- Japan

- /

- Consumer Durables

- /

- TSE:7965

Undiscovered Gems Three Promising Small Caps To Watch

Reviewed by Simply Wall St

In the current global market environment, small-cap stocks have faced mixed performance, with indices like the Russell 2000 experiencing a decline amid broader economic uncertainties and shifts in policy expectations. Despite these challenges, small-cap companies often present unique opportunities for investors seeking growth potential due to their agility and capacity for innovation in evolving markets. Identifying promising small caps involves looking at factors such as strong fundamentals, competitive positioning, and the ability to adapt to changing economic landscapes—qualities that can help them stand out as undiscovered gems in today's dynamic financial climate.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Gallantt Ispat | 15.54% | 36.20% | 40.12% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Macpower CNC Machines | NA | 22.62% | 35.18% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| TechNVision Ventures | 100.73% | 20.37% | 68.50% | ★★★★★★ |

| Shree Pushkar Chemicals & Fertilisers | 21.25% | 18.34% | 4.43% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Hyundai G.F. Holdings (KOSE:A005440)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hyundai G.F. Holdings Co., Ltd. operates in the rental and investment sectors with a market capitalization of ₩732.75 billion.

Operations: The company generates revenue primarily through its rental and investment activities. It has a market capitalization of ₩732.75 billion.

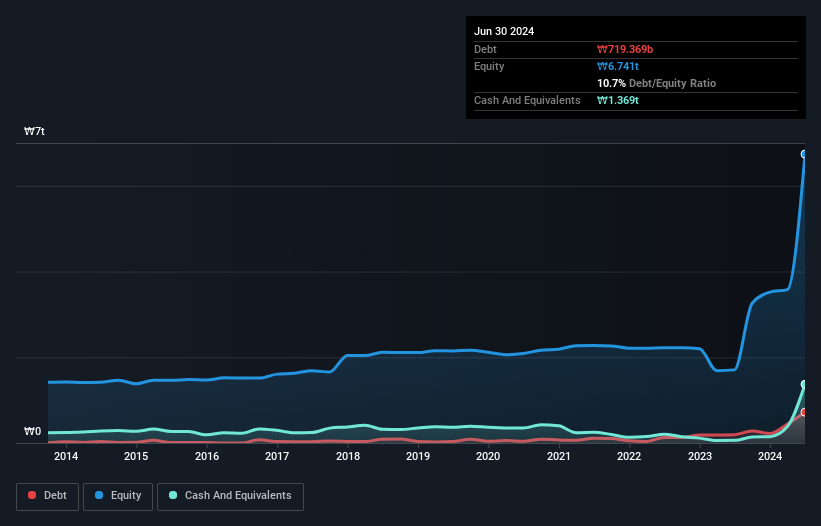

Hyundai G.F. Holdings, a player in the trade distributors sector, appears undervalued, trading at 83% below its estimated fair value. Over the past five years, its debt to equity ratio has risen from 1.6% to 10.7%, indicating increased leverage but manageable due to having more cash than total debt. Impressively, earnings skyrocketed by an astounding 242291% last year, far outpacing industry growth of 21.7%. The company is profitable with positive free cash flow and does not face issues covering interest payments. Revenue is projected to grow annually by over 20%, suggesting potential for continued expansion.

Getein Biotech (SHSE:603387)

Simply Wall St Value Rating: ★★★★★☆

Overview: Getein Biotech, Inc focuses on the research, development, production, and sale of in vitro diagnostic reagents and instruments both in China and internationally, with a market cap of CN¥4.66 billion.

Operations: Getein Biotech generates revenue primarily through the sale of in vitro diagnostic reagents and instruments. The company's cost structure includes expenses related to research, development, production, and distribution activities. It is important to note that financial data such as revenue segments are not specified in the provided information.

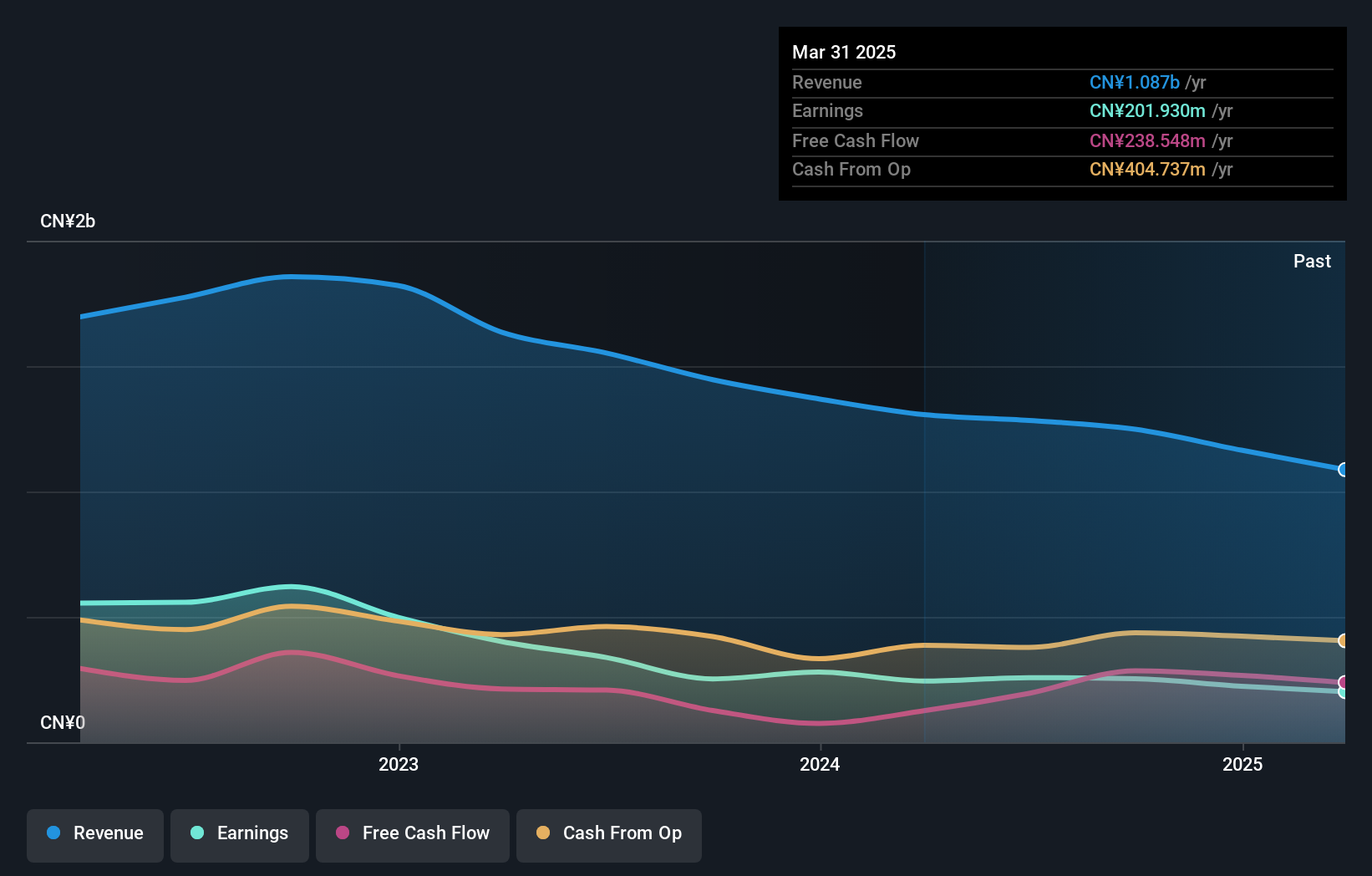

Getein Biotech, a small player in the biotech industry, has shown mixed financial performance. Over the past five years, earnings have decreased by 0.5% annually, and its debt-to-equity ratio rose from 0.8% to 25.3%, indicating increasing leverage. Despite these challenges, Getein trades at approximately 10% below its estimated fair value and maintains more cash than total debt, suggesting financial stability. Recent reports for the nine months ending September show sales of CNY 879 million compared to CNY 1 billion last year with net income at CNY 202 million versus CNY 229 million previously, reflecting a cautious outlook amidst industry pressures.

- Unlock comprehensive insights into our analysis of Getein Biotech stock in this health report.

Gain insights into Getein Biotech's past trends and performance with our Past report.

Zojirushi (TSE:7965)

Simply Wall St Value Rating: ★★★★★★

Overview: Zojirushi Corporation manufactures and markets household products in Japan and internationally, with a market cap of ¥107.12 billion.

Operations: The company generates revenue primarily from the sale of household products in both domestic and international markets. With a market cap of ¥107.12 billion, its financial performance is influenced by various factors, including cost management and operational efficiency.

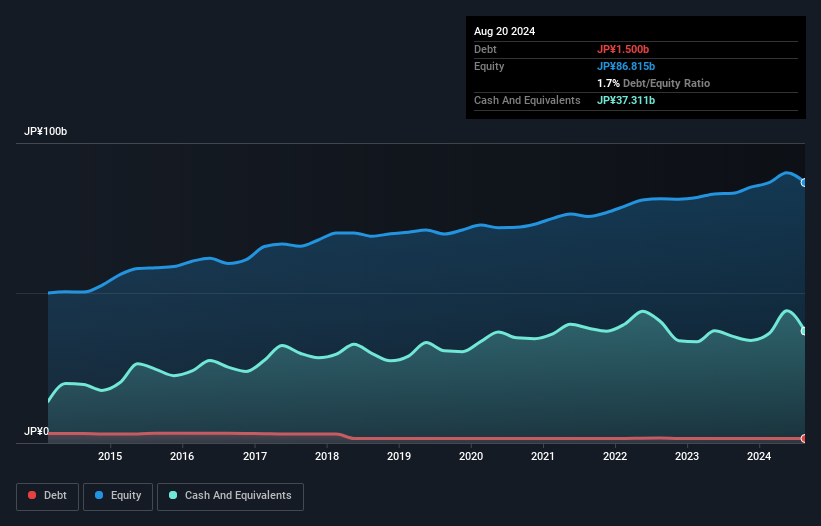

Zojirushi, a notable player in the consumer durables sector, has shown impressive earnings growth of 53.7% over the past year, outpacing the industry average of -9.3%. The company is on solid financial footing with more cash than total debt and a reduced debt-to-equity ratio from 2.2% to 1.7% over five years. However, recent results were influenced by a significant one-off gain of ¥1.9 billion, which could skew perceptions of its profitability quality. Looking ahead, earnings are expected to grow at a modest rate of 1.21% annually, suggesting cautious optimism for future performance.

- Take a closer look at Zojirushi's potential here in our health report.

Assess Zojirushi's past performance with our detailed historical performance reports.

Where To Now?

- Navigate through the entire inventory of 4640 Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zojirushi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7965

Zojirushi

Manufactures and markets household products in Japan and internationally.

Flawless balance sheet with proven track record and pays a dividend.