- China

- /

- Semiconductors

- /

- SHSE:688498

3 Growth Companies With High Insider Ownership And Up To 44% Revenue Growth

Reviewed by Simply Wall St

In the wake of a "red sweep" in the U.S. elections, global markets have seen significant shifts, with major indices like the S&P 500 and Nasdaq Composite reaching record highs. This surge reflects investor optimism about potential economic growth fueled by anticipated regulatory and tax changes. In such a dynamic environment, identifying growth companies with high insider ownership can be particularly appealing, as these stocks often signal strong internal confidence and alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 42.1% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Brightstar Resources (ASX:BTR) | 14.8% | 84.6% |

Underneath we present a selection of stocks filtered out by our screen.

BrightGene Bio-Medical Technology (SHSE:688166)

Simply Wall St Growth Rating: ★★★★★☆

Overview: BrightGene Bio-Medical Technology Co., Ltd. is a pharmaceutical company involved in the research, development, manufacture, and commercialization of pharmaceutical products in China with a market cap of CN¥12.91 billion.

Operations: Unfortunately, the provided Business operations text does not contain any specific revenue segment information for BrightGene Bio-Medical Technology Co., Ltd.

Insider Ownership: 32.2%

Revenue Growth Forecast: 26.5% p.a.

BrightGene Bio-Medical Technology is poised for significant growth, with earnings expected to rise 34.8% annually, outpacing the CN market. Despite recent volatility in its share price and a net income decline to CNY 177.41 million, its revenue growth forecast of 26.5% per year remains robust. The stock trades at a substantial discount to fair value, although debt coverage by operating cash flow is inadequate and return on equity forecasts remain low at 10%.

- Delve into the full analysis future growth report here for a deeper understanding of BrightGene Bio-Medical Technology.

- Our valuation report unveils the possibility BrightGene Bio-Medical Technology's shares may be trading at a premium.

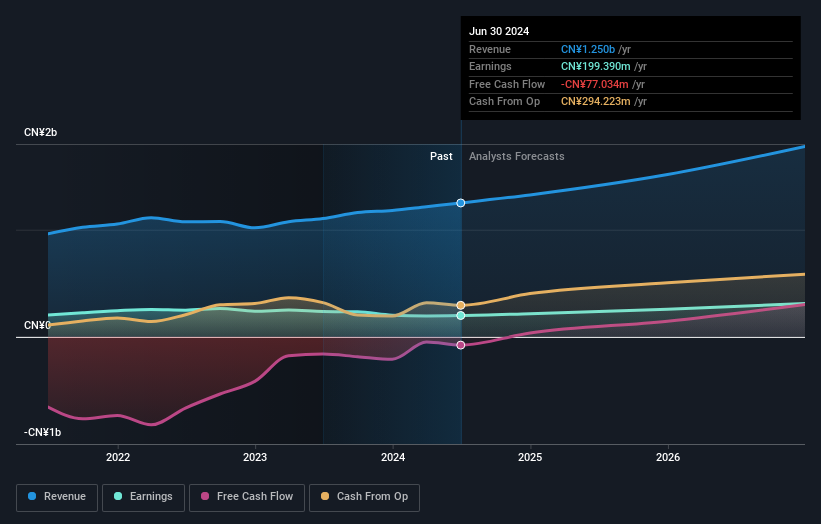

Yuanjie Semiconductor Technology (SHSE:688498)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Yuanjie Semiconductor Technology Co., Ltd. operates in the semiconductor industry and has a market cap of CN¥13.52 billion.

Operations: I'm sorry, but the revenue segment details for Yuanjie Semiconductor Technology Co., Ltd. are not provided in the text. Therefore, I cannot summarize them into a sentence.

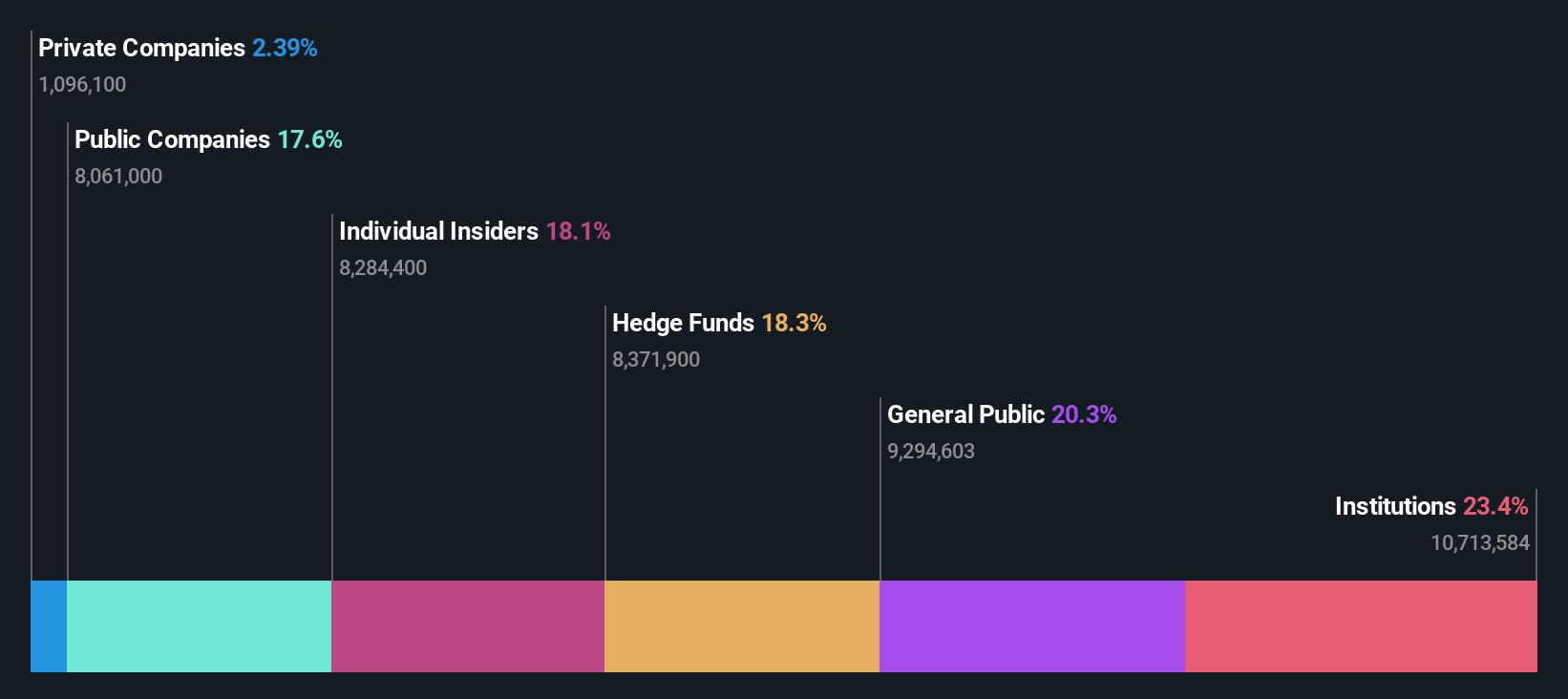

Insider Ownership: 27.7%

Revenue Growth Forecast: 44.4% p.a.

Yuanjie Semiconductor Technology's revenue is forecast to grow 44.4% annually, surpassing market expectations, though the company remains unprofitable with a recent net loss of CNY 0.55 million for nine months ending September 2024. Despite this, it aims to achieve profitability within three years. The stock has shown high volatility recently and completed a share buyback worth CNY 55.41 million, indicating management's confidence in its long-term prospects despite low return on equity forecasts of 7.8%.

- Take a closer look at Yuanjie Semiconductor Technology's potential here in our earnings growth report.

- Our valuation report here indicates Yuanjie Semiconductor Technology may be overvalued.

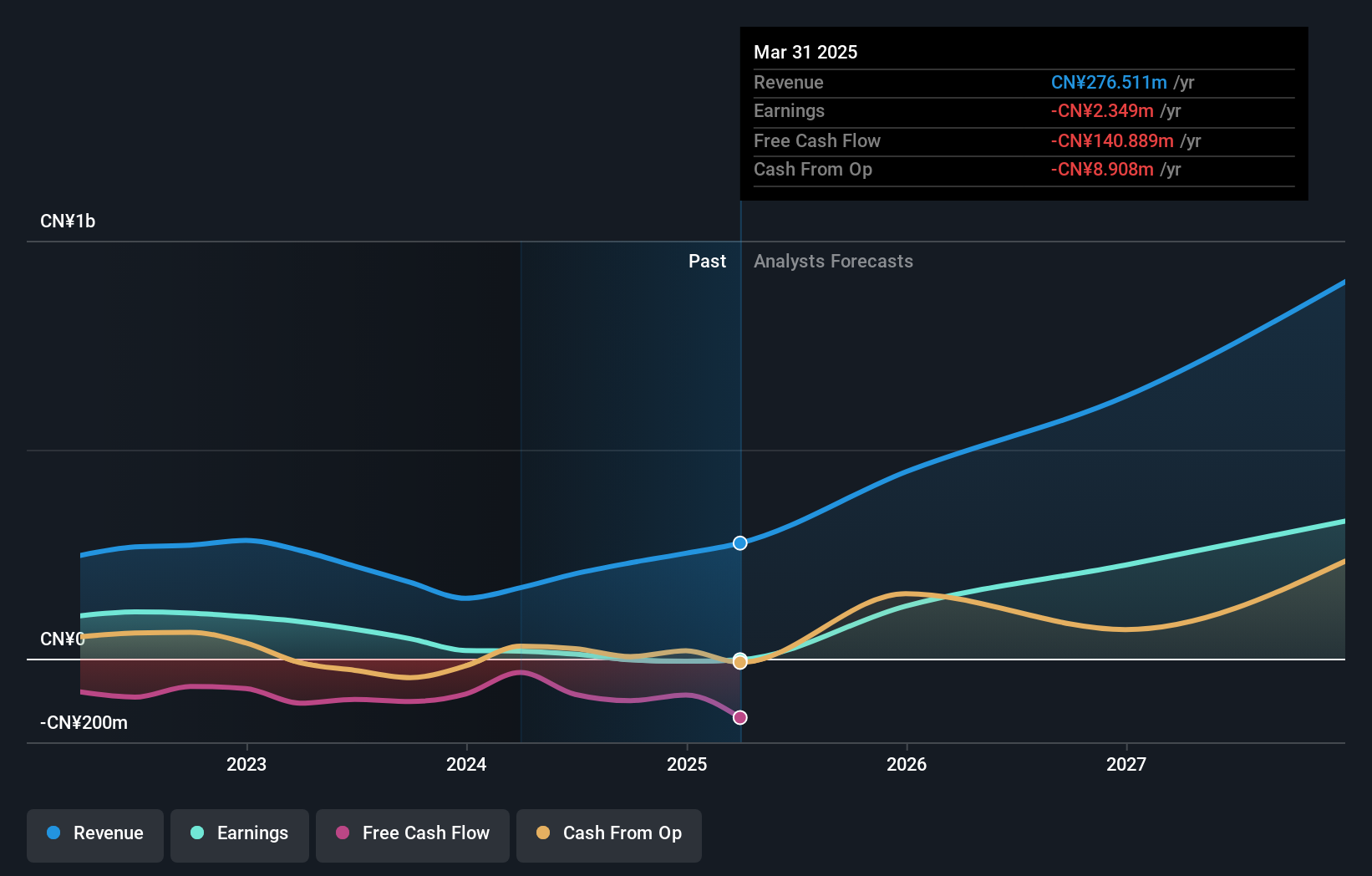

Digital Garage (TSE:4819)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Digital Garage, Inc. is a context company that operates both in Japan and internationally, with a market capitalization of approximately ¥157.02 billion.

Operations: Digital Garage's revenue segments include Online Advertising & Media at ¥12.34 billion, Fintech at ¥8.56 billion, and Incubation Technology at ¥6.78 billion.

Insider Ownership: 18.2%

Revenue Growth Forecast: 16% p.a.

Digital Garage's revenue is projected to grow by 16% annually, outpacing the Japanese market, with earnings expected to rise 80.48% per year and reach profitability within three years. Despite its volatile share price and a low forecasted return on equity of 5.7%, the company recently completed a ¥3.99 billion share buyback, signaling management's confidence in its strategic direction amidst organizational changes focused on enhancing information security management.

- Click here to discover the nuances of Digital Garage with our detailed analytical future growth report.

- The analysis detailed in our Digital Garage valuation report hints at an inflated share price compared to its estimated value.

Turning Ideas Into Actions

- Discover the full array of 1530 Fast Growing Companies With High Insider Ownership right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688498

Yuanjie Semiconductor Technology

Yuanjie Semiconductor Technology Co., Ltd.

Flawless balance sheet with high growth potential.