- China

- /

- Life Sciences

- /

- SHSE:603127

Joinn Laboratories(China)Co.,Ltd.'s (SHSE:603127) Business Is Yet to Catch Up With Its Share Price

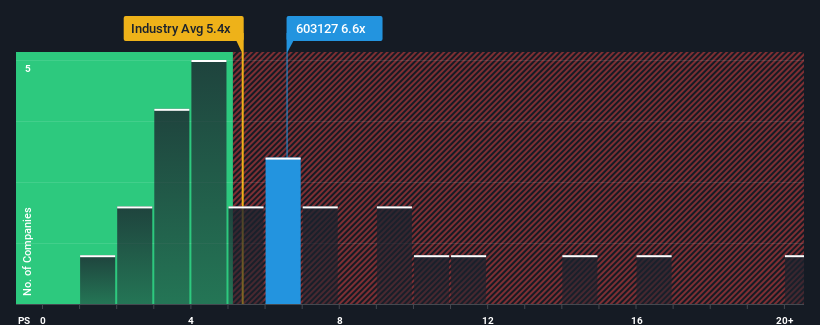

When close to half the companies in the Life Sciences industry in China have price-to-sales ratios (or "P/S") below 5.4x, you may consider Joinn Laboratories(China)Co.,Ltd. (SHSE:603127) as a stock to potentially avoid with its 6.6x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Joinn Laboratories(China)Co.Ltd

What Does Joinn Laboratories(China)Co.Ltd's Recent Performance Look Like?

With revenue that's retreating more than the industry's average of late, Joinn Laboratories(China)Co.Ltd has been very sluggish. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Joinn Laboratories(China)Co.Ltd.How Is Joinn Laboratories(China)Co.Ltd's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Joinn Laboratories(China)Co.Ltd's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 18%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 63% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 4.9% during the coming year according to the seven analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 15%, which is noticeably more attractive.

In light of this, it's alarming that Joinn Laboratories(China)Co.Ltd's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Joinn Laboratories(China)Co.Ltd's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It comes as a surprise to see Joinn Laboratories(China)Co.Ltd trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

Having said that, be aware Joinn Laboratories(China)Co.Ltd is showing 1 warning sign in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603127

Joinn Laboratories(China)Co.Ltd

Provides preclinical and non-clinical services in the United States, the People’s Republic of China, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives