3 Growth Companies With High Insider Ownership Growing Revenues Over 31%

Reviewed by Simply Wall St

In a week marked by fluctuating indices and cautious earnings reports, global markets have experienced notable volatility, with growth stocks generally lagging behind value shares. As investors navigate these uncertain times, focusing on companies with strong insider ownership can provide insights into potential stability and confidence in future performance. In this context, identifying growth companies that not only exhibit high insider ownership but also demonstrate significant revenue growth is crucial for making informed investment decisions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 21.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Here's a peek at a few of the choices from the screener.

Jiangsu Sinopep-Allsino Biopharmaceutical (SHSE:688076)

Simply Wall St Growth Rating: ★★★★★★

Overview: Jiangsu Sinopep-Allsino Biopharmaceutical Co., Ltd. is a biomedical company focused on the R&D, production, sale, and technical service of peptides and small molecule drugs in China, with a market cap of CN¥10.64 billion.

Operations: The company's revenue primarily comes from its Medicine Manufacturing segment, which generated CN¥1.58 billion.

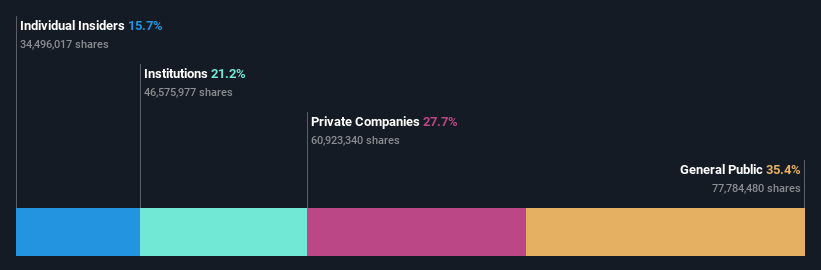

Insider Ownership: 15.7%

Revenue Growth Forecast: 31.1% p.a.

Jiangsu Sinopep-Allsino Biopharmaceutical shows strong growth potential, with earnings and revenue forecasted to grow significantly faster than the Chinese market. Recent financial results highlight a substantial increase in sales and net income, reflecting robust business performance. The company trades at a good value compared to peers, although past shareholder dilution is noted. Despite no recent insider trading activity, high insider ownership aligns management interests with shareholders, supporting its position as a promising growth entity.

- Click here to discover the nuances of Jiangsu Sinopep-Allsino Biopharmaceutical with our detailed analytical future growth report.

- According our valuation report, there's an indication that Jiangsu Sinopep-Allsino Biopharmaceutical's share price might be on the cheaper side.

Anhui Huaheng Biotechnology (SHSE:688639)

Simply Wall St Growth Rating: ★★★★★★

Overview: Anhui Huaheng Biotechnology Co., Ltd. is involved in the development, production, and sale of amino acids and other organic acids both in China and internationally, with a market cap of CN¥7.66 billion.

Operations: The company's revenue is primarily derived from its Bio Manufacturing Industry segment, which generated CN¥2.11 billion.

Insider Ownership: 34.4%

Revenue Growth Forecast: 37.9% p.a.

Anhui Huaheng Biotechnology is positioned for substantial growth, with earnings projected to rise significantly faster than the Chinese market. Despite lower profit margins compared to last year, revenue growth forecasts remain robust. The company trades well below its estimated fair value and shows no recent insider trading activity, indicating stable management interests. However, its dividend coverage by free cash flow is weak, and high share price volatility may concern some investors.

- Click to explore a detailed breakdown of our findings in Anhui Huaheng Biotechnology's earnings growth report.

- Our expertly prepared valuation report Anhui Huaheng Biotechnology implies its share price may be lower than expected.

Shenzhen Dynanonic (SZSE:300769)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Dynanonic Co., Ltd. focuses on the R&D, production, import, sale, and export of nano-lithium iron phosphate and lithium-ion battery core materials in China with a market cap of CN¥10.66 billion.

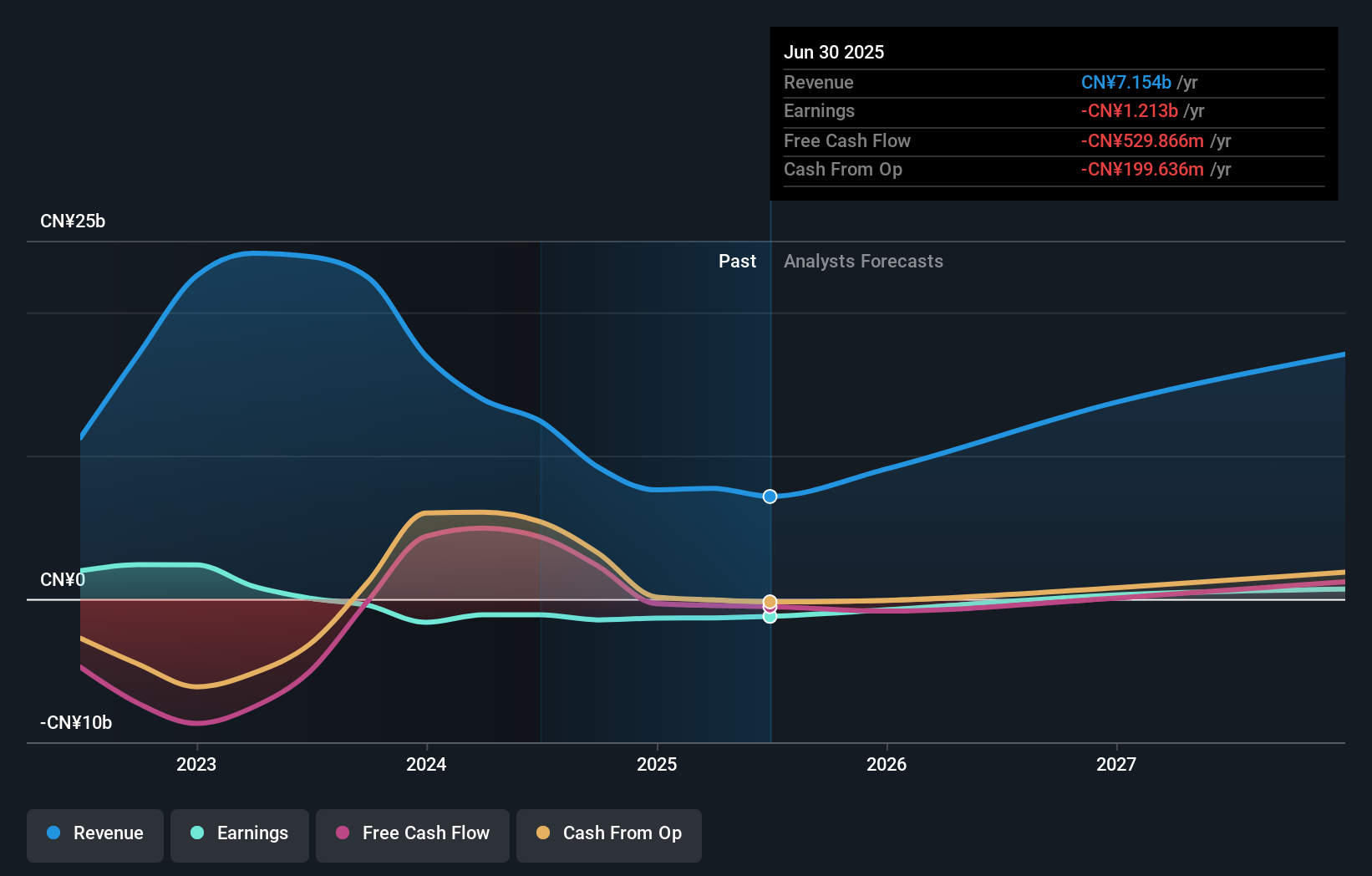

Operations: The company's revenue primarily comes from its activities in the research, development, production, and sales of nano-lithium iron phosphate, amounting to CN¥7.78 billion.

Insider Ownership: 31%

Revenue Growth Forecast: 35.2% p.a.

Shenzhen Dynanonic is poised for significant growth, with revenue expected to increase by 35.2% annually, outpacing the Chinese market. Despite a current net loss of CNY 821.65 million for the first nine months of 2024, profitability is anticipated within three years. Recent insider activity includes a notable acquisition of a 5% stake by Qin Dongdong for approximately CNY 462.87 million, reflecting confidence in future prospects despite high share price volatility and low forecasted return on equity.

- Unlock comprehensive insights into our analysis of Shenzhen Dynanonic stock in this growth report.

- The valuation report we've compiled suggests that Shenzhen Dynanonic's current price could be quite moderate.

Seize The Opportunity

- Discover the full array of 1538 Fast Growing Companies With High Insider Ownership right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688639

Anhui Huaheng Biotechnology

Engages in the development, production, and sale of amino acids and other organic acids in China and internationally.

Exceptional growth potential and undervalued.