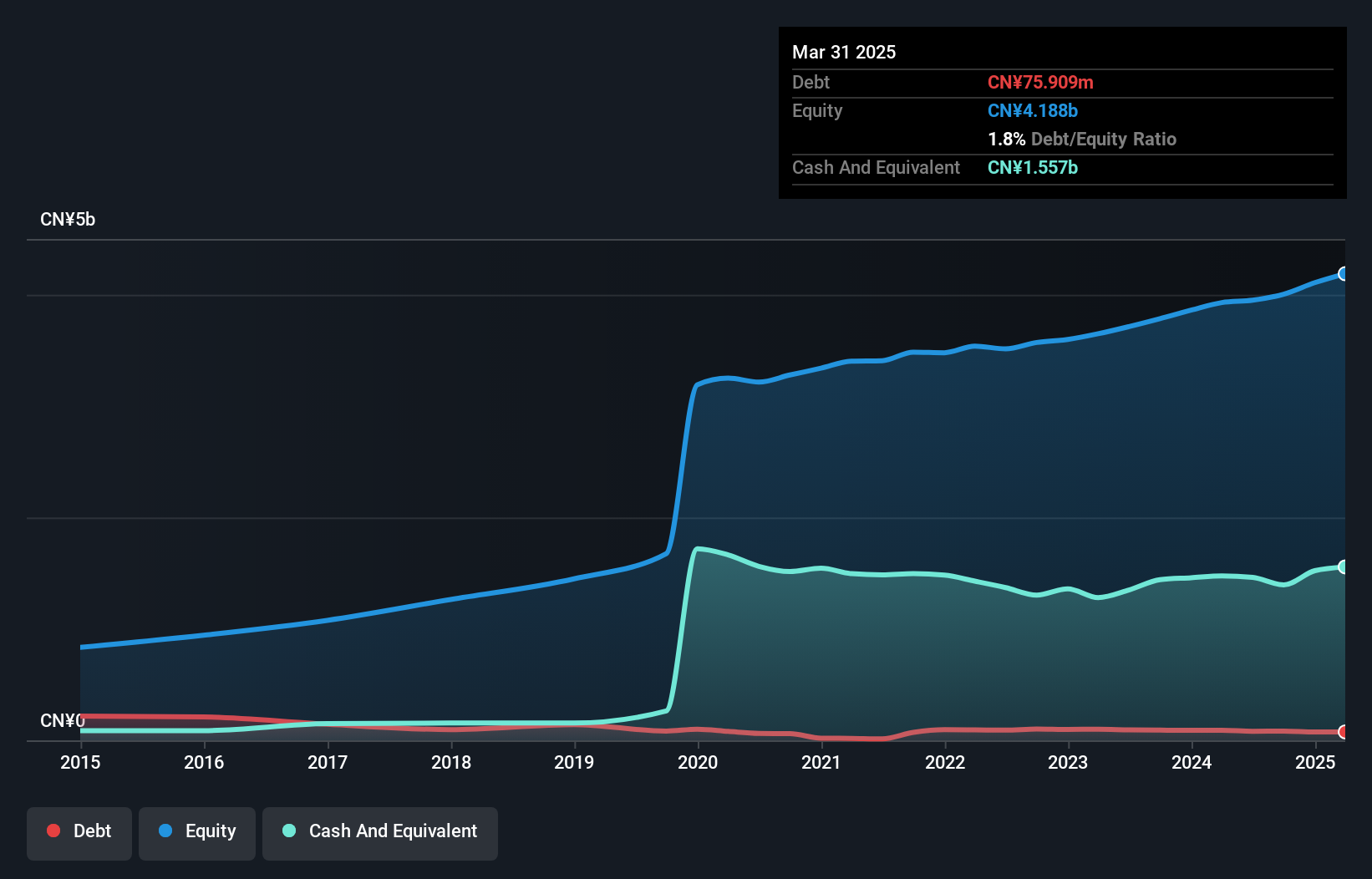

Suntar Environmental Technology is making waves with a robust performance, reporting CNY 1.04 billion in sales for the first nine months of 2024, up from CNY 958 million last year. Net income also rose to CNY 212 million from CNY 182 million. The company enjoys a favorable debt-to-equity ratio that has improved to 2.1 over five years and boasts earnings growth of 37% over the past year, surpassing industry averages. With a price-to-earnings ratio of just 17x compared to the market's average of over double that figure, Suntar seems attractively valued while maintaining high-quality earnings despite not being free cash flow positive yet.

- Click here and access our complete health analysis report to understand the dynamics of Suntar Environmental Technology.

Understand Suntar Environmental Technology's track record by examining our Past report.

HitGen (SHSE:688222)

Simply Wall St Value Rating: ★★★★★☆

Overview: HitGen Inc. is a company that operates a drug discovery research platform focusing on small molecules and nucleic acid drugs both in China and internationally, with a market cap of CN¥5.59 billion.

Operations: HitGen's revenue streams are primarily derived from its drug discovery research platform. The company reported a market cap of CN¥5.59 billion, reflecting its valuation in the financial markets.

HitGen, a nimble player in the biotech space, has shown robust earnings growth of 58.7% over the past year, outpacing its industry peers. The company's recent collaboration with Bridge Biotherapeutics aims to enhance its oncology portfolio through innovative drug discovery using DNA-encoded library technology. Financially sound, HitGen boasts more cash than total debt and maintains positive free cash flow, underscoring its financial health. With revenue climbing to CNY 298 million for the first nine months of 2024 from CNY 246 million last year and net income rising to CNY 30 million from CNY 18 million, it continues to strengthen its market position.

- Delve into the full analysis health report here for a deeper understanding of HitGen.

Evaluate HitGen's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Reveal the 4671 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HitGen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688222

HitGen

Operates as a drug discovery research platform for small molecules and nucleic acid drugs in China and internationally.

Excellent balance sheet with proven track record.